Marcellus | Eagle Ford Shale | NGI All News Access | Permian Basin

Independents Proving Size Doesn’t Matter

Big Oil’s attempt to take over the North American onshore from U.S. independents so far hasn’t paid off as some would have imagined just a few years ago, with the majors still struggling to capture the kind of profits and production results they may have been anticipating.

What gives? Some of it has to do with how major producers are structured, while some of it has to do with their ability to shift operations as efficiently or quickly as independents can, according to analysts. “Big Oil” became the catchword for the top producers because the operators are just that: operations are worldwide, offshore and onshore, with a mix of exploration and production (E&P) competing with refining/marketing dollars.

U.S.-focused independents mostly do one thing — E&P — and aren’t as vested in much beyond drilling, completion and production.

The second quarter results proved the point. ExxonMobil Corp., considered the top North American natural gas producer, had a dismal report from a year earlier, as did Shell, Chevron and BP plc. The four majors together were producing 13.6 million boe/d earlier this year. In 2007, their combined output was about 300,000 boe/d higher.

A big impact to the bottom line has come from declining natural gas prices, which have fallen in the United States from mid-2000 levels. With the massive operations, big producers also are not, at times, as swift as the independents in watching the trends and moving quickly.

ExxonMobil saw its quarterly profits plunge to $6.9 billion from $15.9 billion, and revenue was off 16%. Shell reported earnings down 20% year/year, and it’s launched a portfolio review of its North American onshore after taking a $2 billion charge (see Shale Daily, Aug. 2a). Chevron’s profits fell by close to $2 billion and net U.S output was flat. BP, still smarting from the Macondo oil spill impact, also reported earnings down by more than $2 billion, while U.S. output in 2Q2013 was at its lowest level in 15 years.

A good catalyst for the majors remains in their legacy positions in North America’s onshore, many that have been held for decades, as well as their financial wherewithal and technical operations.

ExxonMobil has big positions in leaseholds across North America, courtesy in part through its buyout of XTO Energy Inc. Chevron scooped up 623,000 net acres from the merger with Atlas Energy Inc. three years ago (seeShale Daily, Feb. 22, 2011). Shell’s onshore unconventional portfolio in North America includes land in Pennsylvania’s Marcellus Shale and Ohio’s Utica, and in the Bakken, the Rockies, California, Kansas and in British Columbia. However, whether the majors could turn their onshore into a cash and production generator is yet to be seen.

Wunderlich Securities’ Irene Haas said, for example, that there’s a “good mix” of large and small operators now working the still-emerging Utica Shale, including usual suspects Chesapeake Energy Corp., EV Energy Partners and Gulfport Energy. ExxonMobil also is a large Utica leaseholder, she said.

The latest quarterly results by the majors would indicate that they’ll need to spend wisely or continue to be beaten by their less-capitalized U.S. independent brethren. Compared with the better capitalized majors, consider these year/year second quarter reports, all by U.S. onshore superstars, all independents, all of which focus primarily in North America:

As Big Oil becomes more medium-size, U.S.-focused operators, without the same financial or technical resources, are going at full throttle. Barclays Capital analysts in June said they expected ExxonMobil, Chevron, BP plc and the now largest independent ConocoPhillips to lead all U.S. E&Ps in spending this year, with capital expenditures on average about 5% higher than in 2012 (see Shale Daily, June 5).

So, what gives?

U.S. Capital Advisors (USCA) analyst Cameron Horwitz and his team reviewed their independent coverage group and on Thursday provided the big themes they see going forward in the onshore. There were “more beats than misses” with many of the coverage group “skewed to the upside,” said Horwitz. USCA covers, among others, EOG Resources Inc. and Southwestern Energy Co. The “most material production outperformance” was from the Permian Basin operators and the “core/tier one” Eagle Ford producers, including EOG. ConocoPhillips has a big position in the Eagle Ford, and it’s performed well, and the majors also hold positions, but they’ve not yet captured the value of what they have.

Wells Fargo’s David Tameron and crew also recapped what they consider to be the things to watch in the second half of this year. Yes, independents are gaining production-wise, but there also are roadblocks on the horizon.

“The efficiency train continues with almost all operators on board pointing toward higher adoption of pad drilling, faster drilling times despite growing lateral lengths, and lower completion costs (or at least on a per stage basis given the proclivity for adding stages),” Tameron wrote. “Do companies keep up the rate of improvement or do roadblocks (stabilization of service costs, downspacing limitations, sliding down the 12-month curve, etc.) start to emerge?”

E&Ps are “increasingly positive on their respective footprints in the Permian and Marcellus” as lower well costs and production growth combine to drive higher returns. The trend, said Tameron, continues for oil and liquids, but there is a “looming presence” for petrochemical and liquefied natural gas export-driven demand.”

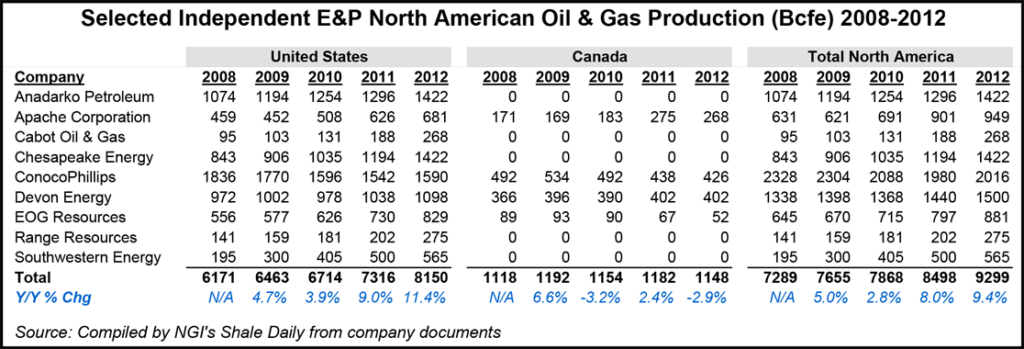

A cross section of independent E&P’s reported 9,299 Bcfe of oil and gas production last year, a 9.4% increase from 8,498 Bcfe in 2011 and up nearly 28% (2,010 Bcfe) from 2008. The increase came through U.S. production, which increased to 8,150 Bcfe in 2012 from 7,316 Bcfe in 2011; Canadian production actually fell 2.9% from 2011 to 2012 and has been nearly flat since 2008.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |