Shale Daily | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

EQT’s 1.4 Bcfe/d Natural Gas Curtailment in Appalachia May Extend Through June

Appalachian natural gas giant EQT Corp. said Tuesday the 1.4 Bcfe/d curtailment announced last week may extend through June.

The news comes on the heels of a $125 million deal with Diversified Gas and Oil plc to sell a bundle of assets in Pennsylvania and West Virginia. Proceeds from the sale, which relieves EQT of $47 million in obligations, are being used to pay down a term loan due 2021.

The sale “demonstrates our commitment to improving the balance sheet and reducing debt,” CEO Toby Rice said. “These assets sit outside our core focus area and the divestment will enable a heightened focus on our core asset portfolio. Additionally, the transaction relieves EQT of the higher relative operating costs and substantial asset retirement obligations associated with these assets and will improve our financial standing.”

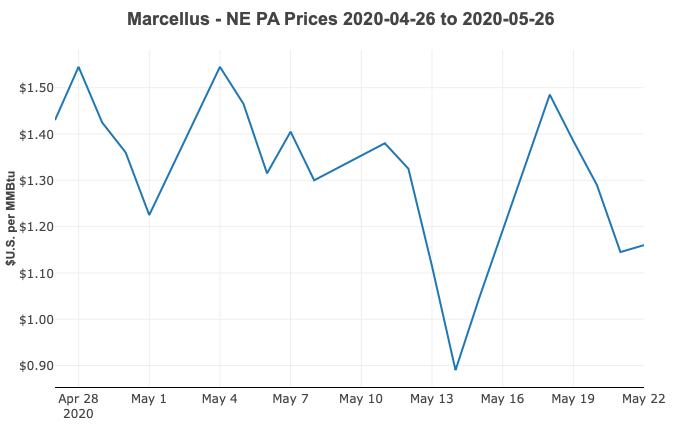

Regarding the gas shut-ins, EQT in mid-May opted to curtail 1.4 Bcfe/d gross, equivalent to 1 Bcfe/d net. The decision was made then to defer production to wait out higher commodity prices, with the duration “subject to commodity price movements, relationships and resulting economics…”

EQT said Tuesday the shut-ins “could potentially continue through the end of the second quarter 2020.”

Assuming the curtailment continues at 1.4 Bcfe/d through June 30, 2Q2020 sales volumes are forecast to total 315-335 Bcfe, about 45 Bcfe lower than previously announced guidance of 360-380 Bcfe. However, the 2Q2020 average differential guidance is maintained at minus 45 cents-minus 25 cents/Mcf.

Because of the fixed cost nature of some operating costs, the 2Q2020 total per-unit operating costs “are expected to be at the high-end” of the full-year guidance of $1.34-1.46/Mcfe.

EQT still expects no changes to full-year guidance.

The sale to Diversified includes 80 Marcellus Shale wells in Pennsylvania with 50 MMcfe/d net in Cameron, Clarion, Clearfield, Elk, Indiana, Jefferson and Tioga counties, including 33 miles of gathering lines. Leasehold and drilling rights are retained on all acreage, excluding Tioga County.

In West Virginia, Diversified is taking over 154 miles of gathering lines and 809 conventional wells with 3 MMcf/d net in Doddridge, Harrison, Marion, Monongalia, Ritchie, Taylor, Tyler and Wetzel counties. Leasehold and drilling rights also are being retained.

“This transaction further solidifies the strong relationship we share with EQT that dates back to 2018 when we completed a $575 million purchase of similar Appalachian assets,” CEO Rusty Hutson Jr. said. “Our teams work exceptionally well together, and we look forward to future opportunities to partner again.”

The new acquisition “builds on the significant momentum we’ve generated this year and continues to validate the large opportunity set of accretive gas and oil producing assets available in this market. As in the past, we now turn our attention to seamlessly integrating the assets into our existing portfolio, eager to capitalize on the embedded upside from the 13 nonproducing wells by restoring them to production and further leveraging the scale and geographic density of our operation to reduce costs while also improving production from the other wells.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |