NGI Archives | NGI All News Access

Marathon Petroleum ‘Optimistic’ on Utica Condensate Plans

Although condensate production in the Utica Shale is occurring at a slower-than-anticipated pace, Marathon Petroleum Corp. (MPC) said it has completed the conceptual engineering for condensate splitters at its refineries in Kentucky and Ohio, part of a $300 million investment to put the company in position to handle increasing volumes in the future.

During a conference call with financial analysts on Tuesday to discuss 1Q2013 earnings, MPC Vice President Michael Palmer, who is in charge of supply distribution and planning, described the current landscape for condensate in the Utica as “somewhat volatile.”

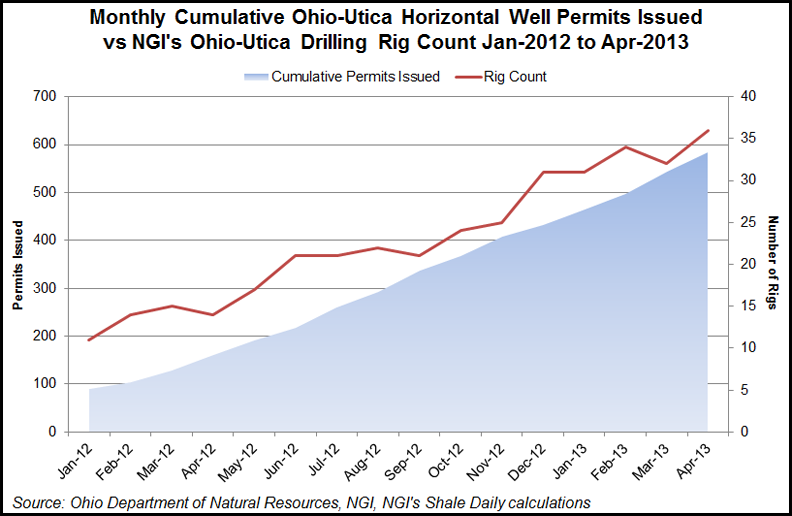

“The important point with the Utica is that there have been a lot of wells drilled,” Palmer said. “The latest numbers that I have is there have been [more than] 600 permits issued, [but] there have been just slightly [more than] 300 wells drilled and you’ve only got 89 of those that are producing. So you’ve got 70% of the wells that have been drilled…waiting to get hooked up to gas processing. That, really, is the bottleneck right now.

“You’ve got companies out there that are spending billions of dollars on this infrastructure, and we fully expect to see our Utica condensate volumes ramp up significantly this year and then significantly, again, in 2014. So it still looks very optimistic to us.”

CEO Gary Heminger said the condensate splitters being constructed at refineries in Canton, OH, and Catlettsburg, KY, would be in-service in late 2015 or in 2016. “We believe without any additional investment, we can run roughly 20,000-30,000 b/d in total of condensate at those two facilities. As the amount of condensate grows there, we want to be in a position to make sure that we can handle more than that amount of volume, which we expect to come online maybe in a year or two.”

Heminger said the splitters would boost MPC’s condensate processing capacity to about 60,000 b/d. The in-service date for the units “is going to really be driven by how quickly the condensate production ramps up there. We’re doing the engineering, but we haven’t finalized exactly when we’re going to come online with those new units.” He added that the units may be suitable for a master limited partnership (MLP).

Last October, MPC signed an agreement with Harvest Pipeline Co. to convert part of its terminal in Wellsville, OH, into a facility capable of loading up to 50,000 b/d of condensate onto barges on the Ohio River (see Shale Daily, Oct. 17, 2012).

“The whole complement of investments in that area is about $300 million…over the next two to three years,” said MPC investor relations chief Garry Peiffer.

Heminger said some engineering work still needs to be completed for the splitters. “The conceptual engineering is complete…We are just in now to the front-end engineering. We do not have the yield structures and optimizations complete at this time yet, it will be awhile until we have that finished.”

The numbers of horizontal well permits and drilling rigs in Ohio’s Utica Shale have both increased steadily since the beginning of last year. A total of 88 permits had been issued and 11 rigs were operating at the beginning of 2012, according to the Ohio Department of Natural Resources. By Jan. 1, those numbers had climbed to 463 permits and 31 rigs, and the increase continues, with a total of 583 permits and 36 rigs reported by April 1.

MPC reported net earnings of $725 million ($2.17/share) for the first quarter of 2013, a 21.6% increase from the $596 million ($1.70) in the first quarter of 2012. The company had a cash balance of $4.74 billion at the end of 1Q2013, down slightly (2.5%) from $4.86 billion at the end of 1Q2012. Refining and marketing earned $1.1 million during 1Q2013, up 17.1% from $943 million in 1Q2012. The transportation segment also fared better, with income increasing 21.4% to $51 million from $42 million in 1Q2012.

MPC refined 1.43 million bbl of crude oil, and 238,000 bbl of other charges and blends during the first quarter of 2013. Both were improvements from a year ago, when the company refined 1.15 million bbl of crude and 174,000 bbl of other charges and blends. MPC credited the increase primarily on higher refined product production and sales volumes, most of which came from the acquisition of the Galveston Bay refinery in Texas on Feb. 1.

MPC was spun off from Marathon Oil Co. on June 30, 2011. Marathon Oil’s 1Q2013 earnings call is scheduled for May 8.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |