NGI Archives | NGI All News Access

Plan In Hand, Newfield Needs to Execute, Analyst Says

Shares of Newfield Exploration Co. (NFX) have taken a beating since the company last week provided its outlook for liquids production growth and announced plans to jettison international assets in favor of U.S. plays. It’s a sign that investors have heard enough talk and are ready to see action.

Newfield shares on Wednesday closed at $24.74, down more than 9% from Tuesday’s close, after trending lower throughout the day. Volume was three times the norm. Before last week’s news — which included a three-year production and budget outlook, a company first (see Shale Daily, Feb. 15) — Newfield shares were hovering around $30.

Instead of the company’s domestic liquids growth story, investors have been focusing on about $2 billion in noncash charges, including $1.5 billion for a writedown of domestic proved reserves, announced last week. Newfield reported a net loss of $1.4 billion (minus $10.39/share) for the fourth quarter compared with net income of $68 million (51 cents) for the year-ago quarter. For 2012 the company reported a net loss of $1.18 billion (minus $8.80/share) compared with net income of $539 million ($3.99) for 2011.

Wells Fargo Securities analysts cut their 2013 earnings per share estimate to $2.24 from $2.38, despite noting that the company’s three-year liquids outlook came out above their forecast.

“…[T]he stock did not respond well to slowdowns in the Eagle Ford [Shale] and Uinta [Basin],” Wells Fargo said in a note Wednesday before the conference call. “NFX shares have underperformed the EPX [Exploration and Production] index by 6% since the report. We figured line of sight on liquids growth would be well received, but apparently investors are not ready to pay for growth until Newfield can show it in results.”

Wednesday morning CEO Lee Boothby told analysts during a conference call he was confident that Newfield’s “decisive actions” would bring about the kind of results investors are looking for. “We see our future clearly today, and we are accelerating the development of our domestic asset portfolio to achieve it,” he said.

Holding on to the international assets would have only held the company back in the domestic onshore, where four liquids plays (the Cana Woodford, Uinta Basin, Williston Basin and Eagle Ford Shale) are the focus going forward, Boothby said. CFO Terry Rathert said proceeds from any sale of international assets would first be used to fund the domestic drilling program.

Boothby was asked about the market’s reaction last week to news of the company’s outlook and initiatives. After a four-year transition period he said the company is now a North American-focused liquids producer. Reducing the company’s complexity and improving its focus also have been achieved, he said, adding that the “choppiness” seen in performance during the transition period is largely in the past.

Standard & Poor’s Ratings Services (S&P) on Wednesday revised its outlook on Newfield to “negative” from “stable” and affirmed all of its ratings, including the “BBB-” corporate credit rating.

“The outlook revision reflects the potential for Newfield’s funds from operations (FFO) to debt ratio to deteriorate from current levels and remain below our downgrade threshold of 30% over the medium term,” the ratings agency said. “The company recently announced a 2013 capital budget of $1.7 billion-1.9 billion, which exceeds our 2013 FFO estimate by $600-800 million. We believe Newfield will initially fund this deficit by drawing on its revolving credit facility, which would push FFO to debt down to 25-30% by the end of 2013, absent other actions.” However, S&P said proceeds from expected asset sales could keep FFO to debt above the downgrade threshold.

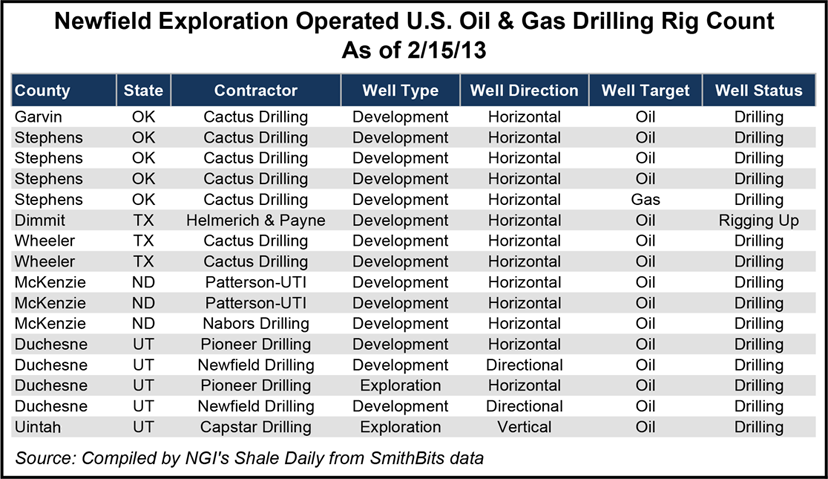

Newfield is running six rigs in the Cana Woodford in Oklahoma’s Anadarko Basin, where it has a 125,000 net-acre position. To date, the company has drilled and completed 30 wells in the play. Fourth quarter net production averaged 10,000 boe/d (60% liquids). Drilling and completions are becoming more efficient, and Newfield recently drilled three consecutive record wells, the most recent with an 8,000-foot lateral that was drilled and cased in 38 days. “Well performance continues to meet or exceed expectations as controlled flowback completion techniques are being employed…” it said. A recently signed gas gathering agreement provides up to 200 MMcfe/d of gathering and processing and offers Mont Belvieu, TX, liquids pricing.

The company’s net production from the Uinta in the fourth quarter was about 20,000 boe/d, down from 22,400 boe/d during the third quarter due mainly to a shortage of refining capacity. Newfield has built an inventory of 250,000 gross bbl above normal operating levels. Without constraints, fourth quarter net production would have been about 3,500 boe/d higher, the company said. Sales of the excess crude have begun and are expected to continue into the second quarter. For 2013, about 200 wells are planned in the Greater Monument Butte Unit. Waterflood development continues to progress with a 30% increase in water injection volumes planned for the year, Newfield said. The company is also focused on drilling vertical and horizontal plays in the Uteland Butte and Wasatch formations. Uinta production is expected to increase about 10% this year. During the second half, the company will benefit from refinery expansions in Salt Lake City, UT, and firm commitments for oil production. Uinta production is expected to increase 20% next year.

In the Williston Basin, Newfield net production averaged 10,500 boe/d during the fourth quarter. The company has drilled 93 wells in the basin, about half of them with super extended laterals (SXL). “Newfield continues to perform well in the field, with ‘spud to total depth’ on its SXL wells averaging about 25 days,” the company said. “Completed well costs continue to reflect efficiency gains and the company estimates that its 2013 wells can be drilled and completed for about $10 million gross.” About 46 Williston wells are planned this year, and production is expected to grow 15% over 2012 levels. Three operated rigs are running and a fourth is to be added in March. Newfield has about 41,000 net acres under active development along the Nesson Anticline and areas immediately west of the Nesson. It is drilling SXL wells from pad locations in the Bakken and Three Forks formations. Additional exploration potential exists in deeper benches throughout the basin, it said.

In the Eagle Ford, Newfield expects to drill about 35 wells this year. The company has drilled and completed four successful SXL wells with lateral lengths of about 7,500 feet in Dimmit County, TX. Recent SXL wells are being drilled and cased in as few as 12 days, Newfield said. The SXL wells have average initial gross production rates of 800 boe/d (75% liquids) under controlled flowback. Newfield estimates that estimated ultimate recoveries (EUR) are more than 500,000 boe per well. Newfield recently completed its first 10,000-foot SXL in Dimmit County; it has been online for 90 days with average production of 917 boe/d and a a peak rate of more than 1,200 boe/d. In Atascosa County, TX, the company has an average 65% working interest in about 8,000 gross operated and outside-operated acres, which are held by production. Current gross production is facility limited at about 2,000 boe/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |