Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Permian Leads Losses as U.S. Rig Count Extends Drop

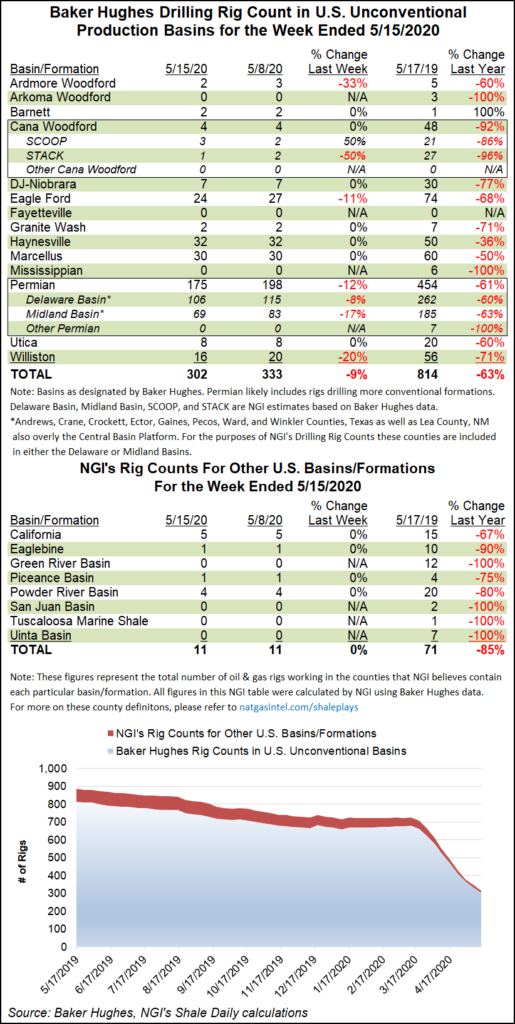

Driven by further losses in the Permian Basin, the U.S. rig count fell another 35 units to end at 339 for the week ended Friday (May 15), extending a vertiginous two-month falloff in upstream activity, the latest data from Baker Hughes Co. (BKR) show.

U.S. operators packed up 34 oil-directed rigs for the week, along with one natural gas-directed, putting the combined domestic tally a pronounced 648 units behind year-ago levels. Since March 13, the U.S. count has fallen 453 units, according to BKR data.

The most recent week’s declines included 32 land rigs, with three exiting the Gulf of Mexico. Thirty-one horizontal rigs and five directional rigs exited the patch, partially offset by the addition of one vertical unit.

The Canadian rig count fell three units — all gas-directed — to end at 23 for the week, down from 63 a year ago.

The combined North American rig count finished the week at 362, down from 1,050 at this time last year.

Among plays, the Permian Basin continued to post heavy losses during the week, dropping 23 units to fall to 175. That’s down nearly three units from the 454 rigs active in the play in the year-ago period.

Elsewhere among plays, the Williston Basin dropped four units, while the Eagle Ford Shale dropped three. One unit exited in the Ardmore Woodford during the week, according to BKR.

Among states, Texas dropped 23 units week/week, with New Mexico and North Dakota each dropping four rigs from their respective totals. Louisiana dropped three rigs during the week, while Oklahoma dropped one.

Amid the recent collapse in drilling activity, permitting for oil and natural gas wells has dropped to a record low, but data from early May has produced glimmers of gains so far this month, according to a recent analysis conducted by Evercore ISI.

The analysis led by James West compiles data from state and federal officials for a deep dive of where permitting is underway and where it has fallen. April permitting was less a bump in the road and more like a train wreck.

However, April showers may be bringing May flowers, the data indicated. Using week/week (w/w) data, Evercore said oil permits climbed 19% from the final week of April to 166 in the first week of May. The Permian Basin accounted for the most permits early this month, rebounding to 100, up by 35 from the week before. The gain was partly offset by the Eagle Ford Shale, with six fewer permits, and the Mississippian Lime, down by seven.

Still, natural gas permits “strengthened to 39,” a 64% gain w/w, “as a result of resilience in the Haynesville Shale,” which added 15 permits. Permitting in other onshore plays dropped to 65, down by 37 from late March.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |