NGI All News Access | LNG Insight | Markets

Natural Gas Forwards Highlight Continued Battle Between Supply/Demand

As the implications of the coronavirus and oil market collapse continue to unravel, natural gas forward prices retreated a bit during the April 23-29 period.

Though volatility remained in the limelight, June forward prices fell an average of only 6.0 cents, while the balance of summer (June-October) dropped an average of 4.0 cents, according to NGI’s Forward Look.

The back of the curve continued to be supported by an expected pullback in production, with small gains seen beginning next winter and extending through calendar year strips, Forward Look data show.

The double whammy of the Covid-19 pandemic and the unparalleled oil market tailspin has spurred significant volatility in the natural gas market, with extensive demand destruction already showing up in various datasets.

Genscape Inc. said its sample of U.S. industrial natural gas demand has continued to decline since late March because of the coronavirus, with total U.S. industrial demand off more than 2.5 Bcf/d year/year from the Energy Information Administration’s (EIA) April 2019 average of 22.4 Bcf/d.

“Demand is still near the five-year average; however, this is a bit misleading as U.S. industrial demand has grown considerably over the past five years,” Genscape analyst Dan Spangler said.

A string of bearish indicators also has been reflected in the EIA’s weekly storage inventory reports. However, it appears the market at least has started to more accurately assess the demand-side implications of the coronavirus.

The EIA reported a 70 Bcf injection into storage inventories for the week ending April 24, which compares with last year’s 114 Bcf injection for the similar week and the five-year average build of 74 Bcf.

Ahead of the EIA report, most surveys had produced an average in the low 70s Bcf, although some estimates were as high as 80 Bcf.

Broken down by region, the South Central reported a 38 Bcf injection into inventories, including a 24 Bcf build into nonsalt facilities and a 13 Bcf add in salts, according to EIA. Midwest inventories grew by 13 Bcf, while the Pacific region added 8 Bcf and the East added 5 Bcf.

Total working gas in storage as of April 24 stood at 2,210 Bcf, 783 Bcf above last year at this time and 360 Bcf above the five-year average, EIA said.

Bespoke Weather Services, which had projected a 71 Bcf injection, said despite some balance improvement in its modeling versus the previous week, the overall theme continued to be a supply/demand balance that is “still quite loose, not bullish,” at least at the front of the curve.

The forecaster sees mild weather likely keeping the pressure on gas prices for a few more weeks until some early-season heat starts to build in the South and East. Although Bespoke noted that some coronavirus-induced shutdowns are starting to ease, liquefied natural gas (LNG) demand also is falling.

The outlook for U.S. LNG has grown increasingly grim over the past couple of months. After emerging from a mild winter that left global inventories at historically high levels and a glut of supply in the market, the coronavirus poured salt in the wound for gas exports.

More than 20 cargoes reportedly have been canceled for June, sending domestic export terminal utilization down by as much as 40%, according to Poten & Partners. Even worse, the firm sees cancellations extending through September. Gobally, more are needed, probably to the tune of 30-40 cargoes a month through October.

Leading LNG developer Cheniere Energy Inc. on Thursday reported another solid quarter, producing and exporting 128 cargoes of LNG, with more than 55% delivered to Europe. In addition, long-term sales and purchase agreements tied to the second production unit of the Corpus Christi terminal were set to begin Friday (May 1).

However, COO Anatol Feygin said Cheniere is seeing the coronavirus’ impact, “as gas demand in Europe’s six main gas markets declined year/year in the first quarter.” Although management declined to discuss in detail how many cancellations it received from offtakers, the Houston-based company’s earnings included more than $50 million in revenues associated with canceled cargoes. Executives also reiterated that Cheniere’s contracts do not include provisions for renegotiations.

“While the demand impact of the coronavirus remains uncertain in the near term, we expect many concerns will be alleviated in the coming months as the world recovers from the pandemic downs, lockdowns are lifted and economic activity resumes,” Feygin said. “Looking beyond the current market events, we believe the long-term fundamentals have not changed in that LNG remains a reliable competitive and flexible solution for the energy needs of both Asia and Europe.”

However, the likelihood of more LNG cancellations occurring over the coming months “highlights the economic vulnerability of the situation,” according to EBW Analytics Group. As Henry Hub spot prices have briefly surpassed key international benchmarks in recent days, the firm said “an economic problem rapidly arises” if higher-cost U.S. LNG is intended to flow from the Gulf Coast to lower-cost international destinations.

“This need to continue exporting LNG and maintain elevated power sector coal displacement helps put a soft ceiling on Nymex futures, at least for the 2020 injection season,” EBW said.

With the calendar flipping to May, the market is anticipating the start of a substantial decline in production.

Although Lower 48 production already is about 7 Bcf off late-November highs and a host of exploration and production companies have announced extensive shut-ins, this hasn’t yet translated into “meaningful” associated gas declines, according to Tudor, Pickering, Holt & Co. (TPH) analysts. This is largely because around 1 Bcf/d of flared gas exited the first quarter, which the TPH team said may need to be worked through the system before sales gas is impacted.

“Flow data for the April 27-May 1 week shows aggregate U.S. gas volumes down roughly 0.9 Bcf/d versus the March average, with the Midcontinent and Texas being the largest contributors with declines of 0.4 Bcf/d and 0.3 Bcf/d, respectively,” TPH said.

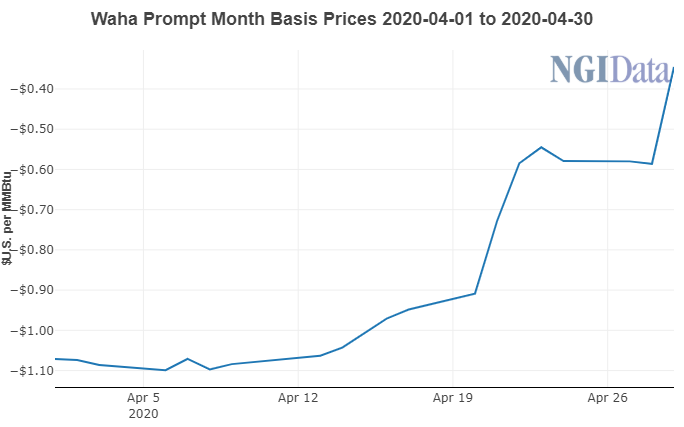

Waha pricing provides a window into Permian Basin flaring, and with basis contracting to around minus 52 cents from a 1Q2020 average of $1.37, it appears flared volumes have come down significantly, according to TPH. In the Bakken Shale, the firm also has begun to see sales volumes decline, but the drop has been minimal so far.

North Dakota Department of Mineral Resources Director Lynn Helms has indicated oil shut-ins have reached around 300,000 b/d, “but with March flaring levels of around 0.3 Bcf/d, we estimate the first roughly 200,000 b/d would have had no impact on sales,” TPH analysts said. “From this perspective, it isn’t surprising the observed impact to sales gas has been minimal so far, but with up to 3 million b/d of shut-ins expected, sales gas should show meaningful impacts in the coming weeks.”

Fresh off a week in which Permian forward pricing far outperformed the rest of the country, West Texas prices continued to fare marginally better than other markets.

Waha June forward prices slipped 3.0 cents between April 23-29 to reach $1.524, while the balance of summer lost 4.0 cents to hit $1.770, according to Forward Look. Winter prices emerged in positive territory as the winter 2020-21 strip climbed 4.0 cents to $2.41, as did prices for next summer, which rose 5.0 cents to $2.04.

The Waha forward curve indicated market expectations for higher prices beginning in May, “and the possibility of a summer in which Permian gas prices could be some of the strongest on a consistent basis since negative pricing first appeared in the basin back in 2018,” according to RBN Energy LLC.

RBN analyst Jason Ferguson noted that there are now several months along the Waha summer 2020 curve that are priced at less than 40 cents below Henry Hub, and most of this year is now priced above the 2021 curve. While the rally in Waha basis over the last few weeks has been “breathtaking,” according to the analyst, prices for the last few months of 2021 have exhibited a more muted price response, an indication that the market is pricing in the impact of two major Permian natural gas takeaway projects set to come online next fall.

Nevertheless, the collapse of crude prices has sent U.S. rig counts plunging as producers drastically scale back their capital expenditure plans. The Permian has been particularly hard hit, given its focus on oil drilling, Ferguson said, with rig counts in the basin having plunged by more than 40% since the beginning of the year.

“In fact, current prices suggest that Permian natural gas production will decline modestly by the end of this year, which will help alleviate pipeline constraints in the basin even before new pipelines come online in 2021,” the analyst said. “However, a supply reduction may come even sooner, as some producers have already announcedcurtailments of production for as early as May. As a result, price improvement for Waha natural gas may arrive quicker than expected.”

Elsewhere across the Lower 48, forward markets posted moderate declines through the summer, with small gains beginning next winter and continuing further out the curve.

On the pipeline front, during the first full week of May, Texas Eastern Transmission (Tetco) is set to conduct several outages along its southern 36-inch diameter Line in the M3 zone. On Sunday (May 5) and Wednesday (May 8), Tetco is scheduled to conduct cleaner tool runs on Lines 1 and 2 from Uniontown to Bedford, impacting flows from Bedford to Heidlersburg by as much as 350 MMcf/d compared to the two-week max but only by 108 MMcf/d compared to the two-week average, according to Genscape Inc. analyst Josh Garcia.

The pipeline also is set to conduct separate cleaner tool runs on the same segment and lines on Monday (May 6) and on May 13, which could impact 199 MMcf/d of flows compared to the two-week max, but Garcia indicated these were not impactful compared to the two-week average.

Meanwhile, Tetco also declared a force majeure from an unplanned outage on Line 10 between its Berne, OH, and Holbrook, PA, compressor stations. This was only five days after the force majeure on Line 25 between the same two compressors was lifted, Garcia said.

“The notice specifically states that as a result, North to South capacity through Berne will be set to 1.51 Bcf/d, which is unusual as a normal operating capacity is reported as 1.28 Bcf/d, meaning capacity has been raised by the force majeure.”

Furthermore, scheduled flows through Berne are much higher than operating capacity regardless, averaging 2.06 Bcf/d over the last month, according to Genscape data. Although there is no estimated date of a return to service, the last force majeure on this segment was first declared on March 13 and lasted about six weeks.

Also of note, Entergy Corp.’s 1,100 MW Indian Point nuclear generating facility In New York retired Thursday (April 30). The move was said to reduce the amount of zero-emissions power consumed in downstate New York and increase demand for gas-fired plants in the short run.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |