NGI Archives | NGI All News Access

Marathon Oil: Eagle Ford, Bakken ‘Highest-Value Resource Plays’

Marathon Oil Corp. production targets are being raised sharply for its growing plays in the Eagle Ford and Bakken Shales, while the targeted sale of assets continues, as evidenced by a $170 million sale of a gas processing interest in Louisiana, CEO Clarence Cazalot said during a 4Q2012 conference call with financial analysts.

Marathon’s play in the Eagle Ford is on track to go from representing 18% of its U.S. production last year to becoming 40% this year, Cazalot said.

Discussions on the sale of a portion of the company’s Canadian assets are ongoing, but there is nothing material to report at this point, and there may not be longer term, said Cazalot, in reporting lower earnings for 4Q2012 and for all of 2012, compared to 3Q2012 and all of 2011, respectively.

Separately, it was announced that Korea-based Samchully Asset Management Co. Ltd. bought Marathon’s 34% interest in the Neptune Gas Processing Plant in St. Mary Parish, LA, for $170 million in an all-cash deal. This purchase represents the Korean firm’s first direct investment in U.S. midstream assets.

Neptune is a cryogenic natural gas processing plant with 650 MMcf/d of capacity whose majority (66%) owner/operator is Enterprise Gas Processing LLC, an affiliate of Enterprise Products Partners LP.

Even with net income down for both 4Q2012 ($322 million) and all of 2012 ($1.58 billion), compared to 3Q2012 ($450 million) and full year 2011 ($2.94 billion), Cazalot characterized last year as having “strong operating results,” culminating in its exploration and production available for sale growing by 32% since 2010. The growth in the past two quarters, he said, was driven almost exclusively by Marathon’s onshore U.S. production centered in the Eagle Ford and Bakken.

“There was more of a doubling of the U.S. production from 3Q2011 to 4Q2012,” said Cazalot, noting that based on early indicators so far this year the company is increasing its production targets in both Eagle Ford and Bakken to 85,000 boe/d and 35,000 boe/d, respectively. He called the onshore U.S. shale plays “the highest-value resource plays” in the world.

In concentrating more on the Eagle Ford and Bakken, along with the Oklahoma resource basins, Marathon will increasingly move toward more use of multi-well pads, particularly in the Eagle Ford, as it cuts rig counts but keeps production levels. The company is looking at drilling more than 290 new wells in the Eagle Ford in 2013, while adding 65-75 new wells in the Bakken this year, Cazalot said.

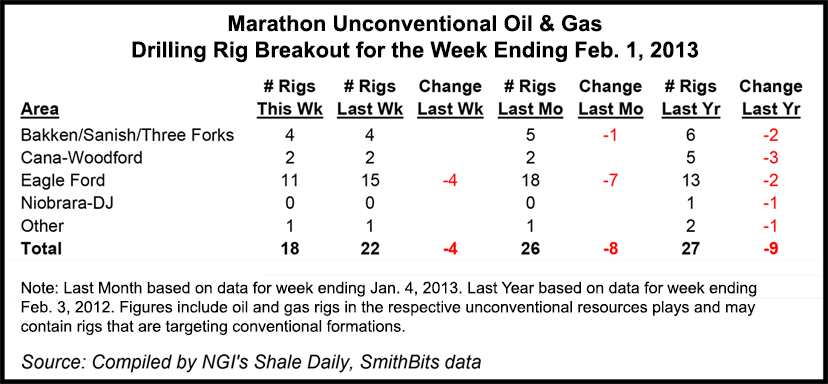

Marathon had 11 unconventional oil and gas drilling rigs in the Eagle Ford at the beginning of February, four fewer than the previous week and seven fewer than a month ago, according to SmithBits data and NGI’s Shale Daily calculations. The company also had four rigs in the Bakken./Sanish/Three Forks and two more in the Cana-Woodford.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |