Shale Daily | E&P | NGI All News Access

Oil Market Said Poised for Partial Recovery as June WTI Surpasses $30

With the most severe impacts of Covid-19 on oil demand now “in the rearview mirror,” Raymond James & Associates Inc. analysts said Monday West Texas Intermediate (WTI) oil should average $50/bbl in 2021, and to reach a long-term average of $65/bbl.

The analyst team led by John Freeman and Pavel Molchanov said in a note to clients the price recovery would be driven by a partial return of oil demand, combined with disciplined adherence by the Organization of the Petroleum Exporting Countries (OPEC) and its allies, aka OPEC-plus, to pledged production cuts, as well as organic supply cuts from countries outside the alliance.

These factors mean that “the stunning inventory builds of 2020 will make way to massive draws in the following two years,” the analysts wrote, forecasting a 2020 global inventory build of 4.4 million b/d in 2020, followed by draws of 3.1 million b/d in 2021 and 5.9 million b/d in 2022.

Although current compliance to the OPEC-plus supply cuts appears to be above 100%, the Raymond James model assumes compliance of 75%.

“We estimate that the OPEC-plus contribution to rebalancing the market cancels out about one-third of Covid’s demand impact (on a full-year basis) in 2020,” the analysts said. “There is no way to avoid large amounts of price-related shut-ins in the second and third quarters, and even so, we forecast 2020 global inventories increasing by 4.4 million b/d, equating to a staggering 1.6 billion bbl for the year.”

The Raymond James price forecast is well above strip pricing, which currently indicates WTI near $30 at year-end 2020 and mid-$30s by year-end 2021, Freeman and Molchanov’s team said. They said at these prices, U.S. oil production would continue to fall nonstop at least through 2025.

“In real life, this cannot happen, since the outcome would ultimately be unsustainably steep inventory draws,” the analysts said.

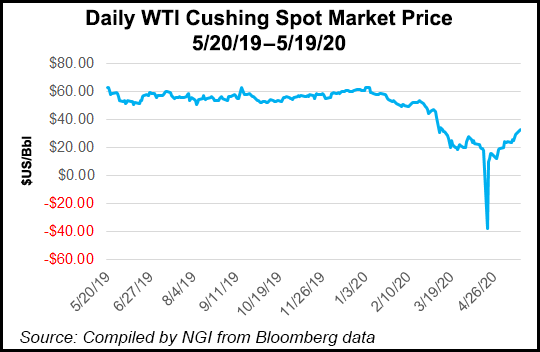

The December 2020 WTI futures contract added $2.06 to settle at $34.07/bbl on Monday. The prompt month contract, meanwhile, surpassed $30 for the first time in two months, gaining $2.39 to settle at $31.82.

Genscape Inc. natural gas analyst Josh Garcia said there are signs of a rebalancing market. He cited a slight uptick in oil demand, the roughly 10 million b/d of OPEC-plus production cuts that took effect this month, a ninth consecutive weekly drop in the U.S. rig count, and the first weekly drop in inventories at the Cushing hub in Oklahoma since February.

The front-end of the New York Mercantile Exchange curve “has shown considerably more strength than we expected,” EBW Analytics Group said Monday. Analysts attributed the gains to faster-than-expected cuts in production flowing to Cushing, as well as funds taking long positions, rising gasoline demand and expectations of demand recovery as states reopen their economies.

EBW analysts cautioned, however, that, “In our view, the market is getting carried away with itself, rising too far too fast,” adding, “The economic shocks from the pandemic will keep global demand depressed for many months.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |