Bakken Shale | NGI All News Access

U.S. Oil Rail Shipments in Quandary Following Quebec Derailment

The future of continued robust growth in railing domestic crude oil supplies has come into question following the Quebec oil tanker car derailment in July, but the transporters don’t see a slowing trend longer term.

The tragedy in Lac-Megantic has led to increasing environmental push-back on rail delivery of coal and oil, compounded by narrowing regional crude oil price differences (seeShale Daily, July 25). These factors have sparked questions about impacts from the wellhead in the Bakken Shale in North Dakota.

RBN Energy Inc.’s Sandy Fielden told NGI‘s Shale Daily on Wednesday that the narrower differentials between West Texas Intermediate (WTI) and Brent crude prices have cut rail transportation. However, longer term he sees that reversing, as the price spreads again widen and provide more opportunities for rail oil transport by the middle of 2014. Until then, a lot of continued volatility and big swings in prices are expected.

“We expect the price differentials between the inland areas and the two coasts will widen to cover the transportation costs,” Fielden said. “Right now there are a lot of moving parts with the U.S. increasing production and replumbing of the whole crude oil distribution system, so it will take until the middle of next year for things to sort themselves out to the extent that we will start seeing some kind of consistency in relationship to crude locations and prices.”

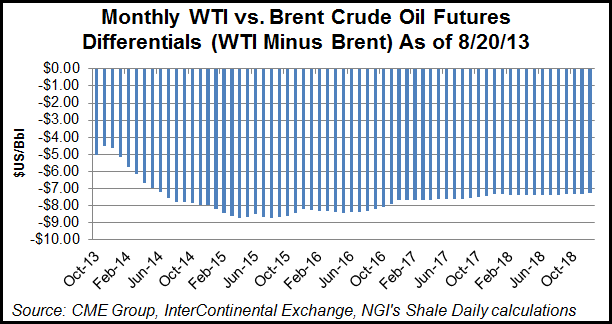

Traders also expect the spread between WTI and Brent prices to widen in future months, which should make U.S.-based crude a bit more attractive to North American buyers, everything else being equal. The October WTI futures contract closed at a $5.04/bbl discount to its Brent counterpart on Tuesday, but that discount is expected to grow to $8.43/bbl in May 2016 before gradually shrinking to $7.29/bbl in December 2018.

Officials in North Dakota have indicated that it is too early to see if the rail developments puts a dent in Bakken oil marketing, which depends on rail to reach markets, east and west from the Williston Basin. Given the legal and government inquiries into the Quebec incident, few in North Dakota know what, if any, alternative means have emerged for keeping the flow of Bakken crude moving at its increasingly brisk pace.

Bakken producers remain the dark about the long-term consequences, said North Dakota Pipeline Authority Director Justin Kringstad. The authority tracks shipments from the Williston Basin. It will be another month until North Dakota has July production numbers and rail transport statistics available, he said. But even those statistics won’t have any indicators of how much Bakken crude is going to any particular refinery.

“If I didn’t know beforehand [of the derailment] how much was going to a particular refinery or region, then after the incident I don’t have any destination information as well,” Kringstad told NGI‘s Shale Daily. July statistics will only show whether rail shipments out of the Bakken went up or down for the month, and if they are reduced, the changes may be due to prices and other factors, he added.

“We’ll have to wait and see what the numbers come back as,” he said, adding that North Dakota would like to have more data on where Bakken crude ultimately ends up, but “there is no public data or information; it is all held confidential.”

In fielding questions about oil volumes moving to Eastern Canada via rail, the Canadian National Railway (CNR) declined to give any information, citing “competitive and confidential” reasons. Montreal, Maine & Atlantic Railway (MM&A), the railroad involved in the accident, has filed for bankruptcy protection.

However, on a 2Q2013 earnings conference call last month, CNR Chief Marketing Officer Jane O’Hagan told analysts that “rail is going to be a permanent part of transportation of crude to the marketplace,” because of its “optionality, in terms of being able to move quickly between markets, and the value proposition [compared to pipelines] is complementary.” The positive view is “supported by customers, and we continue to work on delivering our longer-term initiatives, building out that infrastructure to deliver those volumes.”

In similar questions during a recent conference call, Union Pacific’s senior managers said they had not seen any impact at a major oil loading rail facility from the WTI-Brent price tightening. “We’ve seen some minor impact in our Texas business where there are a lot of pipelines,” said operations chief Lance Fritz. Most of the impact has been in its short-haul business. Longer term, Union Pacific executives said customers are interested in expanding destination terminals, particularly in California where declines of crude from traditional sources, such as Alaska, are causing rail customers to look for oil supplies in Western Canada and the United States.

In the Pacific Northwest, plans are moving ahead for two major new oil rail receipt terminals, including the proposed 360,000 b/d terminal at Port Vancouver, WA. Environmental groups have opposed the rail plans, but the prospects of new jobs and economic growth has held sway with policymakers.

BNSF Railway Co. also is in the midst of doling out its all-time record capital budget of $4.3 billion this year, including $220 million for improvements and expansion in North Dakota; $115 million in Montana; and another $125 million in the state of Washington.

In Eastern Canada, the Irving Oil refinery in New Brunswick that was receiving oil shipments via MM&A’s railway was reportedly reducing its output in late July, however, a spokesperson told reporters that it was part of both scheduled and unscheduled maintenance at the 300,000 b/d facility, which at one time was reportedly receiving 70,000 b/d from the Bakken.

It isn’t clear if the derailment, which closed MM&A’s mainline from Montreal to Saint John, has severely cut shipments to the privately held Irving refinery, part of a network that is Canada’s largest. In its Aug. 8 Chapter 11 bankruptcy filing, MM&A reportedly stated that its shipments to the refinery have increased since the derailment.

Lawsuits are flying on both sides of the U.S.-Canadian border, and MM&A estimates that the cleanup of the derailment site alone will cost more than US$194 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |