Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

U.S. Drops 21 Rigs as Drilling Declines Continue to Mount in Oil Patch

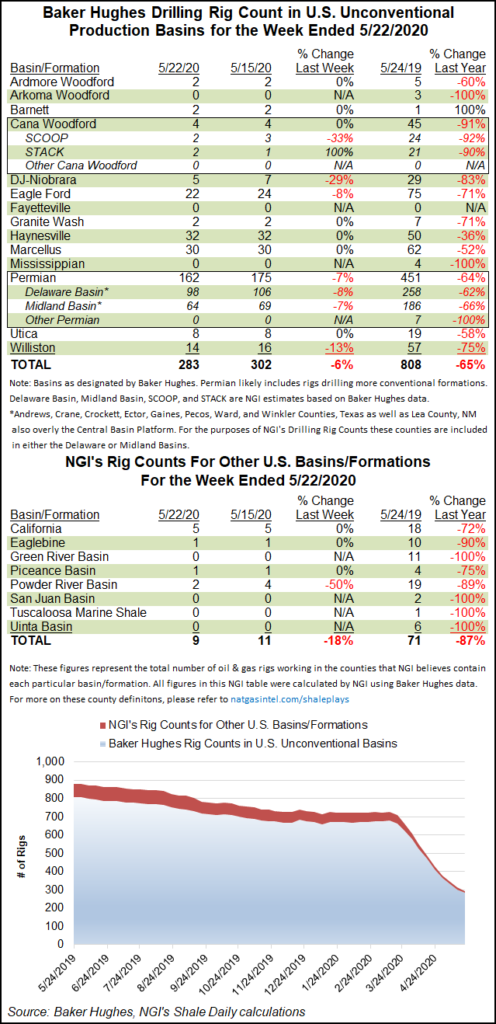

The U.S. rig count continued on its downward trajectory during the week ending Friday (May 22), albeit at a somewhat less dramatic pace, falling 21 units to finish at 318, according to the latest numbers from Baker Hughes Co. (BKR).

All of the declines came from the oil patch for the week, with natural gas-directed drilling holding steady at 79 rigs. The combined U.S. total ended the week 665 units behind its year-ago tally. The U.S. count has now plummeted by 474 rigs since March 13, BKR data show.

Two vertical rigs joined 22 horizontal rigs in exiting the patch, partially offset by the addition of three directional units. Gulf of Mexico activity finished unchanged at 12 rigs.

In Canada, a three-rig decline in gas drilling was partially offset by the addition of one oil-directed rig, dropping the Canadian rig count two overall to 21, down from 78 in the year-ago period.

The North American rig count fell 23 units to end at 339 for the week, down from 1,061 rigs active at this time last year.

Among plays, the Permian Basin saw the largest week/week decline at 13, dropping its total to 162 rigs, versus 451 a year ago. The Denver Julesburg-Niobrara, Eagle Ford Shale and Williston Basin each dropped two rigs for the week.

Among states, the Texas count slid 12 rigs overall to 138, down from 481 in the year-ago period. New Mexico dropped three rigs, while Colorado, North Dakota and Wyoming each dropped two. Pennsylvania dropped one rig from its total week/week, offset by the addition of one rig in West Virginia.

With the Covid-19 pandemic still limiting energy demand, about 1.7 million b/d of existing oil production temporarily could be shut-in across the United States by early June, according to a recent analysis by IHS Markit.

Researchers said the curtailments are coming quickly from operating cash losses, lack of demand and storage capacity, as well as “an unwillingness to sell resources at the very low prices” since Covid-19 usurped demand.

Meanwhile, Equitrans Midstream Corp. said in a regulatory filing early in the week that its largest customer, EQT Corp., has started temporarily curtailing 1.4 Bcf/d of production in Ohio and Pennsylvania.

Equitrans said in the filing it expects the curtailments to last up to 45 days. It revised the forecast for second quarter net income, but full-year guidance remains unchanged.

The news came as the Energy Information Administration said it expects oil and natural gas production from seven of the most prolific U.S. onshore unconventional plays will be down in June from May, a second consecutive decline as the coronavirus continues to dent energy demand and prices.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |