Eagle Ford Shale | NGI All News Access

U.S. Net Oil Independence Possible by 2020, Says Raymond James

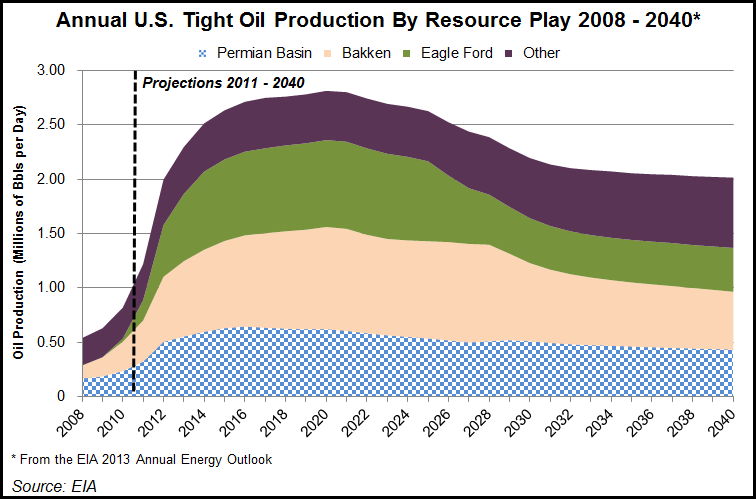

The United States is on track to become net oil independent by 2020, if production continues on its current path in the Permian and Williston basins, and in the Eagle Ford, Raymond James & Associates Inc. analysts said Monday.

J. Marshall Adkins and John Freeman said in a note that U.S. oil production growth is surpassing everybody’s expectations, including theirs.

“While we have been more optimistic (and more right) on U.S. oil supply growth than most, our numbers have still been too low (or conservative by design),” said the duo. “Accordingly, we have recently updated our proprietary, bottom-up, play-by-play U.S. oil supply model with improved type curves, higher rig, and higher well count forecasts.”

The end result was a higher forecast for oil and a lower outlook for natural gas liquids (NGL).

U.S. crude production forecast for 2013 was increased to about 275,000 b/d, while the NGL outlook was cut by 120,000 b/d because of infrastructure constraints.

All of the out-year domestic oil supply estimates were increased. Raymond James analysts initiated a decade-ending U.S. crude and liquids supply forecast of 16.4 million b/d, more than two-thirds above their current forecast of 10 million b/d.

“Given that we expect U.S. oil demand to fall over the next decade, the U.S. is on track to become net oil import independent by the end of the decade,” they said.

The Raymond James team about 18 months ago predicted unprecedented growth in domestic oil production based on a proprietary, bottom-up analysis on a play-by-play basis, which indicated a huge impact from horizontal drilling. In early 2012, few analysts were expecting domestic oil supplies to post solid growth for several years.

“We now think U.S. crude-only production will exit 2014 above 9.5 million b/d and combined crude/NGL production will exit 2014 above 12.5 million b/d. That equates to an average of roughly 150,000 b/d of U.S. crude plus NGL supply growth every month over the next 18 months,” with July 2013 actuals used as the base month.

Analysts recently updated their assumptions and type curves for every major U.S. oil/natural gas play. The analysts now believe that year-end 2014 combined oil/NGL production will average 11.9 million b/d versus U.S. Energy Information (EIA) expectations of 8.8 million b/d.

“Crazy? We think not. Year-to-date, oil production has already been tracking 200,000 b/d above our original forecast, and we were much higher than the EIA’s forecast.” The drivers “of the larger-than-expected oil supply growth (higher well productivity and better drilling efficiencies) have been accelerating, not slowing.”

Take July output as an example. EIA said oil production in July was 7.487 million b/d, which was above Raymond James’ original estimate of 7.310 million b/d. July NGL output of 2.55 million b/d was about 25,000 b/d above the analysts’ forecast. Combining crude and NGLs, total liquids production in the United States for July was up by 1.3 million b/d versus July 2012.

The domestic supply gains will continue for a simple reason, said analysts.

“Technological advancements in drilling and completions will allow producers to continue to generate more production efficiency gains than any of us thought possible a few years ago,” wrote the duo. Last week Adkins and colleagues published a substitute for the domestic rig count using well and footage counts because of the giant switch to horizontal drilling and longer laterals (see Shale Daily, Sept. 25).

Actual crude/NGL growth may be higher even than their newly updated forecasts because “EIA actuals tend to get revised as months pass…In other words, we would not be surprised to see 2Q2013 production figures actually be revised even higher than what has been currently reported.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |