NGI The Weekly Gas Market Report | E&P | NGI All News Access

Mexico’s Pemex Stabilizes Production in 1Q, but FX Losses, Low Prices Hammer Bottom Line

Mexico’s heavily indebted state oil company Petróleos Mexicanos (Pemex) couldn’t catch a break in the first quarter as hard-fought oil and gas production gains were completely undone by the depreciation of the peso and the tumbling price of oil.

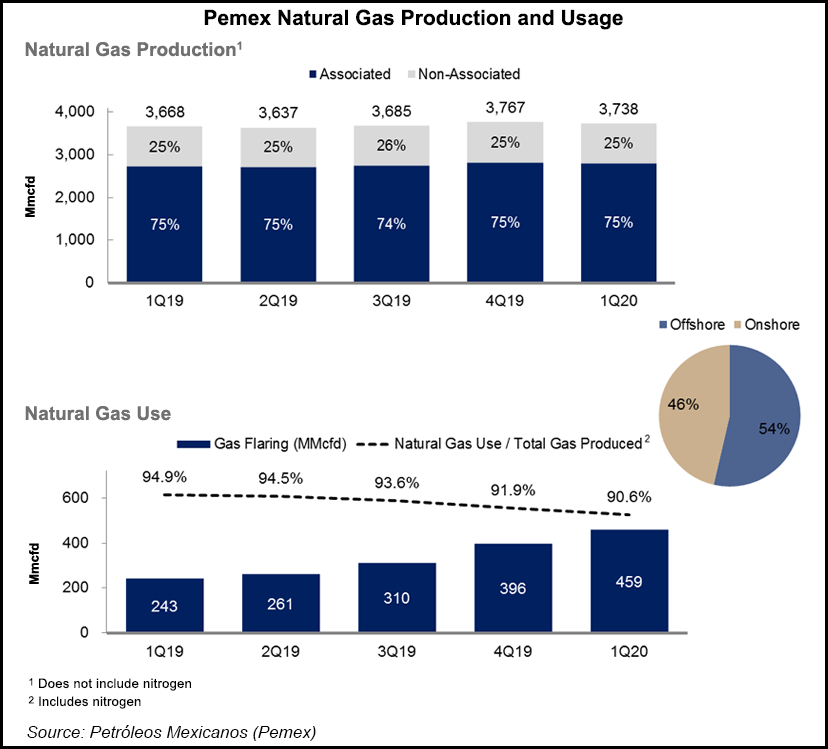

Liquids production rose 2.7% year/year to 1.76 million b/d, compared with 1.67 million b/d in the first quarter of 2019. Natural gas production also stabilized, averaging 3.74 Bcf/d, up 1.9% from a year earlier.

These gains, welcome news after years of falling oil and gas production in Mexico, did little to soften the blow of collapsing prices and a depreciating currency in part because of the global economic impacts of the coronavirus.

The Mexican crude oil basket averaged $40.9/bbl in the quarter, down 38% compared from a year ago.

“This decrease in the price of crude oil is the most relevant variable that affected the company’s export sales in the first quarter,” said CFO Alberto Velázquez in an earnings call.

Crude exports fell by 66,000 b/d to 1.17 million b/d. Meanwhile, the Mexican peso depreciated by 27.4% against the dollar. This foreign exchange loss amounted to a 469 billion-peso ($19.5 billion) blow to the bottom line.

As a result, Pemex reported a staggering loss of 562 billion pesos ($23.4 billion) in the quarter, compared with a loss of 35.7 billion pesos ($1.5 billion) in the year-ago period.

While the valuation of debt balances is impacted by the depreciation, it does not impact cash flow, Velázquez said.

Executives also highlighted the support given by the government to strengthen the oil company’s financial position, including a new fiscal relief decree pertaining to the profit-sharing duty, or DUC by its Spanish acronym, which accounts for 80% of Pemex’s direct fiscal burden. It should amount to 65 billion pesos ($2.7 billion) in savings this year.

The company also reduced 2020 capital expenditures (capex) by 45.5 billion pesos ($1.9 billion), of which 40.5 billion ($1.7 billion) will be in the upstream segment. Planned capex for 2020 was originally set at around $10 billion.

Pemex expects it will receive 7.5 billion pesos ($311 million) for its oil hedge contracted for 2020.

In total, measures instituted by the government to mitigate the impact of falling oil prices on the balance sheet and liquidity amount to 156 billion pesos ($6.5 billion), executives said.

In exploration and production, the so-called “priority fields” touted by Pemex as being key to new production added a total of only 46,000 b/d of new output by the end of March. The slow going was attributed to delays in needed infrastructure, bad weather and operation problems in well drilling.

Additionally, according to the terms of the recent agreement with the Organization of the Petroleum Exporting Countries, Mexico will have to reduce production by 100,000 b/d in May and June.

Gas flaring was also up in the first quarter, with natural gas use falling to 90.6%, compared with 94.9% in the first quarter 2019, attributed partly to a higher nitrogen content in gas production.

In addition, Mexico’s refining sector continued to underperform, even as it charges ahead in building the $8 billion Dos Bocas refinery in Tabasco. Crude oil processing at the nation’s six refineries fell to 542,000 b/d from 559,000 b/d in the year-ago quarter. Executives attributed the fall to ongoing maintenance works at the refineries.

As to the impact of a recent ratings downgrade on Pemex debt to “junk” status, Velázquez said that it was because of the “repercussions of the worldwide health crisis caused by Covid-19.”

He added: “It’s worth reiterating that Pemex has the absolute support of the Mexican government.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |