Marcellus | NGI All News Access

National Fuel’s LDC Adjusting for Supplies ‘Right Under Our Feet’

Five years ago utility National Fuel Gas Distribution Corp. put in place a long-term strategy to supply Pennsylvania and New York natural gas utility customers with gas from long-haul pipelines from the Gulf Coast. The Marcellus Shale has since sent that strategy out the window.

The local distribution company (LDC) sells and transports gas to more than 732,000 customers in western New York and northwestern Pennsylvania. It supplies gas to areas where winter is robust: Buffalo, Niagara Falls and Jamestown, PA, along with Erie and Sharon, PA.

The Marcellus Shale now has provided low-cost fuel and more diversity “right under our feet,” Vice President Bruce Heine told an audience at the Shale Insight conference in Philadelphia. “It’s a great time to be a gas buyer in the Northeast,” he said. “No longer do we have the feeling that we’re sitting at the end of the pipeline with supplies 1,200 miles away…

“Downstream from Lake Erie, we get pretty severe winters, so gas supply and reliability are the top priorities.”

The company’s gas supply planning “comes down to two basic principles, reliability and least costs. Looking back to 2008, we were positioned for demand exceeding productive capacity. Prices were to remain higher and more volatile. Arctic gas and gas imports were supposed to be for the shortfall…”

The former strategy was to use long-haul capacity pipelines from the Gulf Coast to carry liquefied natural gas imports and deepwater gas supplies. It also was relying on new Rocky Mountain gas and was planning for Arctic gas to arrive at some point.

“Gas in Appalachia was limited to very small wells in the Medina formation,” Heine said. “Then came the rock that powered the world, and lo and behold, shale gas.”

Today “it’s no surprise that our market purchases are mainly Marcellus gas. It’s increased to 100% in certain times of the year…In winter, we will still rely on some traditional basins. But for the entire year, close to 80% will come from our market area” in the Marcellus.

The LDC still wants to use “reliable supplies from diversification, capacity and local supplies. We want best-cost services while we are maintaining reliability…That means our strategies have to move on, and we have to adjust for capacity and look to purchase different supplies from different ports.”

A big question, said Heine, is “how much long-line capacity will we be required to hold? We are keeping an open dialogue with [Pennsylvania and New York regulators] that is critical for capacity and supply.”

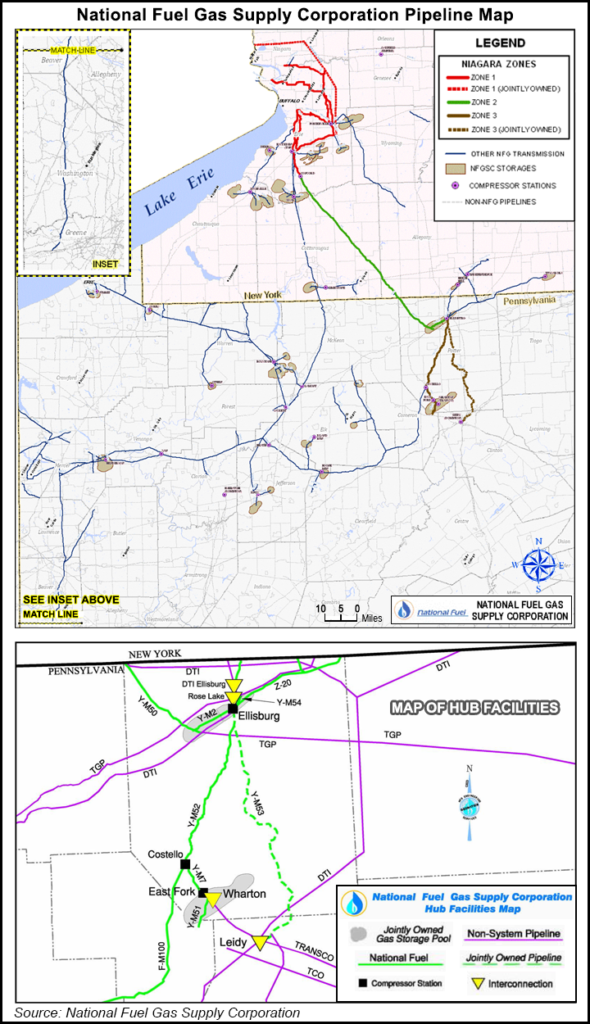

National Fuel now gets gas through seven pipelines and from three storage facilities. “We will keep most of the contracts but we will use them differently,” Heine said. “We don’t see market storage going away anytime soon, even with new supplies. Daily throughput would never be able to meet peaks and valleys without storage.

“It also allows us to baseload gas. We can’t do that without storage.” Storage is a “benefit for producers who want to produce gas and see it flow every day…”

About 71% of the distributor’s receipt points are through Southwest pipes with deliveries by, among others, Texas Eastern Transmission (Tetco) and Transcontinental Gas Pipe Line (Transco). The rest of the capacity is from the Northeast, through National Fuel Supply Corp. (NFSC), Niagara/Empire pipeline system and Tetco.

The LDC wants to change that. “It should be about 50-50 adjusted, which would give us a reasonable mix,” said Heine. However, it still has issues related to the supply contracts put in place ahead of the shale boom.

“We pay demand charges on these contracts to haul capacity down to Mexico,” he said. “Our strategy going forward is to move some receipt points up to the market area. Most pipeline tariffs include rights of first refusal, but they don’t allow shortening of capacity; they have to be able to match any competing offers on capacity.

“It’s difficult to do that in the market area. It’s cherry picking that [regulators] don’t want…But we have to, to some extent, be able to shorten up some of the capacity.”

The distributor also questions how much upstream capacity is needed as shale gas from the Utica and Marcellus expands. “Where will the pooling points develop?” asked Heine. “More infrastructure is needed for liquidity. Upstream capacity is needed for operations because of load capacity.”

In Tennessee Gas Pipeline Co.’s (TGP) Zones 4 and 5 in the Marcellus, “delivery is only fed by Tennessee…but its infrastructure is critical to our situation. Even with the Marcellus, we still need transmission capacity…”

Heine pointed to new pooling points that are developing on TGP’s 219 and 313 points, which he said are “important for reliability…”

At the 313 pool near Ellisburg, PA, “of late, the liquidity has diminished because it’s so constrained out there. We are watching the pool. As new infrastructure is built, liquidity should improve.”

The LDC also is monitoring points on DTI, Transco’s Leidy Line, NFSC and Tetco’s M-2. “We believe the development of these points are critical to purchase reliable supplies in the Northeast,” said Heine. “We would rather buy from a pooling point than specific wellheads. It gives us more choice”

The New York Mercantile Exchange settlement prices “clearly see the benefit from shale production,” he said. “There were $10.00/Mcf prices five, six years ago and it’s to $4.00. We can conclude that the impact of about $6.00 is from shale gas. That transforms directly into Pennsylvania rates, which are now below $10.00 and stable, which is key.”

The Southwest to Northeast supply shift “is significant. For LDCs “it’s the biggest change since…the early ’90s,” when the Federal Energy Regulatory Commission issued Order No. 636, which required pipelines to separate their transportation and sales services, so that all pipeline customers would have a choice in selecting their gas sales, transportation, and storage services from any provider, in any quantity.

“Opportunities are constantly changing,” said Heine. “But the overall strategy must remain flexible. Communication with regulators is critical as the landscape changes…Customers are used to gas being there day in and day out…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |