NGI All News Access | Infrastructure

Alberta’s Helium Industry Ballooning as Prices Soar Far Above Natural Gas

Alberta, Canada’s chief natural gas producing province, has set out to break into international markets for a form of helium, which fetches prices up to 100 times higher.

The provincial government announced a token helium royalty rate and promised a review in 2025 to adapt to competitive conditions.

“Establishing this new rate of 4.25% and structure helps set the stage for investment,” said Energy Minister Sonya Savage.

The action responds to a plan by Richmond, VA-based Weil Group Resources to build CryoHub, a helium refining, freezer, and delivery operation at Medicine Hat in southeastern Alberta.

Weil, Calgary’s North American Helium Inc. and Medicine Hat’s city-owned gas utility sought assurance that their budding industry would avoid a formidable cost hurdle posed by the Alberta resource royalty regime. A sliding-scale rate for fossil fuel gas tops 20% at high prices.

“Removing this barrier unlocks the potential to develop helium deposits in southeastern Alberta and sets us up to take advantage of the close proximity to the United States, the world’s largest helium consumer,” said provincial authorities.

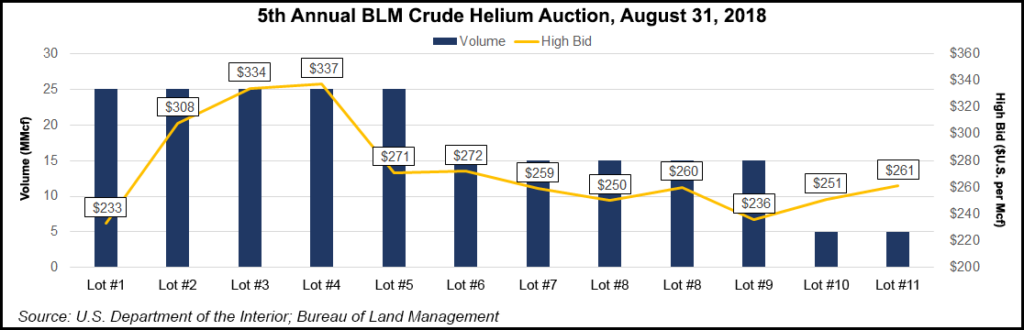

Industry interest in Alberta and Saskatchewan drilling targets grew after the U.S. Bureau of Land Management (BLM) earned stellar prices with its 2019 annual auction at a helium storage, enrichment plant and pipeline system near Amarillo, TX.

Successful bids averaged $279.95/Mcf, up by 135% in 2018. The 2019 BLM sale was the last in a series held under the U.S. Helium Stewardship Act of 2013, to turn over the field gradually to industry.

In April BLM set a 2021 target to transfer the Amarillo facilities to the U.S. General Services Administration and around 2023 to complete its disposal of government-controlled supplies to the private sector.

From helium’s first use in military balloons during the U.S. Civil War, a chilled liquid form has emerged as a cooling agent in medical diagnostic equipment, rocketry, aerospace, welding, fiber optics, cryogenics, particle accelerators and nuclear research.

Alberta and Saskatchewan deposits stand out as industry targets because their helium is associated with harmless nitrogen. A low-cost chilling process used to separate the gases only produces traces of hazardous materials. Most other supplies are byproducts of fossil fuels, and especially refrigeration of liquefied natural gas.

Saskatchewan, where Weil has established an initial Canadian toehold in the budding industry, has issued nearly 300 permits and leases for helium extraction covering about 17,000 square kilometers (6,800 square miles).

Seven years ago BLM gave the green light for a project in eastern Utah to drill an exploratory well in the Harley Domenatural gas field to capture helium. Commercial helium is recovered from many Utah natural gas wells, but BLM said the Harley Dome could be the state’s primary site for helium, which is used in many scientific research and technical applications, as well as party balloons.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |