Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Oil Output Set for Consecutive Declines, but Demand Recovery Likely to Begin This Year

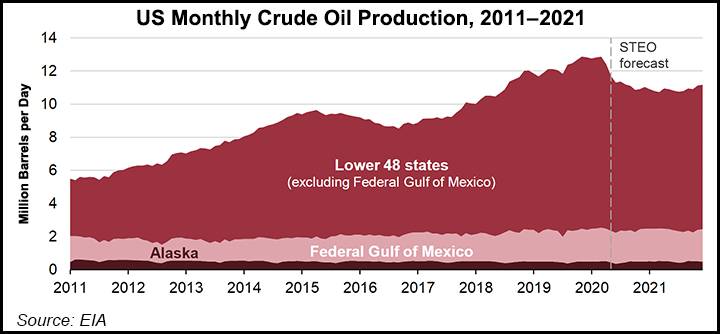

The Energy Information Administration (EIA) said Thursday it expects U.S. crude oil production to decline in both 2020 and 2021, driven by the Lower 48 onshore segment, in response to price and demand destruction caused by Covid-19.

In the latest edition of its Short-Term Energy Outlook, EIA is forecasting average output of 11.7 million b/d in 2020 and 10.9 million b/d in 2021, down 0.5 million b/d and 1.3 million b/d, respectively, from the 2019 figure of 12.2 million b/d.

The expected year/year decline of 800,000 b/d in 2021 would be the largest on record in the United States, researchers said.

They highlighted that West Texas intermediate spot crude prices averaged $17/bbl in April, down from $58 in January, and that the Lower 48 rig count — excluding the Federal Offshore Gulf of Mexico (GOM) — stood at 355 as of May 8, down almost half from the February total of 753, according to Baker Hughes Co.

Researchers said they expect GOM output to remain relatively flat at around 1.9 million b/d in both 2020 and 2021, and for Alaska output to stay at 460,000 b/d in 2020 and increase slightly in 2021.

“Typically, crude oil price changes result in changes in Lower 48 U.S. crude oil production after about six months,” researchers said. “However, current market conditions will likely not follow this relationship as many producers have already announced significant reductions in capital spending and drilling levels, as well as plans to curtail production.”

The American Petroleum Institute’s Dean Foreman, chief economist, found something of a silver lining for the U.S. industry on Thursday. “Significant uncertainty remains over the state of oil markets in the weeks ahead, but the realignment of the supply and demand balance coupled with the gradual reopening of state economies leads us to be cautiously optimistic that the worst may be behind us.”

In its May Oil Market Report also published on Thursday, the International Energy Agency (IEA) said it expects global oil demand to drop by 8.6 million b/d in 2020, versus last April’s forecast of a 9.3 million b/d decline.

“The gradual relaxation of restrictions on movement is helping demand,” said the global energy watchdog. “We estimate that from a recent peak of 4 billion, the number of people living under some form of confinement at the end of May will drop to about 2.8 billion worldwide.”

Researchers warned, however, that “a resurgence of Covid-19 is a major risk factor for demand.”

In the more immediate term, IEA is forecasting a “spectacular” 12 million b/d drop in May global oil supply versus April to a nine-year low of 88 million b/d as the Organization of the Petroleum Exporting Countries (OPEC)-plus curtailment agreement takes effect, along with production declines elsewhere.

“For some OPEC countries, e.g. Saudi Arabia, Kuwait and the United Arab Emirates, lower May production is from record highs in April,” IEA researchers said. “Led by the United States and Canada, April supplies from countries outside of the deal were already 3 million b/d lower than at the start of the year.” That figure could reach 4 million b/d by June, “with perhaps more to come,” the IEA team said.

OPEC, for its part, said Wednesday in its Monthly Oil Market Report that it expects global oil demand to drop by 9.07 million b/d in 2020, a 2.23-million b/d downward revision from the previous month’s forecast, with the deepest contraction seen in the second quarter of 2020 across the Organization for Economic Cooperation and Development Americas and Europe.

The Saudi-led cartel sees non-OPEC oil supply falling by 3.5 million b/d in 2020, a downward revision of nearly 2 million b/d from last month’s forecast.

The revisions “are based on production shut-ins or curtailment plans announced by oil companies – including the majors – particularly in North America.”

In a note to clients Thursday, analysts at Clearview Energy Partners, LLC said that EIA, IEA and OPEC have all forecast sharp increases in global oil demand in 2H2020 versus 2Q2020, but cautioned that “much uncertainty remains regarding a demand recovery, especially in jet fuel,” and that market rebalancing will depend on OPEC-plus compliance with output cuts “and the responsiveness of U.S. and Canadian production volumes to changing oil prices.”

IEA also said it expects global natural gas demand to fall by a record 5% in 2020 because of the impacts of Covid-19.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |