Bakken Shale | E&P | NGI All News Access | Permian Basin

Whiting Adds to Bakken War Chest

Whiting Petroleum Corp. is building its presence in the Williston Basin by purchasing some acreage in North Dakota and Montana, the Denver-based operator said Tuesday.

Management had said in July that increased development was expected in the Bakken and Niobrara/Denver Julesburg formations this year (see Shale Daily, July 30). The Bakken Shale has become Whiting’s primary focus.

Through a $260 million agreement with a private party, Whiting is acquiring producing oil and natural gas wells, along with development acreage, in North Dakota’s Williams and McKenzie counties, as well as Montana’s Roosevelt and Richland counties.

“This acreage expands our presence in our Western Williston Basin area, where we have seen recent strong production growth primarily as a result of positive drilling results at our Hidden Bench, Tarpon and Missouri Breaks prospects,” said CEO James J. Volker.

The properties primarily target the Middle Bakken and Three Forks zones, and include 17,282 net acres in and around Whiting’s acreage in the Missouri Breaks and Hidden Bench prospects. Included in the purchase are 13 operated 1,280-acre drilling spacing units in the Bakken/Three Forks, with an average working interest of 58% and net revenue stakes of 48%. Almost all (92%) of the acreage being purchased is held by production.

Net oil and gas production this month from the purchased properties is estimated to average 2,420 boe/d. Whiting estimates proved reserves at 17.1 million boe, 85% weighted to oil. Close to one-quarter of the reserves are classified as proved developed producing, while 76% are proved undeveloped.

The transaction is set to close by the end of September, financed with debt and existing bank credit.

According to Wells Fargo’s acquisition and divestment information, the purchase likely was from PetroHunt, which began marketing a few months ago a “similarly sized Williston package that included 17,200 net acres, 96% held by production with 1,950 boe/d from 119 wells,” wrote analyst David Tameron.

“As usual, some quick back-of-the-envelope math: at $40,000/boe flowing (as large percentage of current production is likely legacy vertical), we attribute $100 million of the purchase price to production” Tameron wrote. Using Whiting’s $4.4 million present value 10 for its Bakken/Three Forks 400,000 boe type curve and with $90.00/bbl oil prices, “the remaining purchase price can be attributed to 36 locations.”

If Whiting were able to place four Bakken Shale wells and three Three Forks wells in every downspacing unit, consistent with the operator’s recent presentations, “the new assets contain 91 potential locations, although we are not sure how many of these remain,” Tameron wrote. Whiting, he said, “has had recent success in their Missouri Breaks asset through new completion designs, and we believe [the] news could be another positive indication of management’s view on the prospects for area as a whole.”

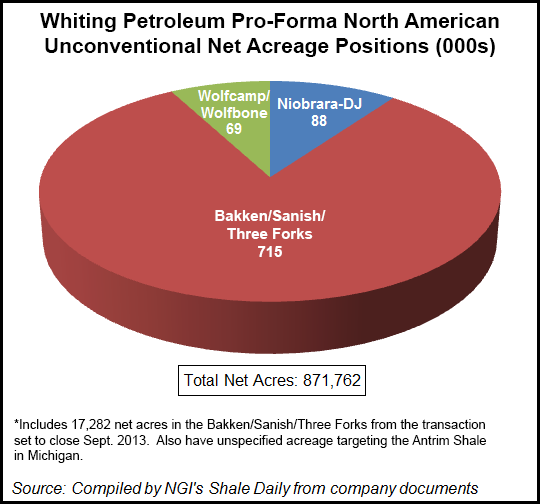

With the transaction, Whiting will have nearly 715,000 net unconventional acres in the Bakken/Sanish/Three Forks. The company has another 88,000 net acres in the Niobrara/Denver Julesburg and 69,000 net acres in the Wolfcamp/Wolfbone.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |