NGI Archives | NGI All News Access

EV Energy Partners Stock Down as Sale of Utica Assets Proves Elusive

Shares of EV Energy Partners LP (EVEP) took a hit Friday after the company announced net losses for the fourth quarter and full-year 2012, and said it could take anywhere from one month to the rest of the year to sell most of its acreage in the eastern Ohio portion of the Utica Shale.

EVEP shares closed at $52.50 on the New York Stock Exchange on Monday. But the stock opened at $55.85/share on Friday and fell 9% to hit a low of $50.84 at 11 a.m. EST. The stock rebounded slightly and closed at $52.00/share, but it was still a 7% loss for the day.

Houston-based EVEP reported a net income loss of $9.9 million for 4Q2012 (23 cents/share). By comparison, the company recorded a $9.7 million net income profit (27 cents/share) during the preceding fourth quarter.

For the full-year 2012, EVEP reported a net loss of $16.3 million (38 cents/share). In 2011, the company recorded a $91.8 million net profit ($2.68/share).

John Walker, CEO of privately held EnerVest Ltd., which controls publicly traded EVEP, told analysts during a conference call on Friday that there has been one bid for EVEP’s overall core position in the Utica, plus multiple bids on four packages and several individual bids for acreage in some Ohio counties.

“We were initially offered several properties in exchange for some or all of our Utica holdings,” Walker said Friday. “[But] our valuation of the exchange properties from potential buyers was below the expectations of the parties offering those properties.

“We spent a considerable amount of time on a large transaction for most of these counties, and that negotiation is still showing progress. In addition, we have reopened negotiations on two Northern counties with multiple parties. Some companies continue to press us into selling individual counties, which we may do if the price is right.”

EVEP is looking to sell 100,000 net working interest acres in the eastern Ohio portion of the Utica, plus at least another 70,000 acres in Ohio and western Pennsylvania. CEO Mark Houser said EnerVest companies were collectively looking to sell 335,000 acres in the Utica.

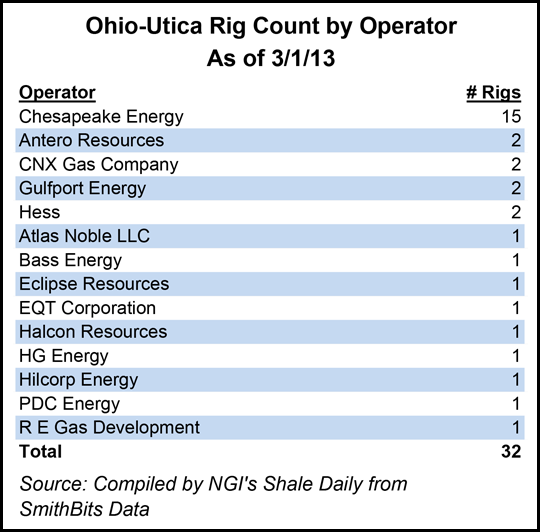

While EVEP did not disclose the name of the negotiating parties, an analysis of SmithBits data on the current Ohio-Utica rig count revealed the most active operators in the play. Of the 32 rigs active as of March 1 in the Ohio-Utica, 15 of them are operated by Chesapeake Energy, while Antero Resources, CNX Gas Co., Gulfport Energy and Hess are operating two rigs apiece. The remaining nine rigs in the play are each operated by a separate operator.

EVEP announced plans to sell acreage last September, but by year’s end conceded that more time was needed to finalize a deal (see Shale Daily, Dec. 27, 2012; Sept. 18, 2012).

“I am disappointed that we’ve not executed the purchase and sale agreement yet,” Walker said Friday. “Fundamentally, the bids have to meet our expectation county by county, and terms must also be acceptable and must conform to standard industry terms.

“I am leading the negotiations with a highly experienced team, and I want to repeat we’re not going to do a transaction that does not deliver an attractive price and acceptable terms. We will announce each deal as it is signed, but I believe that the process could take anywhere from a month to the remainder of the year. Believe me, I am spending an overwhelming amount of my time on this important process.”

EnerVest executives have previously disclosed that the sale of its acreage in the Utica would free proceeds for other oil and gas fields that require less capital and are less risky. The company hired Jefferies & Co. to find a buyer, who would become a joint venture (JV) partner with Chesapeake Energy Corp.

EVEP said it plans to spend between $320 million and $360 million on capital expenditures (capex) in 2013, including $90 million to $110 million on exploration and production (E&P) and $230 million to $250 million on midstream investment.

Houser said about $90 million of the E&P capex budget for 2013 would be spent on drilling and completing 156 gross wells. He added that $66 million of that $90 million would be spent to drill 70 gross wells in the Barnett Shale.

“Most of the drilling activity is occurring in the wet gas window,” Houser said, adding that the company’s JV partners in the Utica — Chesapeake and France’s Total SA (see Shale Daily, Jan. 4, 2012) — are the most active in the play. He said Chesapeake operated about 133 JV wells in 2012 and expects to spud another 240 wells in 2013.

“[Chesapeake has] 15 rigs running in the first quarter 2013 and will have 16 rigs running for the remainder of the year,” Houser said. “Their drilling efficiency continues to improve, and drilling time has continually decreased and lateral link has been increasing.

“Thirty-six wells in which EnerVest has an interest are currently shut in, and many more that EnerVest does not have an interest in we understand are waiting on processing capacity to become available.” Houser added that Dominion Resources Inc.’s natural gas processing and fractionation plant in Natrium, WV, opens in April (see Shale Daily, Jan. 31, 2012).

EVEP reported 4Q2012 production of 10.8 Bcf of natural gas, 277,000 bbl of crude oil and 476,000 bbl of natural gas liquids (NGL), and averaged 15.3 Bcfe for the quarter, a 38% increase from 4Q2011 (11.1 Bcfe). Full-year 2012 production was 42.5 Bcfe of natural gas, 1.1 million bbl of crude oil and 1.7 million bbl NGLs, or 59.6 Bcfe, a 45% increase over 2011 (41.2 Bcfe).

For the first three quarters of 2013, the company set production guidance ranging from 153.2 Mcfe/d to 169.3 Mcfe/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |