NGI All News Access | Coronavirus | LNG Insight | Markets

LNG Recap: Faint Signs of Market Improving as Lockdowns Ease Across World

Countries across the world are slowly starting to ease Covid-19 restrictions and reopen their economies, including demand centers in Europe and Asia, providing some optimism for liquefied natural gas (LNG).

Asian spot prices continued moving upward on Monday from historic lows of $1.80/MMBtu, reaching $2.325 as demand appears to be bouncing back in China and South Korea, where lockdowns are being eased.

In Europe, British wholesale gas prices were trading lower on Monday, Schneider Electric said. Gas was being rerouted from continental Europe creating a surplus. Natural gas is moving toward the UK and away from the Franpipe pipeline, which moves Norwegian volumes to France.

The UK’s National Balancing Point has continued to trade below both Henry Hub and the Dutch Title Transfer facility. Schneider said Nowegian flows will be limited this month due to maintenance at various gas fields, processing plants and pipelines.

“The LNG outlook remains elevated, however, with the likelihood of higher sendout this week compared to the previous based on current cargo schedules,” said Schneider Risk Manager Henry Homer in a Monday note. He added that 12 tankers are set to unload at UK, Dutch and Belgian terminals this week.

Meanwhile, 15 vessels departed U.S. export facilities during the week ending May 6 with a combined carrying capacity of 54 Bcf, according to the Energy Information Administration. That’s an increase from the 11 vessels that left carrying 39 Bcf in the prior week.

But the pandemic’s impacts are still evident. ClipperData said Monday that there were 28 vessels floating with LNG aboard worldwide, up from 26 a week ago, in an indication of global flows as more of the super-chilled fuel is stored on the water for the time being. Many of those, the firm said, were floating in the Asia-Pacific region.

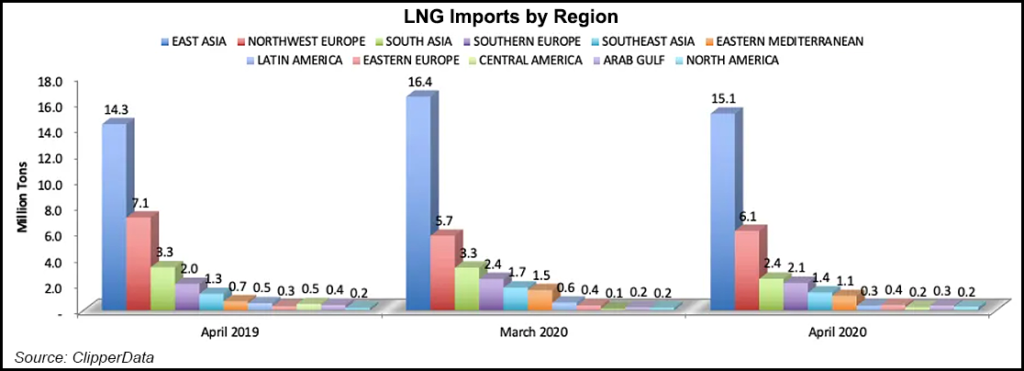

ClipperData also said last week that global LNG exports increased in April to 31.5 million tons (Mt), up from 30.3 Mt in the same month last year. While East Asia took in 15.1 Mt of LNG last month, compared to 14.3 Mt in April 2019, imports to South Asia dropped by 36% to 2.4 Mt, likely due to strict lockdown measures in India.

U.S. exports, ClipperData said, were also steady in April, up 56% from the same time last year to 3.8 Mt. However, U.S. exports fell by 800,000 tons month/month.

U.S. volumes are likely to continue falling as it remains uneconomic to move LNG from North America to key markets in Asia and Europe through the fall. Poten & Partners said Monday that global LNG exports have been falling since February. The shipbroker said U.S. exports in particular remain low considering the new liquefaction that has come online since the end of last year.

While U.S. cargo cancellations have been reported in recent weeks in response to low prices, other producers across the world are announcing that they will shut in some production for maintenance. Equinor SA said last week it would shut down its Melkoya LNG plant in Norway for two weeks of maintenance later this month. Sakhalin LNG in Russia, operated by a Gazprom-led joint venture, is reportedly planning to shut down a train for maintenance this summer too.

Low prices have also prompted new projects to delay final investment decisions (FID). Bernstein said in a recent note that the market could eventually tighten due to such delays and create a 40 million metric ton/year supply deficit by the mid-2020s.

Columbia University’s Center on Global Energy Policy said the same in a commentary last week.

“The coronavirus could actually bring forward and intensify longer-term tightening of the LNG market by creating conditions that do not favor additional investments in LNG projects,” said Senior Research Scholar Erin Blanton.

Most recently, Sempra Energy said it would delay an FID on its Port Arthur LNG export project under development east of Houston.

NextDecade Corp., which is developing the 27 mmty Rio Grande LNG and 16.5 mmty Galveston Bay LNG facilities in Texas, said late last week that it would delay filing its first quarter report due to the impact the pandemic has had on its operations. The company also noted that the economic impact of Covid-19 could “negatively impact our ability to raise capital.”

Rio Grande was approved by federal regulators last year, but Galveston Bay is still working through the approval process.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |