Shale Daily | E&P | NGI All News Access

Colombia Said Ready to Award Fracturing Pilots in October

Colombia’s National Hydrocarbons Agency (ANH) will award contracts for hydraulic fracturing pilot projects to interested companies by October, according to media reports.

ExxonMobil and ConocoPhillips, along with Colombia’s state oil company Ecopetrol SA, are among firms that have expressed formal interest in these pilot projects, which ANH director Armando Zamora said should start “as soon as possible.”

The pilots are seen as a way to demonstrate the resource in place and as a means to highlight what impacts the procedure might have on the environment. Fracturing has been controversial in Colombia and was recently declared in the lower house of congress as legal.

Crude production in Colombia is projected to fall to 750,000-850,000 b/d this year based on a Brent crude oil price range of $25-45/bbl, from a target of around 900,000 b/d at the start of the year, the government said at the end of April.

Some estimates see foreign direct investment in Colombia falling by as much as 20% in 2020 as a result.

The ANH has eased fiscal requirements on oil and gas companies working in the country in a bid to soften the blow of the demand implications of the coronavirus.

Zamora said in May the process of regulation has actually sped up as a result of regulators having to work remotely. He said regulation for the pilots should be set by July.

Meanwhile, the country’s strict lockdown in capital Bogota remains in place and runs through the end of June.

Despite complications, oil and gas companies have expressed no interest in leaving the country, Zamora said.

Ecopetrol CEO Felipe Bayon has said previously that he considers fracturing key to the country’s long term energy security.

Proven natural gas reserves in Colombia were 3.1 Tcf at the end of 2019, equivalent to eight years of production, but Zamora sees contingent gas reserves as eight times higher.

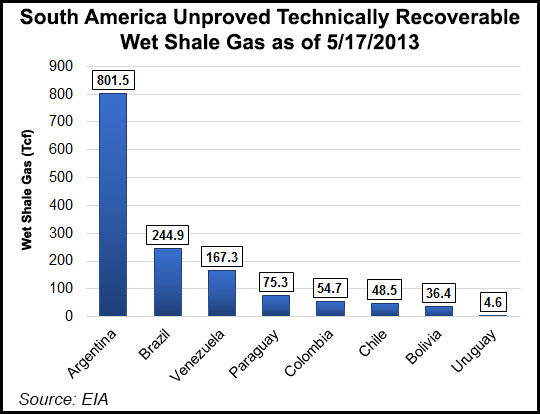

Colombia has 55 Tcf of technically recoverable shale gas resources, which would place it fifth in South America, according to the U.S. Energy Information Agency. Argentina has 802 Tcf and Mexico 545 Tcf of technically recoverable unconventional gas.

In Latin America, only Argentina has employed fracturing on a commercial scale, in particular in its Vaca Muerta shale formation. Mexico has practiced the technique, and regulation is in place, but the current government of Andrés Manuel López Obrador opposes it.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |