NGI The Weekly Gas Market Report | E&P | LNG Insight | Markets | NGI All News Access

EIA Sees Natural Gas Prices Stiffening This Year; Henry Hub to Average $2.89 in 2021

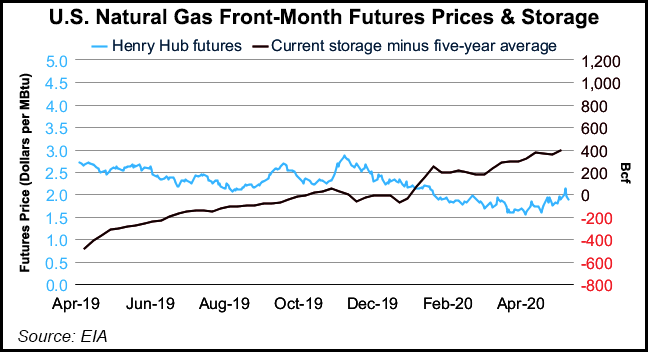

Natural gas prices are likely to remain relatively low in the near term because of reduced business activity and bulging storage levels, but slowing production, growing industrial demand and winter demand will stiffen prices beginning in the third quarter, according to the Energy Information Administration (EIA).

Henry Hub spot prices are forecast now to average $2.14/MMBtu this year, EIA said in its latest Short-Term Energy Outlook (STEO), which was released Tuesday. That compares with a $2.11 forecast included in EIA’s two previous STEOs. At the same time, EIA expects Henry Hub to average $2.89 in 2021, a significant increase compared with 2020 prices, but down 9 cents compared with last month’s STEO.

The front-month natural gas futures contract for June delivery at the Henry Hub settled at $1.89 on May 7, up 31 cents from April 1, EIA said.

“The natural gas 1st-13th price spread settled at minus 67 cents/MMBtu on May 7, continuing a period of contango (when near-term prices are lower than longer dated ones) which began in November 2019…because of three major factors,” EIA said.

“First, mild winter weather contributed to higher inventories relative to the five-year average. Second, reduced demand for natural gas in the power and industrial sectors related to mitigation efforts related to Covid-19 has contributed to lower front-month prices relative to 13th-month prices. Finally, EIA expects U.S. production of dry natural gas to fall by more than consumption over the next year, placing upward pressure on future prices.”

EIA is forecasting a decline of 0.2 Bcf/d and 4.9 Bcf/d in consumption and dry gas production, respectively, between June (the current front-month futures price) and June 2021 (the current 13th-month).

The most significant effects of Covid-19 related restrictions on natural gas demand are expected to occur in the industrial sector, where consumption is expected to decrease by 7% in 2020 compared with 2019.

“The decline reflects a reduction in economic activity, leading to a declining forecast natural gas-weighted manufacturing index through October 2020,” EIA said.

“The industrial demand for natural gas forecast is particularly sensitive to macroeconomic conditions, and the size and pace of the forecast economic contraction and the subsequent expected economic recovery significantly affect industrial demand for natural gas.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |