Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Concho Shutters 5% of Permian Output, Takes $12.6B Impairment on Low Prices

Permian Basin pure-play Concho Resources Inc. has shut-in about 5% of its volumes, and more are likely to be curtailed later this month, executives said Friday.

With oil prices tanking and supply overflowing, Concho “made the economic decision to curtail some of our highest-cost properties… and continue to evaluate the need for larger curtailments,” President Jack Harper said. “As we sit here today, it’s about 4% to 5% of our volumes, but I think we expect that number to grow as we get in further into the month.”

Harper shared a microphone with CEO Tim Leach to discuss first quarter performance and the near-term outlook.

“This is an extremely challenging environment, but our first priority is the safety and well-being of our employees, business partners and communities,” Leach said. “The operating environment has changed considerably since our last update, and we expect a sustained period of low commodity prices.”

Concho fetched realized prices in 1Q2020 of $45.85/bbl for oil and 79 cents/Mcf for gas.

This year’s 2020 capital spending has been slashed by 40% to $1.6 billion, and Concho is targeting another $100 million in operating efficiencies.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

Asked how long the curtailments in the Permian could last, Harper said it would depend “on how pricing plays out here over the month of May.” Oil volumes in 1Q2020 totaled 209,000 b/d, at the high end of the guidance range and up from 210,000 b/d in 1Q2020. Natural gas production totaled 699 MMcf/d. Total output was 326,000 boe/d, slightly lower than the 328,000 boe/d produced in the year-ago period.

The volumes shut-in beginning in 2Q2020 have led Concho to drop eight of its 18 rigs. “This level of activity allows us to…preserve our inventory and our ability to lead in a price recovery,” Harper said.

Absent more curtailments, the spending levels set for 2020 could sustain full-year adjusted oil volumes of around 200,000 b/d, he said.

“While our lower spin rate demonstrates our commitment to capital discipline, it also highlights the efficiencies our team has captured over the last nine months as well as cost savings allowing us to do more with less…However, I do want to emphasize that conditions are changing daily, and we are likely to curtail additional volumes and possibly in meaningful quantities.”

Concho is going to “continue to respond to what the market is telling us through low oil prices,” Leach said. The independent spent roughly $500 million in 1Q2020 and it plans to spend around $1 billion in the remaining three quarters of the year.

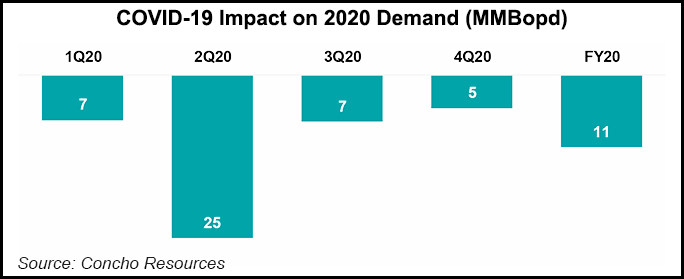

“The world’s population continues to grow, so I don’t believe that reduced demand is the new norm,” Leach said. “Demand for oil will return. However, the shape, whether it’s a ”U’ is unknown. There’s a great deal of uncertainty regarding demand. We believe the current market signals will result in substantially less in supply” as capital and activity reductions should have a long-term impact on U.S. supply.

“We’ve long said that oil prices are going to be more volatile, not less, and oil prices have made a significant departure from the normal trading range,” Leach said. “The significant drop in demand and current oil supply of amplified commodity price volatility, but we don’t believe today’s current price represents the future of our industry or business.”

Concho would be directly impacted by potential production quotas under consideration by the Railroad Commission of Texas. Commissioners are scheduled to vote on a measure on Tuesday (May 5) that would require operators to cut output statewide by 20%. The company would rather allow the free markets to work.

“I think what Concho looks like and the strategy going forward will be a continuation of what we were building going into this, and it’s more of a model of moderated growth and cash flow generation,” Leach said. “I think that we have shown that the U.S. shale production is the swing production in the world.”

However, output from the Lower 48 operators is “going to be sloppy going forward because we’re not a cartel,” like the Organization of the Petroleum Exporting Countries, which can set quotas across the board.

“We’re a bunch of individually managed private companies. And yeah, from time to time we will get strong price signals that will cause us either to add production or curtail production,” Leach said. “So we’re strong believers in the market working…I think the market is working…”

Because of a one-time impairment from low prices of $12.6 billion, Concho reported a massive net loss in 1Q2020 of $9.3 billion (minus $47.49/share), compared with a year-ago net loss of $695 million (minus $3.49). Adjusting for the noncash charge, Concho earned $142 million (72 cents/share) in 1Q2020.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |