NGI The Weekly Gas Market Report | Coronavirus | E&P | NGI All News Access

NGLs Emerge as ‘Small Silver Lining’ for U.S. Producers Amid Coronavirus Pandemic, Oil Downturn

Natural gas liquids (NGL) production in the United States could prove a relative bright spot in an otherwise grim run for the energy sector.

NGL prices historically have been linked to crude oil for most products, including butane and propane, and linked to Henry Hub natural gas for ethane. However, amid the extraordinary volatility in oil and gas markets, pricing relationships are breaking down as NGL supply falls faster than global demand, according to BTU Analytics LLC.

“Support for NGL prices has been, and could remain, a small silver lining,” said analyst Erika Coombs.

Nearly half of global demand for butane and propane, for example, comes from the residential and commercial sectors, and more than one-third of the supply of these fuels is sourced from oil refineries, according to BTU. However, following a severe drop in crude oil demand tied to the coronavirus pandemic, refinery runs have dwindled and, by extension, so has production of butane and propane. Unlike oil, though, demand persists for the NGLs and is supporting prices.

“NGL demand is resilient as it is driven by petrochemical and residential and commercial sectors, as opposed to transportation fuels,” said Antero Resources Corp.’s David Kennalongo, vice president of liquids marketing and transportation, during the Denver-based company’s recent earnings call.

NGLs are used as fuels and feedstocks to manufacture plastics and resins. End products include medical equipment and cleaning supplies sought during the pandemic.

NGL prices, as a percentage of West Texas Intermediate (WTI) oil, nearly doubled between February and late April, Kennalongo said, “and the strengthening has occurred during the shoulder season, when NGL prices are historically the weakest.”

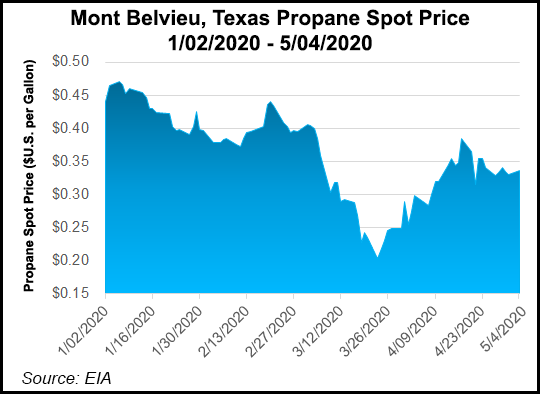

Before pandemic-related shutdowns, propane at the massive liquids hub at Mont Belvieu, TX, for instance, averaged 32% of WTI prices. As the coronavirus fallout washed over the energy sector, NGL prices at the market hub “continued to surge as a percent of WTI, peaking at over 120% of WTI” shortly after crude prices went negative on April 20, Coombs said.

As producers shut-in oil production in the Permian Basin, as well as the Bakken and Eagle Ford shales and other Lower 48 regions, the impact on associated NGL supply will likely intensify, energy industry executives said.

NGL supply is waning, “but on the demand side, we’re seeing increases,” Enterprise Products Partners LP CEO James Teague said on the recent earnings call. NGL fractionators “are full and will remain so,” he added, “and our NGL pipelines, overall, haven’t seen a downturn.”

Fort Worth, TX-based Range Resources Corp. executives were similarly upbeat during the recent earnings call. COO Dennis Degner said the liquids business continued to expand on premiums relative to Mont Belvieu.

“Our portfolio of domestic and international ethane contracts performed very well during the quarter and generated a significant uplift relative to Mont Belvieu, while propane and butane markets benefited from an increase in Marcus Hook export premiums,” he said of the terminal near Philadelphia.

Propane fundamentals also improved during the first quarter despite a warmer-than-average winter, driven by a 17% decline in domestic production from the start of the year, according to Degner.

“Given the historic reduction in U.S. drilling activity and refinery utilization that will be experienced this year, we expect reductions in NGL supply to accelerate as the year continues and into 2021,” Degner said. “We are already seeing the results of a tighter market in the Northeast, with propane barrels bid at a much higher differential to Mont Belvieu than at this time last year.”

Internationally, demand for propane and butane remains “strong in the second quarter on significantly reduced global refinery supply and expectations of decreased supply” from global producers, Degner said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |