NGI Archives | NGI All News Access

SandRidge Shareholders to Consider Hedge Fund’s Board Candidates

Following a judge’s decision in favor of TPG-Axon Capital, SandRidge Energy Inc. on Tuesday cleared the way for shareholders to consider a slate of candidates proposed by the hedge fund to replace SandRidge’s entire board of directors.

The SandRidge board approved of the director candidates proposed by TPG-Axon “in light of the court’s ruling…[and] for the limited purpose of the change of control provisions of its indentures,” the company said in a filing with the Securities and Exchange Commission (SEC). By making the move, the board is no longer subject to an injunction approved in the court ruling, SandRidge said.

SandRidge had previously refused to give its approval to the hedge fund’s candidates and opposes their election by shareholders.

“The board continues to oppose the election of the director candidates proposed by the TPG-Axon group, believes their election is not in the best interest of the company’s stockholders, and recommends that stockholders support the company’s existing experienced board of directors,” said the SEC filing.

The decision in the Court of Chancery of the State of Delaware found that SandRidge directors, in their recent efforts to block the hedge fund’s attempt to replace the current board, had violated their fiduciary duty.

“Given the cloud the incumbent board has intentionally flown over the voting decisions and the absence of any rational, good faith justification for its nondecision as to approval, I believe this limited injunctive relief is proportionate and equitable,” Judge Leo Strine wrote in a 38-page opinion. The injunction enjoined SandRidge’s board from “impeding TPG’s consent solicitation process in any way” and barred the company from continuing to solicit consent revocations until TPG-Axon’s director nominees were approved.

“TPG-Axon believes the ruling further demonstrates why SandRidge directors must be replaced — time and time again, they have shown disregard for stockholders, obsequiousness to CEO Tom Ward, and persistently prioritized their own self interest,” TPG-Axon said. The hedge fund is beneficial owner of 7.3% of outstanding SandRidge shares.

The complaint was filed by shareholder Jerald Kallick.

Both Oklahoma City-based SandRidge and TPG-Axon have been appealing to SandRidge shareholders for support (see Shale Daily, Feb. 21). The hedge fund has alleged that a company controlled by Ward’s children controls roughly 475,000 acres in the Mississippian Lime formation near SandRidge operations. That acreage count would make the private investment company, WCT Resources, the fifth largest E&P company in the Mississippian, according to TPG-Axon, which said it is “concerned” with the scale of WCT’s involvement in the play and by the “suspicious timing” of WCT’s land purchases.

In response, SandRidge has urged shareholders to reject TPG-Axon’s “false and misleading campaign” to replace the board of directors. The current board “has found no evidence of wrongdoing” regarding SandRidge’s transactions with WCT Resources, which “is an independent company — no person affiliated with SandRidge has any control over WCT Resources activities.”

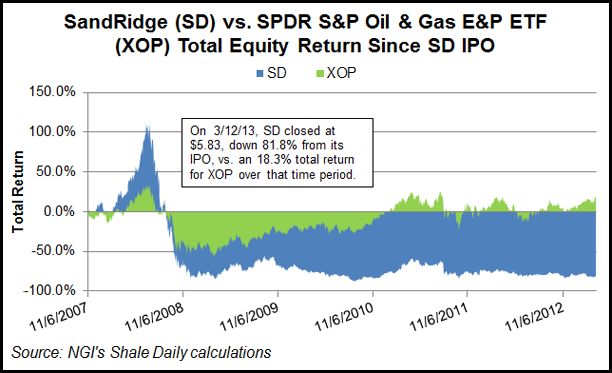

The hedge fund has said it invested in the company because “the stock represents extraordinary value,” with a $12-14/share range “realistic and achievable.” But SandRidge stock “has been a disastrous performer,” TPG-Axon said.

SandRidge’s transition from a natural gas producer to an oil explorer appears to be paying off, with the company’s Mississippian Lime operations experiencing success and its bottom line improving, but the market seems unconvinced (see Shale Daily, March 4). SandRidge ended the trading day Tuesday at $5.83/share, down 81.8% from its initial public offering in 2007. During that same period, the SPDR S&P Oil & Gas E&P index has provided an 18.3% total return.

The deadline for consent solicitations is Friday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |