NGI All News Access | Coronavirus | Markets

Natural Gas Futures Bounce After On-Target EIA Storage Build

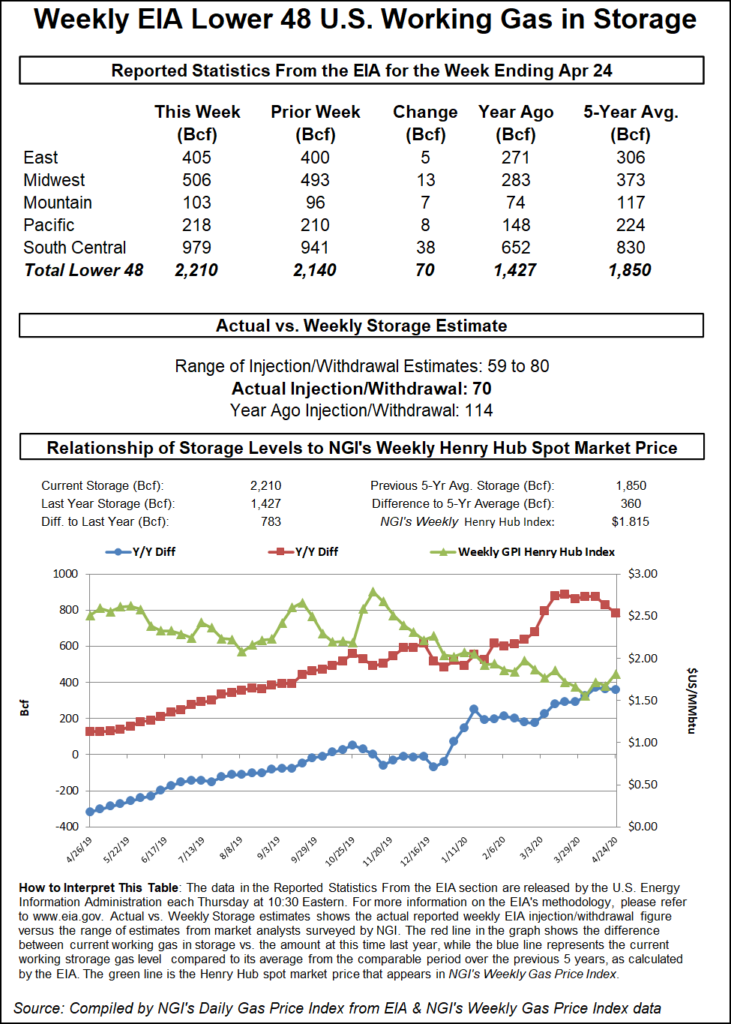

The U.S. Energy Information Administration (EIA) reported an on-target 70 Bcf injection into storage inventories for the week ending April 24.

The reported build compares with last year’s 114 Bcf injection for the similar week and the five-year average build of 74 Bcf, according to EIA.

For the second week in a row, the EIA figure came close to market estimates ahead of the report, a potential indication of a firmer grasp on the amount of demand loss stemming from the coronavirus. A Bloomberg survey of six analysts produced a range of 64 Bcf to 76 Bcf, with a median of 71 Bcf. A Reuters poll of 17 market participants had injections ranging from 59 Bcf to 80 Bcf. NGI also modeled an 80 Bcf build.

Natural gas futures caught a bid after the data was released. The June Nymex contract was holding relatively flat day/day at $1.873/MMBtu in the minutes leading up to the report. When the print crossed trading desks, the prompt month bounced to $1.882 and by 11 a.m. ET, was trading at $1.914, up $4.5 cents from Wednesday’s close.

Broken down by region, the South Central reported a slightly higher-than-expected 38 Bcf injection into inventories, including a 24 Bcf build into nonsalt facilities and a 13 Bcf add in salts, according to EIA.

Market observers on The Desk’s Enelyst.com energy platform attributed the hefty South Central storage build to production declines in the region that aren’t fully captured because of the “Texas black box” of intrastate pipelines.

“I think production is falling more than we can see,” said Genscape Inc. senior natural gas analyst Eric Fell. “There is a lot of liquids-rich production in Texas, Oklahoma and New Mexico that is behind intrastate pipes…There are no signs that demand has begun rebounding as of last week.”

The EIA said Midwest inventories grew by 13 Bcf, while the Pacific region added 8 Bcf and the East added 5 Bcf.

Total working gas in storage as of April 24 stood at 2,210 Bcf, 783 Bcf above last year at this time and 360 Bcf above the five-year average, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |