Infrastructure | Coronavirus | NGI All News Access | NGI The Weekly Gas Market Report

Coronavirus Slowing Energy Infrastructure Permitting and Project Development in Mexico

The coronavirus pandemic has led to a slowdown in the progress of energy infrastructure projects in Mexico as nonessential businesses remain shuttered and permitting processes are delayed.

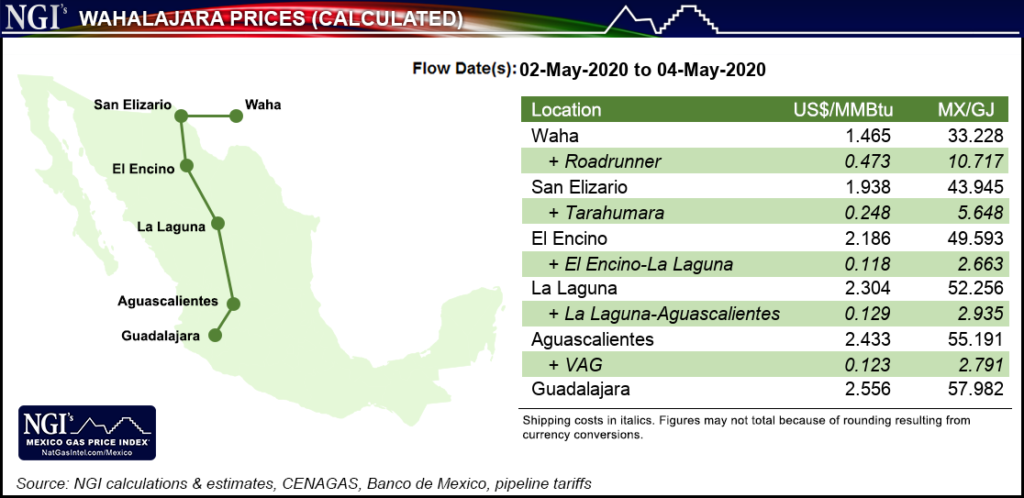

In line with this, Genscape Inc. analysts have pushed back the estimated in-service date for the Wahalajara system’s 0.9 Bcf/d Villa de Reyes–Aguascalientes–Guadalajara natural gas pipeline from May to July.

Originally set to come online at the end of March, analysts see a new liquified natural gas (LNG) supply tender launched by state utility Comision Federal de Electricidad (CFE) for mid-May delivery to the Manzanillo LNG terminal as a sign “that CFE is not expecting significant commercial flows from Wahalajara into the Manzanillo-Guadalajara area during next month.”

In December, the 453-kilometer (281-mile), 1.3 Bcf/d La Laguna-Aguascalientes pipeline, the first part of the Wahalajara system, began commercial operation. When the system is fully functional, the system being developed by Mexican company Fermaca will move gas from Waha in West Texas to Mexico’s industrial heart of Guadalajara.

The risk of further delay “is high,” analysts said, due to the likely slowdown of paperwork and permitting processes because of the ongoing implementation of Phase 3 of the government response to coronavirus and “the coronavirus-induced destruction of Mexican demand.”

Since early April, immediately after Phase 1 of the coronavirus contingency plan began, Mexican natural gas imports from the United States have dropped to below the 4.7 Bcf/d mark, according to Genscape, compared to a year-to-date average as of late March, or right before stay-at-home measures were put in place, of slightly above 5.2 Bcf/d.

Meanwhile San Diego-based Sempra Energy executives remain confident that the Energía Costa Azul (ECA) LNG export project in Mexico’s Baja California will get an export permit and go ahead as planned, but recognized in a Monday earnings call that the pandemic will slow the timing of permitting.

“Our forecast remains that we will get that permit in the second quarter,” Finance and Investor Relations VP Faisel Khan said. “I think we have to be sensitive to the fact that everyone, not just in the United States, but in Mexico is taking the Covid challenge very seriously and certainly impacting the delay is the agencies are currently shut down.”

The proposed $1.9 billion two-phase ECA liquefaction project, a joint venture between Sempra subsidiaries Infraestructura Energética Nova (IEnova) and Sempra LNG, would be built adjacent to Sempra’s existing ECA LNG receipt terminal near the city of Ensenada. The project already has U.S. Department of Energy authorizations allowing Sempra to export U.S.-produced natural gas to Mexico and then re-export it globally.

Finally, Mexico’s independent power system operator Centro Nacional de Control de Energía (Cenace) said on Friday that it was indefinitely suspending all preoperative tests, including those currently in process and those not yet started, of intermittent power options, such as wind and solar projects.

Cenace said that the intermittent nature of solar and wind farms affected the reliability, quality and continuation of power supply in Mexico as it tries to assure energy supply during the coronavirus. The decree essentially puts a pause on new renewable energy projects in the country.

In last year’s 2019-2033 Prodesen power sector development plan published by energy ministry Sener, photovoltaic solar accounted for 29.4% and wind 18.9% of the planned 70,313 MW power projects planned for the period. Combined-cycle plants accounted for 41.6% of this figure.

Cenace last year also suspended long- and medium-term electricity auctions in Mexico, which was seen at the time as a particular blow to renewable energy.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |