Extensive Sell-Off for Natural Gas Futures as Tetco Production Largely Rerouted; Cash Slips Too

In one fell swoop, natural gas futures on Wednesday erased all of the previous day’s gains resulting from a pipeline explosion on one of the Lower 48’s oldest natural gas pipelines. With much of the impacted production on that line being rerouted, the June Nymex gas futures contract plunged 19.0 cents to settle at $1.944. July tumbled 14.1 cents to $2.171.

Spot gas prices, which closely tracked futures higher on Tuesday, also declined, though losses were fairly small. NGI’s Spot Gas National Avg. fell 9.0 cents to $1.795.

In discussing the freefall in the futures market, NatGasWeather said it would be interesting to see whether strong gains the past two days — totaling around 24 cents — would hold when considering impacts from pipeline explosions often are resolved or redirected within several days.

“Yesterday, bears were trapped at the official open…today, bulls,” the firm said.

The explosion on the Texas Eastern Gas Transmission Co. system (Tetco), the second blast in less than a year, occurred late Monday upstream of last year’s incident, north of its Owingsville, KY, compressor on Line 10. As a result of the blast, the pipeline cut to zero the north-to-south capacity through the Owingsville compressor station, down from 1.33 Bcf/d.

Tetco said that the National Transportation Safety Board (NTSB) has assumed control of the incident site, including the investigation into its cause. Tetco is lending its support to the NTSB and as such, said it is “unable to provide updates on the investigation or the response. No return to service timeframe is estimated at this time.”

Much of the production flowing on the Tetco system appears to have been rerouted. Genscape Inc. pipeline data showed that after revisions, Southwest Pennsylvania production was down to around 7.7 Bcf/d for Monday, while Tuesday output showed a roughly 580 MMcf/d day/day decline. In addition, a handful of gathering system interconnects located east of the Berne station on Tetco had decreased nominations around 650 MMcf/d.

“While production was showing a decrease, total flows on Tetco remained somewhat steady, as receipts from interstate interconnects increased by about 650 MMcf/d as gas was rerouted through the area,” Genscape analyst Nicole McMurrer said.

Genscape pipeline data indicates that as north-to-south capacity to Owingsville had fallen to zero, flows south toward Kentucky and west toward Berne fell by nearly 1 Bcf. “The increased receipts along interstate interconnects on Tetco were rerouted heading east through the northern Penn-Jersey line and the South 36-inch system,” McMurrer said.

As of Wednesday, Genscape revised total Southwest Pennsylvania production upward by around 805 MMcf/d, while Monday production estimates were revised again, slightly higher by around 45 MMcf/d. Current nominations in Southwest Pennsylvania indicate the total production impact of the explosion to be around 165 MMcf/d for Monday, with flows resuming pre-explosion levels of around 8 Bcf/d by Wednesday.

“Production levels for Wednesday are around 70 MMcf/d less than Sunday, although the morning nominations are always subject to day/day revisions,” McMurrer said. “Compressor stations heading east are still showing increased flows.”

Some minor fluctuations were seen in total U.S. production as well as in liquefied natural gas (LNG) demand, according to Bespoke Weather Services. But the firm said the background picture is more bullish for the winter strip rather than the front of the futures curve, at least “until we confirm that risk of completely filling storage is lowering.” However, erratic price moves are expected to continue given the uncertainties in play.

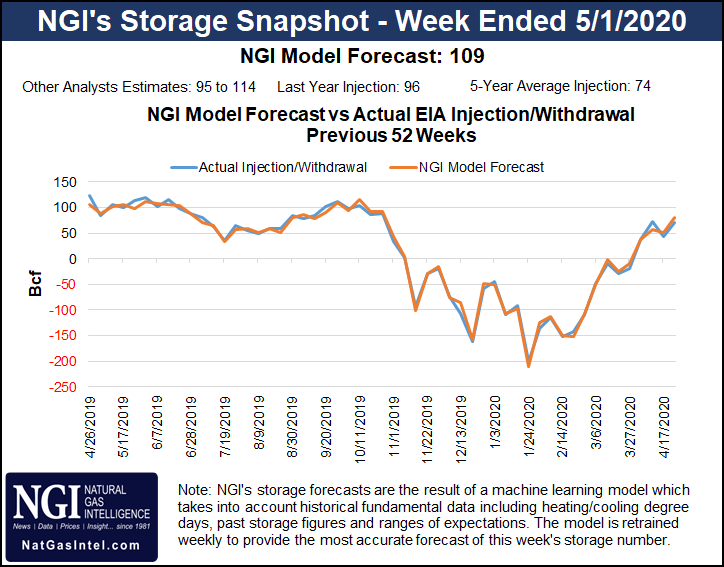

On Thursday, the Energy Information Administration (EIA) is set to issue its weekly natural gas storage inventory report for the week ending May 1, with estimates pointing to the first of many triple-digit injections this month.

A Bloomberg survey showed injection estimates ranging from 101 Bcf to 114 Bcf, with a median of 111 Bcf. A Reuters poll of 17 analysts had a wider range that included a low of 95 Bcf and produced a median injection of 106 Bcf. A Wall Street Journal poll’s results also averaged 106 Bcf, while NGI projected a 109 Bcf build.

This compares with the 96 Bcf increase in storage recorded by the EIA in the same week last year and the five-year average build of 74 Bcf for that week.

Inventories as of April 24 stood at 2,210 Bcf, 783 Bcf above year-ago levels and 360 Bcf above the five-year average, according to EIA.

“Even with some demand coming back, along with lower production, that may not be enough yet to lessen the risk of full storage once we reach fall, especially if we see reductions in LNG over the summer, which remains a real risk given low global pricing,” Bespoke said. “We do still feel that summer weather will be supportive (hotter), but as we have been saying, we are still a few weeks away from the time when that will begin to grow important in price action.”

Spot gas prices were overwhelmingly lower on Wednesday as “near-ideal” temperatures were forecast to rule Texas, the South and the Southeast, according to NatGasWeather. The firm said that weather systems with showers and cooling were expected to remain over the northern United States through the middle of next week, while the Southwest is on tap for extreme heat.

“Essentially, heating degree days will fade as cooling degree days slowly gain, but neither strong enough to impress but with the potential for hotter trends during the second half of May,” NatGasWeather said.

Even with demand on the rise in the Northeast, spot gas prices in the region posted substantial losses given the rerouting of supply following the Tetco explosion. Transco Zone 6 NY fell 20.5 cents to $1.430, while other markets posted similar declines.

Meanwhile, Genscape said that demand in the East has risen 8.59 Bcf/d since May 2 to 25.8 Bcf/d, and is expected to peak at 27.5 Bcf/d on Saturday (May 9.)

Texas Eastern M-2, 30 Receipt prices continued to fall, dropping 14.0 cents day/day to $1.360, in line with other losses in the region.

Spot gas prices across the country’s midsection also moved lower, but decreases were capped at around 15.0 cents. The sell-off was even less pronounced on the West Coast, where the SoCal Border Avg. slipped 4.0 cents to $1.935.

Permian Basin pricing stood strong on Wednesday as prices continued to mount small gains. El Paso Permian next-day gas climbed 5.0 cents to $1.790.

Meanwhile, Vector Pipeline is scheduled to begin the third and final phase of planned pigging runs, impacting gas days Thursday and Friday and next Tuesday (May 12.) On the most impactful days, eastbound flows could be reduced by 748 MMcf/d and deliveries off Vector could be cut by up to 383 MMcf/d, according to Genscape.

“The pigging has been done in phases since mid-April, during which interconnects along a different segment of the pipeline have been mostly shut-in, except for certain receipts and deliveries scheduled in order to move the pigs,” Genscape analyst Anothony Ferrara said. “This final phase will be run on the 36-inch diameter mainline between Milford Junction and Belle River.”

The analyst noted that during the last event of this magnitude in the region, an outage on Nexus Gas Transmission LLC in 2019 that cut more than 1 Bcf/d of flow onto Vector, prices at Dominion South fell. “We again expect this event to again be bearish for Dominion, and to a lesser extent bullish for Chicago, Michigan Consolidated and Dawn price hubs.”

Though not exactly bullish for Chicago, the maintenance may have played into the smaller declines seen in prices for gas delivered Thursday. Chicago Citygate cash averaged $1.905, off 6.5 cents day/day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |