NGI Mexico GPI | E&P | NGI All News Access

Mexico’s Pemex Touts Capex Cut, Fiscal Relief Ahead of Earnings Results

Mexico’s troubled state oil company Petróleos Mexicanos (Pemex) on Monday sought to assuage concerns about its finances ahead of a first quarter earnings call slated for Thursday, citing recently approved fiscal relief measures and a reduced 2020 capital expenditure (capex) budget.

In a letter to investors, CEO Octavio Romero Oropeza and CFO Alberto Velázquez said the national oil company (NOC) has slashed its 2020 capex budget by 40.5 billion pesos ($1.66 billion) and will benefit from a presidential decree last week authorizing 65 billion pesos ($2.66 billion) in fiscal relief for the state-owned producer. The executives also said they expect Pemex to receive an estimated 7.5 billion pesos ($309 million) in additional income from its oil hedging program.

All told, the measures add up to 113 billion pesos ($4.63 billion) in relief for Pemex to soften the crushing impact of the Covid-19 pandemic on oil demand and prices, the executives said.

The capex cut follows similar reductions announced by fellow Latin American NOCs Ecopetrol SA of Colombia ($1.2 billion) and Petróleo Brasileiro SA (Petrobras) of Brazil ($3.5 billion).

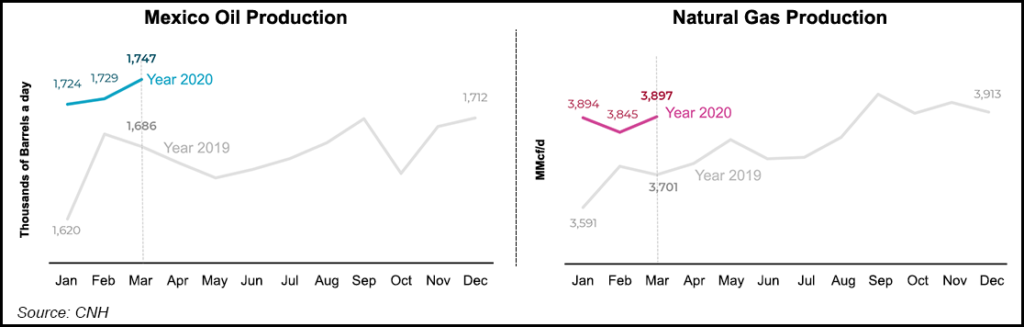

Romero and Velázquez said Pemex has achieved its goal of stabilizing a years-long decline in oil production and is now “on a path of production growth and increasing the crude oil processing levels of our refineries,” and claimed that production costs at the company’s new priority fields are below $5/bbl.

This contradicts analysis of Pemex’s portfolio by researchers at Welligence Energy Analytics, who said this month that 80% of the fields are cash flow negative at a $35/bbl Brent. The June Brent futures contract was trading at around $20/bbl as of midday Tuesday.

Pemex’s crude oil export basket price, meanwhile, stood at $6.55/bbl.

Romero and Velázquez also downplayed a recent downgrade of Pemex debt to “junk” status by Moody’s Investors Service, the second major rating agency after Fitch Ratings to lower Pemex bonds to “speculative” grade.

The downgrade “is not attributed to incorrect operational and financial decisions made by the administration, but rather to the repercussions…of a severe worldwide health crisis caused by the Covid-19 pandemic,” the Pemex executives said.

While Moody’s credit analysts said the coronavirus and low oil prices factored heavily into the downgrade, they also cited Pemex’s “underinvestment in exploration and production in favor of an expansion of its refining business, which has generated losses for several years.”

President Andrés Manuel López Obrador, meanwhile, has pledged to direct more oil to Pemex refineries instead of a global export market awash in crude and lacking in available storage capacity.

Romero and Velázquez did not specify which fields or projects would be postponed under the capex reduction, but said the company would prioritize investments of “high profitability.”

The fiscal relief decree pertains to the profit-sharing duty, or DUC by its Spanish acronym, which accounts for 80% of Pemex’s direct fiscal burden, Romero and Velázquez said, adding that the latest cut is in addition to a seven-point DUC reduction that entered effect in January.

The executives said “as a result of a prudent and responsible use of…debt, as well as of the refinancing operations during recent months, the company reduced its liquidity risk exposure which will allow us to better face the temporary effects of this crisis.” Pemex’s financial debt stood at $105.2 billion as of end-2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |