NGI All News Access | E&P | Earnings

Energy Transfer Says U.S. Oil Consumption Has Bottomed, Growth Ahead

Energy Transfer LP (ET) has found new ways to store products and has reduced spending for the year as it navigates the historic oil price collapse, but management for the Dallas-based midstreamer said the market has reached a bottom with improvement and growth for the remainder of the year.

Speaking Monday during the first quarter earnings call, Chief Commercial Officer Marshall McCrea said because of the oil downturn and nationwide shutdowns because of the coronavirus pandemic, “things really got difficult” in late April and at the beginning of May. About 8% of the volumes on the gathering and processing assets in the Permian Basin’s Midland sub-basin were shut-in. However, ET has seen about 25% of the volumes already turned back online.

“As we look through all of our assets and all of our segments, we see that things have bottomed out…that things are improving, and they’re going to grow,” said McCrea.

The path forward depends on the direction of West Texas Intermediate crude prices, but management is optimistic by the recent strengthening of prices that are currently in the mid- to high $20/bbl range.

“We’re pretty optimistic that’s going to be the path that we’re on,” McCrea said. “How quickly that’ll grow remains to be seen, but we do expect if not faster growth, at least gradual growth for the next quarter. We don’t anticipate that volumes stay down where they are for any significant period of time.”

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

Optimism notwithstanding, ET has contracted 6.2 million bbl of storage capacity in the Department of Energy Strategic Petroleum Reserve (SPR) through the end of the year. “We have a connection to reserve through our Nederland terminal,” on the Houston Ship Channel, and contract “is an efficient extension for our franchise,” CFO Thomas Long said.

Long said the SPR capacity has provided a much needed market for producer customers. “Things have certainly slowed down on the market side, but we needed to have that market for all the barrels that we buy for our customers to make sure our customers’ barrels move.”

Meanwhile, “wide and profitable” contango spreads are allowing ET to “capture significant margins, utilizing our extensive network of storage assets,” according to Long. The company has converted some storage facilities at Mont Belvieu, TX, to store “a significant amount” of natural gasoline and diesel barrels into 2021. “This demonstrates another valuable benefit of our dynamic franchise.”

In addition, ET has reduced capital expenditures by at least $400 million, down to $3.6 billion for the year, with its commercial team focused on locking in existing volumes for longer terms rather than developing assets. The company spent around $1 billion during the first quarter, primarily on natural gas liquids (NGL), refined products and the midstream segment, and is evaluating another $300-400 million in potential reductions this year.

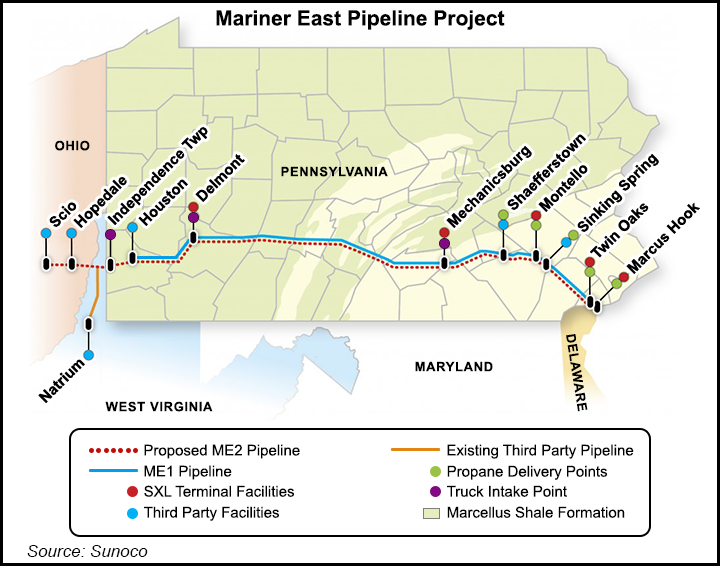

“Approximately 70% of the growth capital spend in 2020 will be spent on projects that are 60% or more complete and are expected to be in service in 2020 or early 2021,” Long said. These include Mariner East (ME), the Lone Star Express fractionation facility, the Orbit NGL export facility and other liquefied petroleum gas export projects in Nederland.

ME 1 entered service in 2016 and ME 2 entered service last year using a short stretch of repurposed line. It has ramped up since, but work still needs to be finished on the mainline in Chester and Delaware counties. Work on ME 2 and ME2X has repeatedly been stalled by regulatory and legal setbacks. Management plans to bring on about 25,000 bbl on ME2X on June 1, with the full project online in the 1Q2021, a delay from the original 4Q2020 target.

There are unlikely to be any major organic growth projects added to its backlog into 2021. Furthermore, the annual run rate is less than $2 billion.

“We remain committed to generating free cash flow and still expect to be free cash flow positive in 2021 after growth capital and equity distributions,” said Long. The company had about $4 billion in liquidity at the end of the quarter.

Net losses in 1Q2020 were $855 million (minus 32 cents/share), compared with 1Q2019 earnings of $808 million (31 cents). One-time goodwill impairments in 1Q2020 included $1.3 billion from decreases in commodity prices and market demand. Distributable cash flow was $1.42 billion, down $177 million from the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |