NGI Archives | NGI All News Access

McClendon Out, but Chesapeake ‘Not for Sale’

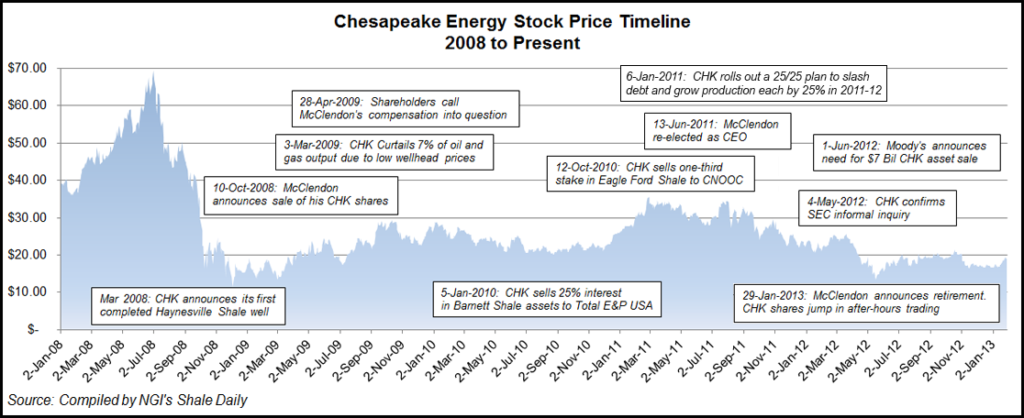

Energy analysts and the market weighed in Wednesday on the news that natural gas pioneer and industry cheerleader Aubrey K. McClendon, co-founder, CEO and president of Chesapeake Energy Corp., is retiring effective April 1. His departure would end one point of controversy, but it won’t solve the problems facing the producer, according to some.

McClendon, who founded Oklahoma City-based Chesapeake 24 years ago, said late Tuesday he would continue as CEO until a successor is named. The retirement agreement was reached with the board of directors, according to Chairman Archie W. Dunham, who took the helm last June after McClendon was stripped of that role (see Shale Daily, June 22, 2012; May 2, 2012).

“Over the past 24 years, Aubrey McClendon has crea ted one of the most valuable and innovative companies in the energy industry,” Dunham said. “Under Aubrey’s strong leadership, Chesapeake has built an unmatched portfolio of natural gas and oil assets in creating one of the world’s leading energy companies. He has been a pioneer in the development of unconventional resources, and he has also been a leader in the effort to make the United States energy independent.

“However, as the company moves toward more fully developing the value of its outstanding assets, Chesapeake is at an important transition in its history and Aubrey and the board of directors have agreed that the time has come for the company to select a new leader. The board will be working collaboratively with Aubrey to make a smooth transition to Chesapeake’s next chief executive officer.”

Dunham assured employees in an email that the company was not for sale.

McClendon, in a separate letter to the workforce that he built, said his departure centered on some differences with the board of directors.

“By now you all should have received the press release announcing that the board and I have mutually agreed to my resignation as CEO as of April 1,” he said. “Although this is due to certain philosophical differences that exist between the board and me, the separation will be amicable and smooth.

“I have the utmost confidence in you and the company’s future and I will always treasure the time we have spent together building Chesapeake into the unique and dynamic company that it is today.”

The search for a new CEO is said to be well underway, with the board considering internal candidates, as well as a possible heavyweight from outside. A successor may be named before McClendon’s April departure, a company source told NGI’s Shale Daily.

McClendon, a geologist by trade, founded Chesapeake with Tom Ward, who now runs SandRidge Energy Inc. (which also has come under scrutiny). Under McClendon’s watch, Chesapeake grew to become the largest natural gas producer in the United States, a position only lost when ExxonMobil Corp. bought XTO Energy Inc.

McClendon recognized the value in shale gas early, and through a string of acquisitions and property development, financed in part by joint ventures (JV) with foreign firms, amassed a giant reserve holding. NGI first reported on an acquisition by McClendon’s Chesapeake in 1998 when he paid $88 million for properties in British Columbia and the Anadarko Basin (see Daily GPI, Jan. 1, 1998).

As the shale gas boom drove down prices McClendon’s strategy began to misfire. At that point, burdened by debt, Chesapeake was unable to make the switch as others did to oil and liquids-based properties, and the company’s revenue and cash flow deteriorated at about the same time the world financial crisis hit.

The flamboyant leader’s tenure has not been without controversy on a personal level either. In 2008 McClendon was forced to sell nearly all of his 33 million shares in the company to meet margin loan calls. The CEO’s “profligate spending” also has long been questioned by analysts (see Shale Daily, Dec. 6, 2010).

Shareholders and analysts overall seemed to view the news as positive. When the market closed Tuesday Chesapeake was trading at $18.97/share. However, after the retirement news broke around 5 p.m. ET Tuesday, the share price climbed in after-hours trading. At 2 p.m. ET Wednesday Chesapeake had gained 8.70% to $20.62 in heavy volume, before finishing out the day at $20.11, up $1.14, or 6.01% from Tuesday’s close. More than 72 million shares traded hands on the day, versus average volume over the past three months of about 13.5 million a day.

Federal and state investigations still hang over Chesapeake’s head, which were put there on McClendon’s watch and in some cases because of him.

The Internal Revenue Service and the Securities and Exchange Commission have been investigating some of McClendon’s financial transactions for almost a year. The issues deal with the company’s long-time Founder Well Participation Program (FWPP), of which McClendon was the sole participant and which gave him the contractual right to receive a 2.5% stake in every well the company had drilled since 1993 (see Shale Daily, April 19, 2012).

Chesapeake’s board plans to release information about McClendon’s financing arrangements, and other matters, between him, entities in the FWPP, “and any third party that has had or may have a relationship with the company in any capacity,” when the 4Q2012 and year-end earnings are released by Feb. 21.

“The board’s extensive review to date has not revealed improper conduct by Mr. McClendon,” it stated. “The board and Mr. McClendon’s decision to commence a search for a new leader is not related to the board’s pending review of his financing arrangements and other matters.”

As natural gas prices and Chesapeake’s revenues tumbled over the last couple years, the company has been forced to sell off large blocks of its holdings in unconventional resource plays. Pension and hedge fund investors have complained of McClendon’s leadership and called for his ouster. In June a Moody’s Investors Service analyst said the company would have to sell at least $7 billion in assets in 2012 to avoid a breach of debt covenants and a credit downgrade (see Shale Daily, June 1, 2012).

McClendon’s retirement is be handled as a “termination without cause,” which means he could leave Chesapeake with about $45 million in total compensation, based on filings by the company.

McClendon, who oversaw all facets of the company’s operations until last May, now earns close to $1 million in base salary, which with no cause of termination, would be paid annually to him over the next four years, according to his contract. He also is entitled to a $1.95 million base bonus for the next four years, something that he agreed not to take for 2012 (see Shale Daily, Jan. 9). In addition, McClendon holds close to 1.5 million shares of stock, which depending on market conditions could be around $20/share, and that would be immediately vested on April 1.

GHS Research analysts, who met with McClendon in 4Q2012, said his departure caught them by surprise. They had come away thinking a difference of philosophies between the embattled CEO and the new board were more in line than at opposite ends.

“In fact we were told that everything positive that could come from tighter corporate discipline at Chesapeake would in fact emerge,” analysts said in a research note Wednesday.

With McClendon’s departure, Chesapeake’s asset sales are expected to accelerate beyond $17-19 billion for 2012/2013 because the board “likely” will favor pulling the present value of Chesapeake’s 15.1 million undeveloped leasehold acreage forward, said the GHS team. There is “value” for a major that might want to make a move as well because Chesapeake has massive leaseholds that it still hasn’t developed in the Utica, Marcellus and Eagle Ford shales, as well as the Mississippian Lime and Powder River/Denver Julesburg Basin. Some of those assets already are up for sale.

“We think that a major with lower cost of capital versus Chesapeake can quickly get to a starting point of $30/share of value fairly easy,” GHS noted.

What could hinder buyers, however, is Chesapeake’s “intimidating” capital structure, which includes seven JVs, close to $13 billion in long-term debt, $3 billion in preferred equity and around $2.4 billion in noncontrolling interests.

BMO Capital Markets analyst Dan McSpirit said Chesapeake faces a lot of problems that basically have nothing to do with McClendon’s departure.

“What remains is a company struggling with its balance sheet,” McSpirit wrote. “What remains is a stock that’s a leveraged proxy for natural gas, highlighted by production naked to strip pricing.”

Chesapeake’s shares were trading at seven times BMO’s 2013 gross earnings estimate, said McSpirit. “This compares with a group median closer to six times. Not cheap, in our view. Our NAV [net asset value] analysis yields $24. An NAV of $15 results after excluding the value of the still-uncertain Utica Shale and the economically challenged dry gas operations targeting the Barnett Shale and Haynesville Shale plays. We see greater uncertainty. We see greater downside.”

Tudor, Pickering, Holt & Co. (TPH) analysts feel much the same. “In our view, the idea of change is brighter than reality and CHK still faces a steep climb,” analysts said. “Absent a big move in gas prices, we think fixing the balance sheet will require more divesting of core assets with CHK likely sacrificing growth to get a peer average valuation of 5.4 times…in 2015. Chesapeake remains relatively expensive on multiples…and we firmly believe the company is not for sale.”

One “most discussed question” for TPH’s team is, “what if CHK targeted a transformational divestment (think Marcellus) and pursued a shrink to grow strategy?

“Our view is that such an action, combined with other assets marked for monetization, improves the balance sheet near-term. However, the company struggles to maintain activity while preserving reasonable long-term leverage…Gas price leverage is still key to reevaluation…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |