NGI The Weekly Gas Market Report | E&P | Earnings | LNG | LNG Insight | NGI All News Access

Total’s LNG Sales Grew in 1Q, But Slowdown Likely Ahead

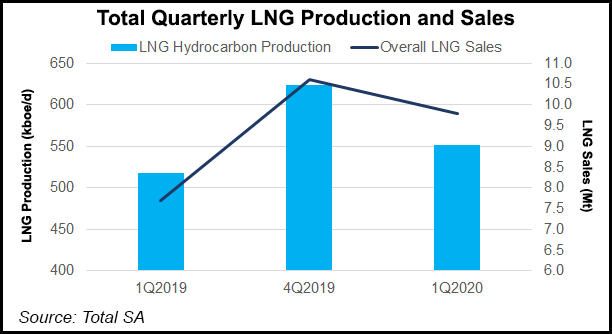

Total SA on Tuesday highlighted the resilience of its liquefied natural gas (LNG) sales in the first quarter, which increased by nearly 30% year/year during a period that otherwise squeezed many facets of the supermajor’s operations.

A crisis in the oil markets and the Covid-19 pandemic’s impact on demand saw commodity prices fall by more than 30% on average across the board during the first quarter, the Paris-based operator said, with profits and cash flow taking a hit. However, the integrated gas, renewables and power segment generated $900 million of cash flow, up 40% year/year thanks to LNG sales of 9.8 million tons (Mt).

LNG sales volumes were flat with the fourth quarter, but up from 7.7 Mt in 1Q2020, despite an oversupply and low demand because of the virus. While cargo cancellations, delivery deferrals and elevated floating storage levels were among the quarter’s headlines, Total’s results affirmed that global LNG production and sales were steadyduring the turmoil.

CEO Patrick Pouyanne told analysts on a call to discuss the quarter’s results that despite headwinds in LNG trading, the first quarter “was quite positive” and indicated the strength of its portfolio. LNG sales jumped mainly from production ramp at Yamal LNG in Russia and Ichthys in Australia.

However, delivery deferrals are expected through the end of September because of the economic slowdown. Meanwhile, the precipitous slide in oil prices also expected to negatively impact long-term LNG contract prices in the second half of the year. The cost of oil-indexed LNG is typically based on the previous three- to six-month average of crude, which is expected to fall in the months ahead.

As for some other aspects of its business, Total is slashing global production by 5% from a previous forecast to 2.95-3.0 million boe/d. The company produced about 3.1 million boe/d in the first quarter, compared with 2.9 million boe/d in 1Q2019.

Building on cuts announced earlier in the year, the company also is limiting investments to less than $14 billion for 2020, a decrease of nearly 25%. Pouyanne and board members are also taking pay cuts.

In another marquee announcement, Total laid out an ambitious plan to achieve net-zero emissions by 2050 across its operations, following its European peers, BP plc, Equinor SA and Royal Dutch Shell plc. Over the same time, the effort also includes targets to reach net-zero emissions across all the production and energy products used by European customers and a 60% reduction in the average carbon intensity of energy products used by customers worldwide.

Oil and gas, along with low-carbon electricity, is part of the plan. Total is boosting its spending on low carbon electricity to 20% of capital spend by 2030 or sooner.

Pouyanne acknowledged that “energy markets are changing, driven by climate change, technology and societal expectations.”

Total reported net income of $34 million (1 cent/share) in 1Q2020, compared with $3.1 billion ($1.17) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |