NGI All News Access | E&P | Markets

U.S. Natural Gas Count Down One as Oil Rigs Further Depleted

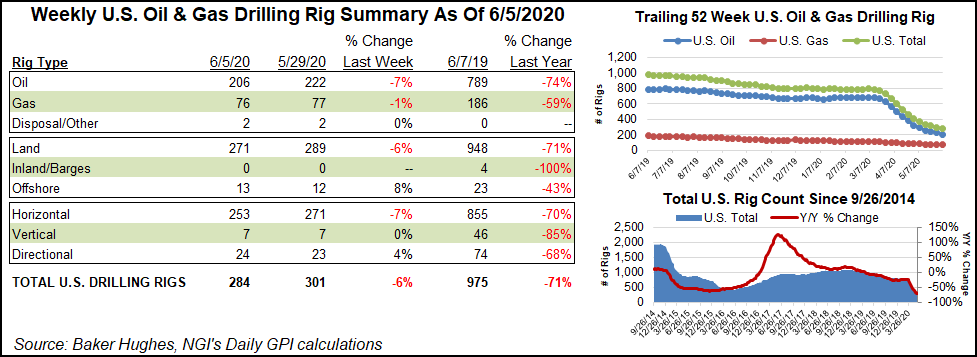

The U.S. natural gas rig count fell one unit to 76 for the week ending Friday (June 5), while further oil drilling declines showed domestic upstream activity still searching for a bottom even after months of retrenchment, according to the latest figures from Baker Hughes Co. (BKR).

The domestic declines included 16 oil-directed rigs, with the combined U.S. total ending the week 691 units behind the 975 rigs active at this time last year. The U.S. count has plummeted more than 500 rigs since March 13, BKR data show.

Land drilling fell by 18 rigs for the week, while one rig was added in the Gulf of Mexico. The addition of one directional rig partially offset the departure of 18 horizontal units, according to BKR.

The Canadian rig count increased by one oil-directed rig to end at 21 for the week, off from 103 in the year-ago period.

The combined North American count ended at 305, down from 1,078 a year ago.

Among major plays, the Eagle Ford Shale saw the largest weekly decrease, falling nine units to 13, versus 74 a year ago. The Permian Basin fell seven units to 141, while the Ardmore Woodford, Granite Wash and Haynesville Shale each dropped one rig.

Meanwhile, the Cana Woodford saw a net increase of one rig, ending the week with five active units, versus 44 in the year-ago period.

Broken down by state, BKR recorded a 12-rig drop in Texas for the week, leaving the Lone Star State with 115 active rigs, versus 473 a year ago. New Mexico dropped three rigs overall, while Louisiana, Oklahoma and Wyoming each dropped one, according to BKR.

Nineteen North American exploration and production (E&P) operators have filed for bankruptcy protection since the start of the year, and it is “reasonable to expect” more companies will seek protection from creditors in the months to come, according to a recent analysis by Haynes and Boone LLP.

The law firm has monitored North American oil and gas producer bankruptcies since 2015. Its latest report noted that five filed for Chapter 11 in 1Q2020 and 14 more have sought protection to date in the second quarter.

“Following a steep drop in oil prices in the fourth quarter of 2018, the number of filings started trending up in 2019,” the firm said. “At the end of last year, we were predicting that this trend would continue into 2020 based on expectations that oil prices would remain in the $55-60/bbl range. Since January, however, oil prices have fallen from $63/bbl to a one-day drop into negative territory closing at minus $36/bbl on April 20.”

Crude prices have shown signs of recovering in recent weeks, but West Texas Intermediate futures in the $30/bbl range still won’t provide a “sufficient clearing price for many heavily leveraged shale producers,” according to the firm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |