NGI Weekly Gas Price Index | Markets | NGI All News Access

Springtime Temperatures Sap Demand, Send Weekly Spot Natural Gas Prices Sharply Lower

With the eastern United States thawing from an unusual winter blast over Mother’s Day weekend, and cloud cover keeping truly hot weather at bay in the South, spot gas prices for the May 11-15 period dropped by the double digits across the Lower 48. NGI’s Weekly Spot Gas National Avg. was down 23.0 cents to $1.520.

Temperatures on the East Coast, which just days ago had plunged to a seasonal record low of 24 degrees in New York City, have climbed rapidly in the days since. Highs were set to reach the 60s to lower 80s in the coming days, squashing demand.

Given the bearish set-up, Transco Zone 6 NY spot gas prices fell 26.0 cents week/week to average $1.250. Cash fell more than double that at Iroquois Zone 1, which averaged $1.200 for the week.

Losses between 20 and 30 cents also were seen throughout most of the country. Benchmark Henry Hub tumbled 21.5 cents week/week to average $1.615, while Chicago Citygate was down 25.0 cents to $1.595.

In the Rockies, Kern River fell 20.5 cents on the week to average $1.505. SoCal Citygate plunged 31.5 cents week/week to $1.780.

The past month has been volatile for gas futures prices, and this week was more of the same. What was different about this week’s swing, however, was the extent to which price fell, especially at the front of the curve.

The June Nymex gas futures contract tumbled 18.0 cents from Monday to close out the week at $1.646. July posted an even more impressive loss of 25.2 cents to settle Friday at $1.833.

The dramatic pullback in gas pricing occurred as liquefied natural gas (LNG) demand — which had been holding up fairly well amid weak global demand stemming from the coronavirus pandemic and a mild winter that left storage inventories unusually high — finally buckled under pressure. NGI’s U.S LNG Export Tracker shows feed gas deliveries hovering around 5.7 million Dth on Friday, down from around 7 million Dth/d on May 9.

With more than 30 U.S. LNG cargoes canceled for June and more cancellations likely over the coming months, demand for the super-chilled fuel could fall further as global economies are slow to recover from coronavirus-led shutdowns. Meanwhile, storage inventories around the world are sitting at unusually high levels after the past winter failed to produce any significant cold.

The latest projections from Energy Aspects are factoring in 4 million tons of U.S. shut-ins against what it would have considered normal production for 2020 given the increases in liquefaction capacity. Other LNG turndowns will continue to be necessary to help balance the global market, according to the firm, even after substantial year/year cuts in pipeline deliveries to Europe.

“We are seeing these production cuts kicking in across a range of non-U.S. LNG producers, largely as a function of them opting not to export spot cargoes below certain prices,” said Energy Aspects analyst James Waddell. “We have already observed year/year production slowdowns in Egypt, Algeria and Southeast Asia, and we could see some curtailments in Australian output. But the collective producer response from these countries is still insufficient to prevent substantial U.S. turndowns.”

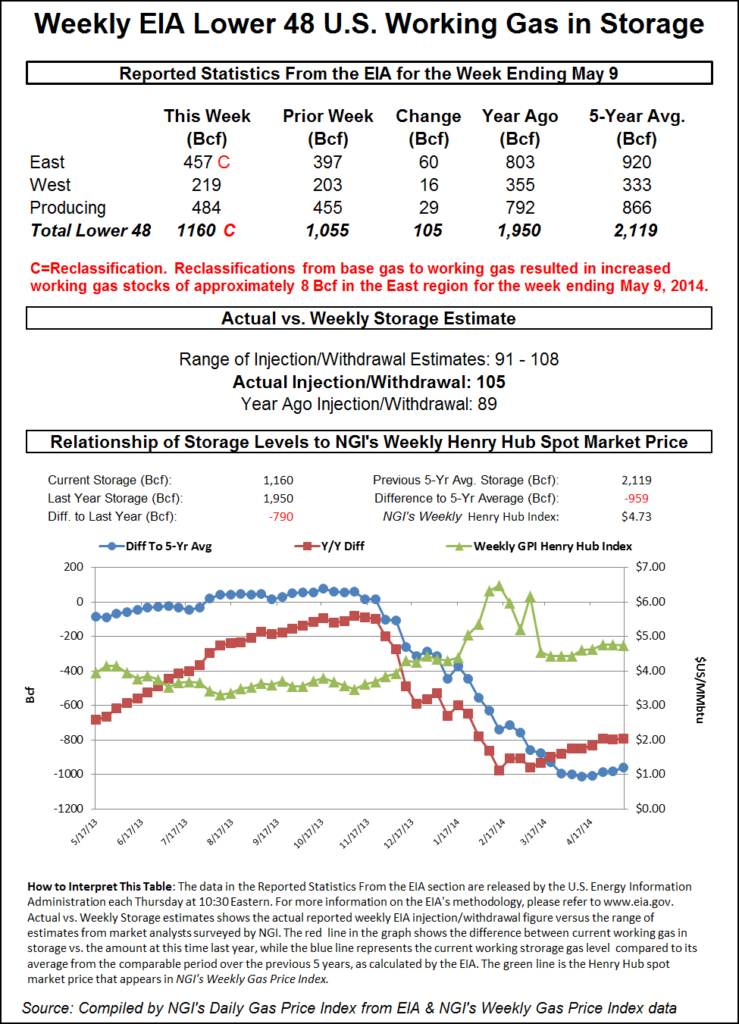

Meanwhile, the stranded U.S. supplies may mean already plump storage stocks fill at a faster pace this injection season. On Thursday, the Energy Information Administration (EIA) said that inventories grew by 103 Bcf for the week ending May 8, lifting working gas in storage to 2,422 Bcf, 799 Bcf above year-ago levels and 413 Bcf above the five-year average.

At the current pace of injections, and without material tightening in supply/demand balances, the market could fill storage above its estimated capacity by October. While EIA’s LNG export estimates have historically been too low, July-September LNG exports are now forecast to average only 4.8 Bcf/d, which is roughly half of January peak levels. As a result, EIA now expects end-of-season natural gas inventories to reach 4,155 Bcf, a new record high.

“Although huge uncertainties remain, further bearish macroeconomic revisions could be in store in the months ahead,” EBW Analytics Group said.

Spot gas prices across much of the Lower 48 bounced back on Friday as low prices incentivized some stronger power burns despite the generally mild weather.

NatGasWeather showed temperatures remaining “comfortable” across the northern United States into the “foreseeable future,” as a projected cool shot across the Midwest and East Monday and Tuesday is only expected to bring minor cooling. Meanwhile, Texas, the South and Southeast are forecast to stay in the mid-80s to lower 90s through the end of the month, though bouts of heavy showers should prevent widespread coverage of 90s, “a requirement if bearish weather sentiment is to flip to bullish,” according to the forecaster. Weather systems also were expected to push into the West throughout the week, but these are far from cold, the firm said.

Nevertheless, cash prices were up across the country. On the West Coast, prices for gas delivered through Monday were up a few pennies in California and as much as 6.0 cents in the Rockies.

A similar trend played out across most of Texas, though Permian Basin pricing retreated a bit day/day.

Some slightly sharper increases were seen in the Midcontinent, where Enable East spot gas jumped 9.0 cents to average $1.540 for gas delivered for the three-day period. Most markets in the Midwest tacked on a few cents day/day, while REX Zone 3 Delivered jumped 8.0 cents to average $1.525.

Farther east, Appalachian gas prices posted the largest gains given the brief cool snap hitting the region in the coming days. Dominion South averaged $1.165 after climbing 18.0 cents day/day, while similar gains were seen in the non-NY portion of the Transcontinental Gas Pipeline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |