NGI All News Access | E&P | Infrastructure

Another Four Natural Gas Rigs Exit as Oil Count Extends Rapid Descent

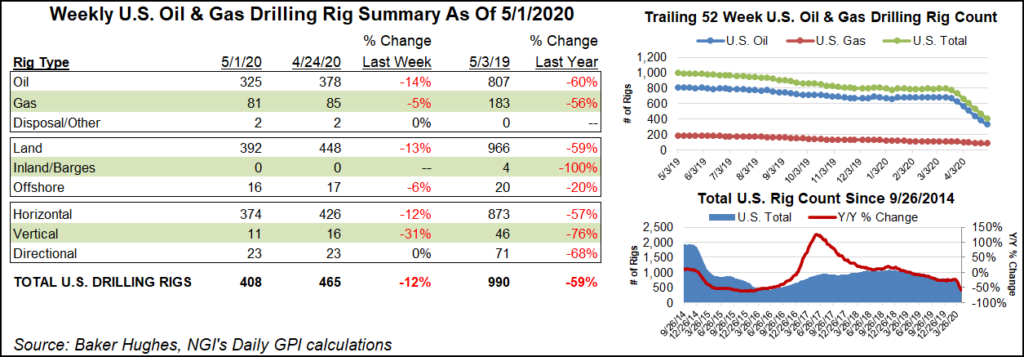

The U.S. natural gas rig count dropped four units to fall to 81 during the week ended Friday (May 1), while aggressive retrenchment remained the dominant theme in the oil patch, according to data from Baker Hughes Co. (BKR).

Oil-directed drilling declined by 53 rigs, lowering the overall U.S. count to 408. That left the United States with well under half of the 990 rigs running at this time last year. As the Covid-19 pandemic has decimated demand and collapsed oil prices, the domestic rig count has fallen 384 units since March 13.

Most of the declines occurred on land, with the Gulf of Mexico dropping one rig to end the week at 16, versus 20 a year ago. Five vertical units joined 52 horizontal units in departing, with directional rigs holding steady at 23 for the week.

The Canadian rig count grew by one week/week to finish at 27, versus 61 in the year-ago period; the addition of two gas-directed rigs offset the departure of one oil-directed.

The combined North American rig count finished the week at 435, down from 1,051 a year ago.

Among plays, the Permian Basin’s total took another major hit during the period, tumbling 27 rigs to fall to 219, down from 459 last year. The Denver Julesburg-Niobrara dropped eight rigs, while the Eagle Ford Shale dropped five. The gassy Haynesville and Marcellus shales dropped two rigs a piece, while one rig departed in the Williston Basin, according to BKR.

Among states, the Texas count tumbled 30 rigs to finish at 201. Elsewhere, Colorado dropped seven rigs; Oklahoma and Utah each dropped five; and New Mexico dropped four. Pennsylvania and Wyoming each dropped two rigs, while Louisiana and North Dakota each dropped one.

Energy operators have been sharing their latest quarterly financial results with investors and analysts, and the comments so far paint a sobering picture of what lies ahead for an industry hammered by the coronavirus.

National Oilwell Varco Inc. (NOV) CEO Clayton Williams offered hope for the future but held nothing back in assessing the difficulties operators face.

“NOV is persevering through a pandemic that is presenting historic and extraordinary challenges to the oil and gas industry on several fronts,” said Williams. “We expect this downturn to get much worse during the second quarter, so we are intensifying our cost-cutting efforts to position NOV appropriately for the challenges ahead.

“…This virus is not going to keep the global economy down forever. And when the world wakes up from this, we’re going to need oil and gas again and we are going to need it for decades to come. This massive historic contraction in a critical industry will affect the future supply curve dramatically.”

Denver-based Liberty Oilfield Services Inc. is expecting to see “very little” completions activity through the rest of the year across North America as Covid-19 continues to consume energy demand.

While confident it can continue to be free cash flow positive through the year, CEO Chris Wright warned of painful conditions overall across the oil and gas sector.

Holding back the rippling impacts of the devastating pandemic has been nearly impossible.

“Regrettably, for the first time in the company’s history we undertook a reduction of our personnel and staffed fleet count by approximately 50%,” Wright said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |