NGI The Weekly Gas Market Report | Coronavirus | E&P | Earnings | NGI All News Access

Enterprise ‘Creating Value,’ Cutting Costs Amid Coronavirus Uncertainty

Enterprise Products Partners LP (EPD) has yet to see a “material change” to volumes across its system, but given the “highly uncertain” impacts of the coronavirus for the remainder of 2020, it has reduced planned growth capital investments by $1 billion and sustaining capital expenditures (capex) by $100 million.

The cost-cutting measures include the cancellation or deferral of spending on 13 projects, including a natural gas pipeline to Carthage that was targeted for in-service by the end of the year and the Gillis Lateral, which is an extension of the Acadian natural gas system in the Haynesville Shale.

EPD also is in negotiations on six joint ventures, which could lead to a further reduction of capex, according to Co-CEO Jim Teague.

“I’ve been through many cycles in my life, but I have never seen anything like what we’re going through now,” Teague said Wednesday on the first quarter earnings call.

EPD expects natural gas, natural gas liquids (NGL) and crude oil production to decline more rapidly than in previous supply shock cycles. “We have not yet seen a material change to volumes across our system. However, we will not be immune,” Teague said.

EPD continues to see “good demand pull” from petrochemical customers and in liquefied petroleum gas (LPG) exports, however, “the key to a recovery for the energy industry will be the restart of the global economy, the timing of which is unknown at this time,” Teague said.

In the meantime, three NGL wells at EPD’s Mont Belvieu, TX, complex have been converted to refined products. Tanks also have been converted to crude oil services.

“Our people have found places to store crude oil that two months ago we didn’t even know existed,” Teague said.

EPD management continues to review and “prudently” reduce operating expenses. It also boosted liquidity to around $8 billion at the end of the first quarter.

“All of this and much more is being done to succeed in this environment,” according to the company chief.

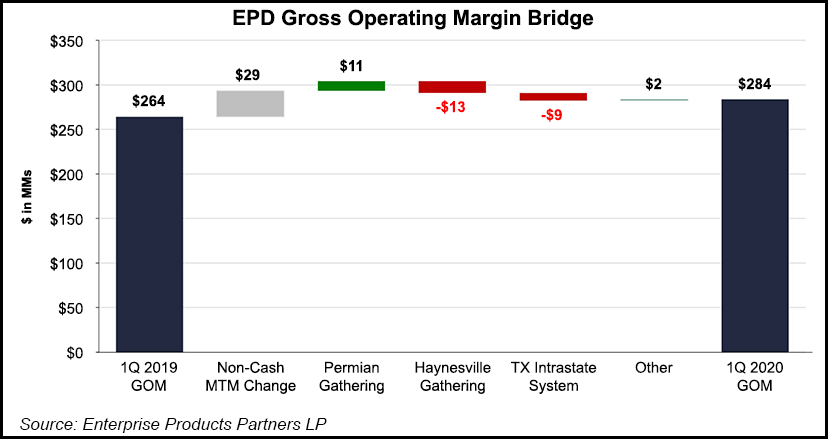

EPD reported increased earnings in the first quarter across its natural gas, NGL, and petrochemical and refined products segments, but decreased earnings in the crude oil pipelines segment.

Total natural gas transportation volumes were 13.9 trillion Btu/d for the quarter, compared to 14.2 TBtu/d for 1Q2019. However, EPD’s Haynesville gathering system saw a 245 billion Btu/d decline in gathering volumes during the quarter.

“Natural gas throughput on our Texas and Louisiana intrastate pipelines have been full, while our natural gas processing has suffered,” Teague said. However, “this is a business that I believe has potential upside in the second half of the year. Opportunities around our assets are abundant. Our storage is worth its weight in gold as there is contango on every hydrocarbon, and we’ve even seen some cases of backwardation and they’re all location differentials around our pipelines.”

With the “material decrease” in demand for octane enhancement products expected to continue, EPD expects its octane enhancement facility to operate at low utilization rates during the second quarter until shelter-in-place mandates and travel restrictions are broadly rescinded.

However, its NGL fractionators are full and are expected to remain so as EPD’s NGL pipelines overall haven’t seen a downturn. The company’s Permian crude lines also are fully contracted.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

On Wednesday’s call, Co-CEO Randy Fowler noted that EPD’s top 200 customers represented 96% of 2019 revenues, with the vast majority of the revenues from investment-grade customers.

EPD’s earnings are typically 80-90% fee-based depending on the commodity price and spread environment, Fowler said. Take-or-pay contracts comprise 45-55% of EPD’s fee-based earnings, while durable fee earnings from storage throughput and wholesale residential deliveries make up another 20-30%. Certain “demand-based” volumes make up the balance.

“Even within our volumetric-based earnings, we have a high degree of confidence,” Fowler said, noting that earnings “capture the many ways our commercial and operational teams have hustled to keep our assets full, such as repurposing storage and pipeline assets.”

More than 90% of EPD’s LPG and crude oil contracts are take-or-pay, while 95% of its ethylene capacity is contracted under that structure, according to management. Like Kinder Morgan Inc., EPD management is “pretty comfortable” that it won’t have any issues with producers using force majeure declarations on its contracts.

However, given the uncertainty over the timing and level of economic recovery, EPD management is looking “at all aspects of how we operate our systems in terms of overall cost reduction,” according to Chief Operating Officer Graham Bacon.

Management is “hyper-focused” on variable cost reductions, “whether it be how much power we use for pump station operation, if there’s declining volumes from fixed cost. We have a number of strategies that we use to reduce and extend our maintenance cost. We don’t put a lot of targets out there, but certainly I think from a standpoint of where we’re looking sustainable, we can go 10% or lower for some period of time.”

EPD has long embraced volatility and “has a 20-year track record of creating value,” according to Teague. “We have a footprint that lends itself to having opportunities that in normal circumstances aren’t there, and that’s been the case through hurricanes and financial meltdowns and now through coronavirus.”

EPD’s capital investments for the first quarter were $1.1 billion, which included $69 million of sustaining capital expenditures. For 2020, EPD currently expects growth capital investments to range between $2.5 billion to $3.0 billion. Sustaining capex for the year is projected to be $200 million.

Based solely on sanctioned projects, EPD currently expects growth capital investments for 2021 and 2022 to be approximately $2.5 billion and $1.5 billion, respectively. These amounts do not include capital investments associated with the proposed Sea Port Oil Terminal, which remains subject to governmental approvals, which are not expected this year.

First quarter net income was $1.4 billion (61 cents/share), up from $1.3 billion (57 cents) in 1Q2019. Net cash flow from operations was $2.0 billion for the quarter, up from $1.2 billion a year ago. Free cash flow increased 78% to $3.4 billion for the 12 months ending March 31, while distributable cash flow for the quarter was unchanged year/year at $1.6 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |