NGI Archives | NGI All News Access

Gulfport Gas Output Up, Oily Production Falls

Gulfport Energy Corp., which released its 4Q2012 and full-year operations results on Wednesday, reported strong natural gas growth in the onshore, with falling oil and natural gas liquids (NGL) output.

The Oklahoma City-based company, which announced its operations results this week, said 4Q2012 net production was 608,500 boe, an 8% decline from the 661,700 boe produced in 4Q2011. Natural gas production nearly doubled year/year to about 366.3 MMcf from 186.3 MMcf. However, oil production fell 12.5% during the same period to 540,558 bbl from about 617,900 bbl, as did NGL production, which fell 46% to about 289,728 bbl from about 535,400 bbl.

Two southern Louisiana fields, Hackberry and West Cote Blanche Bay, accounted for 48.3% (293,906 boe) and 35.8% (217,686 boe) of net production in 4Q2012, respectively. The Utica Shale accounted for another 11.5% (69,667 boe), the Permian Basin was 2.8% (17,100 boe), and other formations, including the Bakken and Niobrara, accounted for 1.7% (10,140 boe).

Net production in 2012 totaled 2.57 million boe, which was 10.3% higher than the 2.33 million boe produced in 2011. Natural gas production, up 26% year/year, accounted for a large chunk (to 1.11 Bcf in 2012 from 878.1 MMcf in 2011), while oil output rose 9.1% (to 2.32 million bbl from 2.13 million bbl), and NGL output was up 9.9% (from 2.47 million bbl to 2.71 million bbl).

The company reported total proved reserves of 13.88 million boe for the year-end 2012, which included 33.8 Bcf of natural gas and 8.25 million bbl of oil. About 59.8% of total proved reserves were classified as proved developed.

Eleven horizontal wells are scheduled to be online by June, Gulfport said.

In eastern Ohio’s Utica, Gulfport has three horizontal wells in Harrison County — Wagner 1-28H, and Boy Scout 1-33H and 5-33H — flowing into sales pipelines (see Shale Daily, Nov. 16, 2012; Oct. 15, 2012; Aug. 16, 2012). The company plans to bring two Belmont County, OH, wells online by March 15 — Shugert 1-1H and 1-12H (see Shale Daily, Nov. 29, 2012). Two more wells — BK Stephens 1-14H and Ryser 1-25H — are scheduled to be online by March 24. Three wells — Clay 1-4H, and Stout 1-12H and 2-12H — would be brought online by April 1. Another four wells — Groh 1-12H, Lyon 1-27H and 2-27H, and Stutzman 1-14H — would be connected to sales pipelines by June 1 (see Shale Daily, Jan. 24).

“The delay in flowing the remainder of the wells drilled in 2012 is primarily associated with MarkWest [Energy Partners LP]’s challenge to obtain right-of-way and acquire necessary state and federal permitting,” Gulfport said. “[We] have been working closely to address these matters and expect all wells spud in 2012 to be connected and flowing by the beginning of June.”

A third drilling rig contracted for the Utica is scheduled to begin operations in early March.

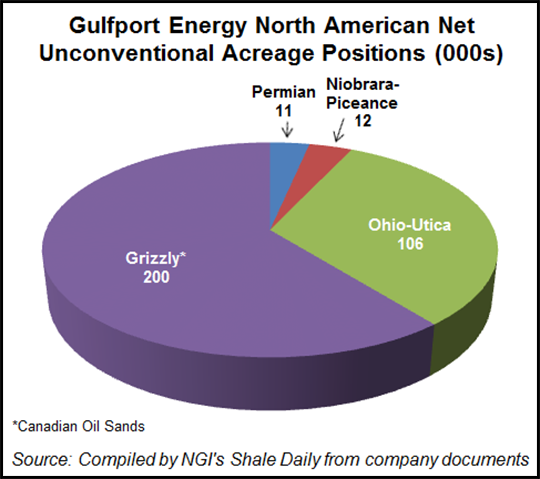

Last December, Gulfport announced two separate deals with Windsor Ohio LLC to buy 37,000 net acres total in the Ohio’s Utica for $372 million (see Shale Daily, Dec. 21, 2012, Dec. 19, 2012). The transactions boosted Gulfport’s position in the shale play to about 137,000 gross acres (106,000 net). Gulfport also has about 12,000 net acres in the Niobrara-Piceance and 11,000 net acres in the Permian, along with approximately 200,000 net acres in Canada’s Grizzly oil sands, according to company records.

Gulfport is scheduled to release its quarterly and full-year 2012 earnings report on Feb. 26; a conference call is scheduled for the following day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |