June Natural Gas Futures Stabilize After EIA Reports High Side, Triple-Digit Storage Build

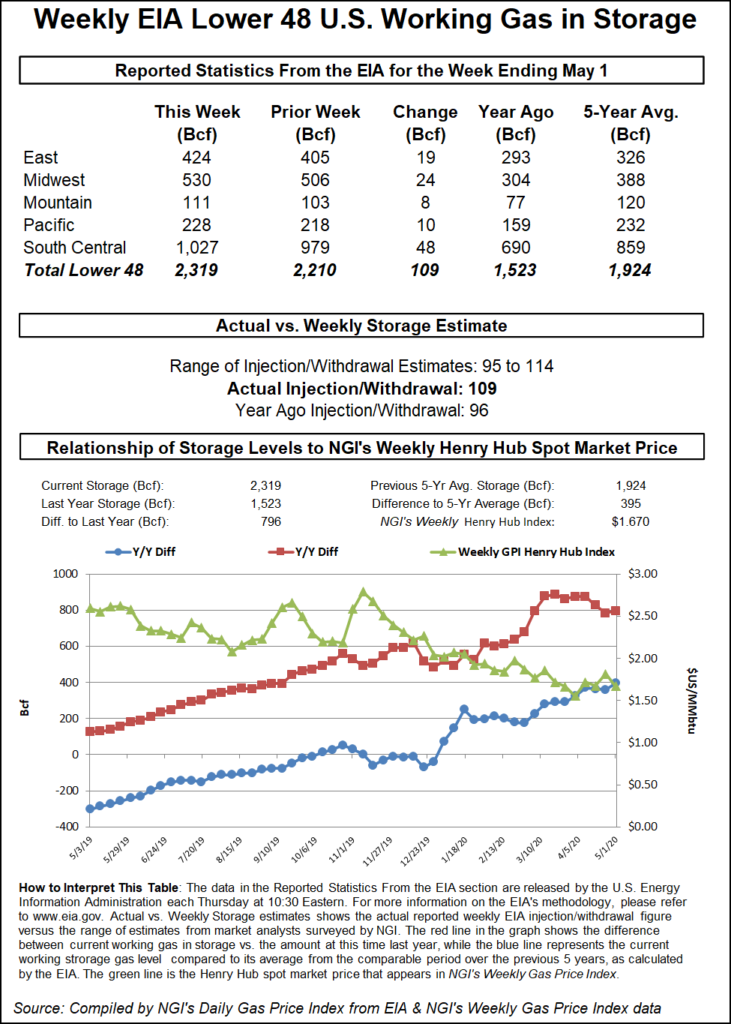

The U.S. Energy Information Administration (EIA) reported a 109 Bcf natural gas storage injection for the week ending May 1, on the high end of market estimates, but on the money with NGI’s projection.

The triple-digit build sent Nymex gas futures lower, at least initially. Ahead of the EIA report, the June contract was holding steady near $1.940/MMBtu, but as the print hit the screen the prompt month slipped a few pennies to around $1.905. By 11 a.m. ET, however, the June contract was trading back at $1.937, down only seven-tenths of a cent from Wednesday’s close.

The EIA’s 109 Bcf injection compares with the 96 Bcf increase in storage recorded in the same week last year and the five-year average build of 74 Bcf for that week.

Bespoke Weather Services said the EIA figure once again shows that balances last week were “very loose.” However, the firm expects to see some tightening over the next few weeks.

“The problem is that we need to tighten quite a bit in order to lower the risk of completely filling storage this fall, and it remains to be seen if we accomplish this given that there is also risk of LNG slowdowns with global prices remaining at very low levels,” the firm said.

Ahead of the report, a Bloomberg survey showed injection estimates ranging from 101 Bcf to 114 Bcf, with a median of 111 Bcf. A Reuters poll of 17 analysts had a wider range that included a low of 95 Bcf and produced a median injection of 106 Bcf, while Wall Street Journal poll results averaged 106 Bcf.

Broken down by region, the South Central region led with a 48 Bcf build, which included a 31 Bcf injection into nonsalt facilities and a 17 Bcf build in salts, according to EIA. The Midwest added 24 Bcf into storage, and the East added 19 Bcf. Pacific inventories grew by 10 Bcf, while Mountain region stocks rose by 8 Bcf.

Total working gas in storage as of May 1 was 2,319 Bcf, 796 Bcf above year-ago levels and 395 Bcf above the five-year average, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |