Shale Daily | E&P | Haynesville Shale | NGI All News Access

Black Stone, Aetheon in Haynesville Tie-Up, Drilling Slated for 3Q2020

Black Stone Minerals LP is restarting development in East Texas of its Shelby Trough Haynesville/Bossier Shale acreage in Angelina County in an agreement with affiliates of Aethon Energy.

The agreement entails minimum well commitments by Aethon in exchange for reduced royalty rates and exclusive access to Black Stone’s mineral and leasehold acreage in the contract area, the partnership said Tuesday.

The deal mandates a minimum of four wells to be drilled in the initial program year, which begins in the third quarter, increasing to a minimum of 15 wells/year starting in the third program year.

Calling Aethon “one of the most experienced operators” in the Haynesville, Black Stone CEO Thomas Carter Jr. said, “The Shelby Trough holds enormous resource potential, and our deal with Aethon positions both companies to benefit from decades of attractive development opportunities.”

In a first quarter earnings call Tuesday, Carter told analysts, “Assuming the initial wells in the program go well, it should lead to significant drilling activity on our high-interest acreage there as we move into ’21 and beyond.”

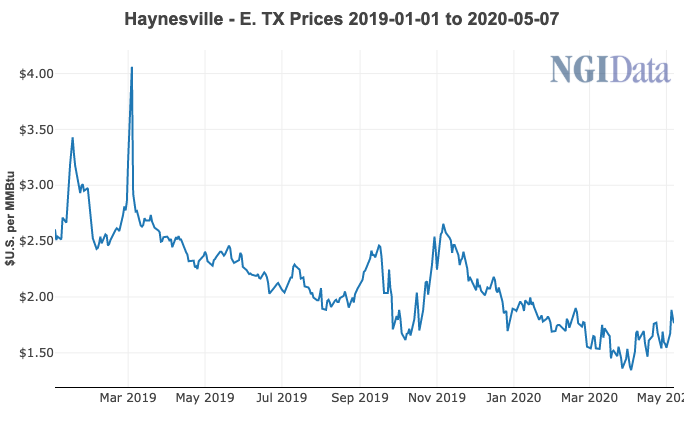

CFO Jeff Wood said impending shut-ins of crude oil and associated natural gas supply, namely in the Permian Basin, have boosted the outlook for natural gas pricing and generated some renewed interest in dry gas plays such as the Haynesville.

Wood said at a $3/MMBtu gas price, the economics of the Shelby Trough dry gas wells are “much superior” to oil wells in the Permian’s Midland and Delaware sub-basins at a $30-40 oil price.

In a Thursday note to clients, Raymond James & Associates Inc. analysts said the production outlook for Black Stone’s gassier acreage “continues to improve with the market for natural gas (which we see reaching $4/MMBtu next year).” They also cited Black Stone’s “low-leverage profile” and “enviable hedge book,” noting that more than 60% of 2020 oil and gas production is hedged.

Fellow Haynesville independent Comstock Resources Inc. also is optimistic about the outlook for natural gas pricing, CEO Jay Allison said Thursday, predicting “a much healthier supply and demand balance for natural gas later this year and in 2021.”

The Black Stone announcement follows sanctioning in March by Midcoast Energy LLC of the CJ Express pipeline expansion project, which would allow Haynesville producers greater access to Gulf Coast markets by early 2021, when the pipeline is slated to enter service.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |