NGI Archives | NGI All News Access

EOG Partnering with ZaZa, Range in Eaglebine

EOG Resources Inc. has struck a joint exploration and development agreement with Eaglebine formation partners ZaZa Energy Corp. and Range Resources Corp. in Walker, Grimes, Madison, Trinity and Montgomery counties, TX.

EOG is to acquire up to a 75% working interest in up to 55,000 net acres and operate the joint venture (JV) acreage comprising 73,000 of ZaZa’s 92,000 net mineral acres. ZaZa will retain a 25% working interest in the 73,000 acres, ZaZa said. The assets include lands that are wholly owned by ZaZa and also incorporate certain properties covered by a participation agreement with Range Texas Production LLC, a unit of Range Resources.

“Partnering with one of the largest unconventional oil-focused operators in the country validates the Eaglebine work program that has been executed by ZaZa to date,” said ZaZa CEO Todd Brooks. “Our new joint venture will benefit from economies of scale and focus on optimizing field development and accelerating production at a reduced cost.”

Early-stage drilling preparations are under way for the first two JV wells, and Houston-based ZaZa said it expects that EOG will have drilled the first three earning wells by January. The development program consists of three phases, each covering a three-well drilling program plus associated cash payments. Phases two and three are electable by EOG upon satisfaction of the preceding phase’s work obligations, ZaZa said.

“We had previously heard that EOG was involved in the Eaglebine, but the company has been fairly tight-lipped,” said Wells Fargo Securities analyst David Tameron in a note Monday. Others active in the Eaglebine include Halcon Resources and Encana Corp., he added.

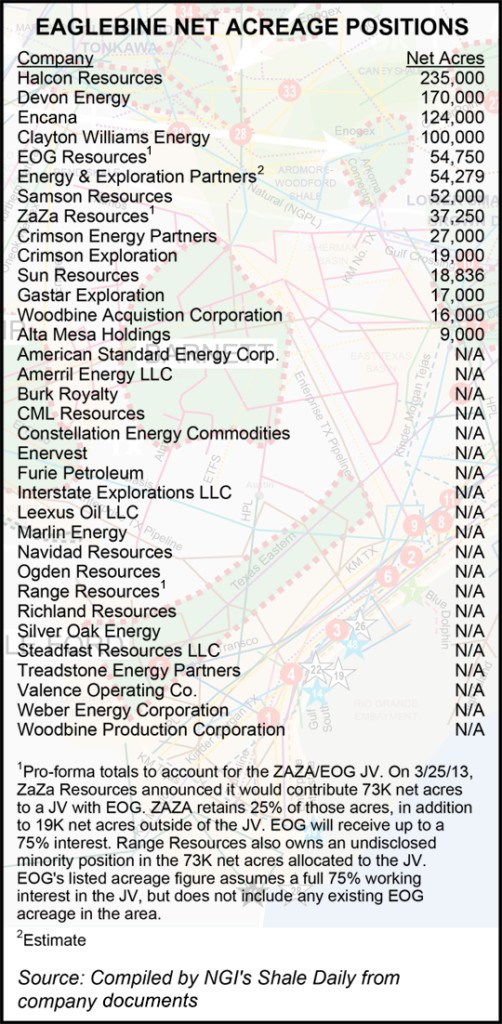

Halcon is the largest leaseholder in the Eaglebine, with 235,000 net acres, and Encana has 124,000 net acres, according to company documents. Other major players in the Eaglebine include Devon Energy (170,000 net acres) and Clayton Williams Energy (100,000 net acres).

Separately, ZaZa said it is selling about 10,000 net acres in Fayette, Gonzalez and Lavaca counties, TX, which the company calls its Moulton properties. The deal includes all of ZaZa’s interest in seven producing wells in Moulton. The cash sale price is about $43.3 million. Closing is expected during the second quarter. In a separate deal, ZaZa said it is selling its remaining Moulton properties for about $9.2 million with closing also expected during the second quarter.

“As part of the Hess [Corp.] division of assets in 2012 [see Shale Daily, June 13, 2012], we received cash and a significant amount of acreage in the Eagle Ford play. We are in the process of monetizing select assets in order to improve our balance sheet and high grade our resource base with a focus on the Eaglebine,” Brooks said.

Last November, Brooks touted ZaZa’s early well results in the Eaglebine.

“Today, the Eaglebine play is one of the most exciting, emerging, liquids-rich resource plays in the country, and the data we have in-house supports this sentiment,” Brooks said. “As the first mover in the Eaglebine play, ZaZa holds what it believes to be some of the Eaglebine’s most promising and untapped acreage. We have amassed a dominant, nearly contiguous land position of about 90,000 net acres located in the thickest part of the play [see Shale Daily, Nov. 7, 2012].”

ZaZa plans to use net proceeds from both sales to fund exploration on its other properties and reduce debt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |