NGI Data | NGI All News Access

October Bidweek Off A Nickel; Traders Looking Ahead to Winter

With the shoulder season in full swing where it is cool enough to turn off the air conditioning yet not cold enough to turn on the heat, NGI‘s October Bidweek National Spot Gas Average was a nickel lower than September at $3.44, yet 47 cents higher than the October 2012 bidweek average of $2.97. Most regions of the country for October 2013 eased anywhere from a couple of pennies to as much as a dime.

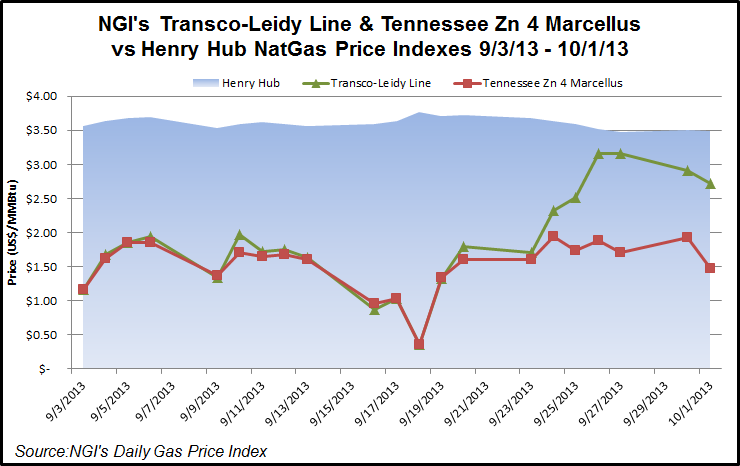

Of the actively traded points, the greatest gains could be found in the Northeast. Dominion and Millennium East were both up 8 cents to $3.25 and $3.18, respectively. Tetco M-3 and Transco Zone 6 New York also each added 8 cents to $3.46 and $3.58, respectively. The greatest individual point losses were posted by the infrastructure-challenged Marcellus Shale region, with Tennessee Zone 4 Marcellus sliding 34 cents to $1.62, and Transco-Leidy Line dropping 43 cents to average $1.58.

Much attention is being paid to pricing points in the Marcellus Shale, where too much production and not enough transportation continues to create a volatile situation in which 20-cent swings have become commonplace.

Commenting on the supply constraints of pricing points within the heart of the Marcellus Shale, David Thompson, executive vice president of Washington, DC-based Powerhouse, said the current situation plaguing the region is reminiscent of the Rockies a number of years ago. “In the Rockies, the thinking was, ‘we’ve got all this gas, Chicago is going to want it all,’ but everyone jammed up the pipelines and you couldn’t get any more gas out. What is the value of gas [stuck] in the middle of the Piceance Basin? Just about zero. I think this is what we’re seeing with the Marcellus now.”

“The situation remains the same,” said a Northeast trader. “Too much gas is being produced in the region for the current takeaway pipeline infrastructure to manage, so you get these price swings. Some pipe expansion projects have already come online to help the situation, and more are on the table or under construction. We certainly need them.”

As far as regional October bidweek prices are concerned, the Midwest declined 10 cents to $3.68, and South Louisiana was down 6 cents to $3.46. Overall, the Northeast was down 6 cents to $3.20, and South Texas was also off 6 cents to $3.45. California was down 5 cents to $3.60, and the Midcontinent was off 4 cents to $3.37. The Rocky Mountains and East Texas came in a couple of pennies lower at $3.29 and $3.45, respectively.

October futures expired Thursday at $3.498. For the five trading days, Tuesday through Monday, November futures slid 11.7 cents to $3.560.

Going into bidweek trading, there was a tendency to wrap up October using traders’ historical experience so that attention could be focused on winter requirements. “I think you had people two months prior who had been burned going long and getting burned on the [more favorable] short side of the market,” said a Houston-based Great Lakes marketer. “Last month they flopped that around.”

In September, “they were relatively short and got burned again. I don’t think traders are eager to be going one way or the other. The sense I am getting is that it is time to put October to bed and focus on the winter.”

The marketer suggested that buyers and sellers would tweak their October historical numbers based on expected loads or weather forecasts. No one was trying to second guess the market for October.

“The people I talk to said they just want to use October as a chance to get ready for the winter,” he said. “They are saying, ‘I don’t want to have anything working on the day or something where I am exposed. Just fill up storage and get that topped off.'”

On the other hand, a Michigan buyer said his company was going into October “fairly strong.”

As bidweek came to a close Monday, physical traders had to deal with a cash market for Tuesday delivery that overall rose by 7 cents as broad weather-driven market strength was more than able to offset double-digit declines in the Marcellus.

Only a few scattered points along with the Marcellus lost ground, and most locations added close to a dime if not more. At the close of futures trading, November had slipped 2.9 cents to $3.560, and December was down 4.0 cents to $3.729.

Futures traders were uninspired by the day’s performance, but they see prices trading within a range of $3.50 to $3.75, with the upcoming storage builds priced into the market.

Traders and risk managers see the time approaching to begin probing the long side of the market.

Devo Capital Management President Mike DeVooght said the market has been able to hold important technical support levels in spite of last week being a down week. “As we approach the heating season, we should see good support in the low $3 range. On a trading basis, we will start to be less aggressive on the short side and start to probe the long side of the market if the spot contract trades into the $3.30-3.40 range. We also will book profits on our short speculative positions Monday morning. We will hold our short producer hedges.”

DeVooght suggested that end-users stand aside the market, but producers should continue to hold short a November-March strip from $4.50-4.60.

Warm temperatures were enough to lift quotes as above-normal readings were expected to envelope the Mid-Atlantic, Ohio Valley and Midwest. AccuWeather.com predicted Monday’s high in New York of 74 would be 78 on Tuesday before reaching an anomalous high of 85 on Wednesday. The normal high in New York City at this time of year is 59. Pittsburgh’s high of 71 on Monday was expected to climb to 76 Tuesday before hitting 79 Wednesday. The typical late-September high in Pittsburgh is 58. Chicago’s high reading of 72 Monday was forecast to jump to 81 on Tuesday and Wednesday, well ahead of the norm of 70.

The National Weather Service in Pittsburgh said “a ridge of high pressure will remain in control through Thursday with dry conditions and temperatures to average 5-10 degrees above normal.”

Next-day power prices also added a supportive undertone to the market. IntercontinentalExchange reported that Tuesday peak power at the New England Power Pool’s Massachusetts Hub rose $1.98 to $36.98/MWh, and next-day peak power at the PJM West Interconnection added $7.75 to $46.04/MWh.

Gas for Tuesday delivery at the Algonquin Citygates was quoted 16 cents higher at $3.58, and parcels into Iroquois Waddington added a 4 cents to $3.72. Gas on Tennessee Zone 6 200 L rose by about 19 cents to $3.61.

Other eastern points firmed as well. On Dominion, Tuesday gas came in at $3.30, 2 cents higher, and at Tetco M-3, gas for next-day delivery was $3.48, 6 cents higher. Gas headed for New York City on Transco Zone 6 rose by 20 cents to $3.65.

At the Chicago Citygates, gas came in at $3.63, 14 cents higher, and on Northern Natural Ventura, next-day gas was quoted at $3.75, 32 cents higher. On Michcon, Tuesday gas changed hands at $3.64, down 6 cents, while at Dawn next-day gas was seen at $3.77, a penny higher.

While most cash quotes were headed north, Marcellus locations turned tail and ran the other way. Deliveries to Transco-Leidy Line dropped about 18 cents to $2.73, and gas on Tennessee Zone 4 Marcellus plummeted 45 cents to $1.48.

MDA Weather Services in its one- to five-day outlook showed a broad fairway of above- to much-above normal temperatures bounded by North Dakota and New Mexico on the west to the Eastern Seaboard on the east excluding Florida. The Pacific Northwest is forecast to be below normal.

Tom Saal in his work with Market Profile on Monday noted some buying interest in the back years, calendar 2014, 2016 and 2018 and said, “buyers, be ready.” He expects the market to test last week’s value area at $3.600-3.502 and then test $3.827-3.761.

The season is approaching for stout storage builds. Energy Metro Desk in its Early Bird Survey of 17 traders and analysts for the upcoming storage report showed an average 94 Bcf with a range of 82-100 Bcf. According to editor John Sodergreen, the five-year average is 82 Bcf, and last year 77 Bcf was injected.

In its 11 a.m. EDT Tuesday report, the National Hurricane Center (NHC) said Tropical Storm Jerry was stationary about 1,300 miles east of Bermuda and winds had declined to 45 mph from 50 mph. NHC was also following an area of thunderstorms southwest of Jamaica and gave it a 50% chance of becoming a tropical cyclone in the next five days.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |