Shale Daily | Coronavirus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

[Article Headline]

Houston-based National Oilwell Varco Inc. (NOV), whose expertise is plowed into every major global oilfield worldwide, on land and offshore, in drilling and in production, may be facing historic challenges, but the company will be one of those left standing when all is said and done, its CEO said Tuesday.

Clayton Williams helmed a microphone to discuss the company’s first quarter results, offering hope for the future but holding nothing back about the challenges facing the oil and gas industry.

“NOV is persevering through a pandemic that is presenting historic and extraordinary challenges to the oil and gas industry on several fronts,” said Williams. “We expect this downturn to get much worse during the second quarter, so we are intensifying our cost-cutting efforts to position NOV appropriately for the challenges ahead.”

Planned 2020 capital expenditures have been cut by 25% to $250 million. Cost-cutting initiatives have reduced spending by another $395 million. Cash generation is the focus, with an eye on shrinking the inventory and improving collections. The workforce has been reduced, the facilities footprint shrunk and management compensation cut.

The lifeblood of any oilfield services firm is its technology offerings. And on that front, investments may slow but they will continue, Williams told analysts.

“Although we have trimmed and slowed spending on certain technologies, we continue to invest in new products and technologies that will shape our organization and extend our competitive leads as the market emerges from the current downturn,” he said. “By making the right moves now, NOV will exit this downturn stronger and leaner and with the capital necessary to take advantage of strategic opportunities that will emerge.

“Capital in the oil and gas space gets more valuable every day, and NOV will be in the small club of oilfield service companies that have it.”

One thing is crystal clear, Williams said.

“This virus is not going to keep the global economy down forever. And when the world wakes up from this, we’re going to need oil and gas again and we are going to need it for decades to come. This massive historic contraction in a critical industry will affect the future supply curve dramatically.

“When demand recovers, this industry will find itself short of capital, of people, of equipment — a huge opportunity for those of us in the oilfield services industry still left standing. To our employees listening around the world, we have a very difficult two years ahead of us.”

Out of the turmoil, NOV found some positives.

“Interestingly, the threat of disrupted supply chains has presented NOV with the opportunity to introduce new ways of doing business,” Wiliams said. For example, a proprietary tracker vision system permitted one customer to perform a factory acceptance test of equipment remotely by satellite link-up with augmented reality, keeping the project on schedule despite the disruptions.

Tracker vision also enables efficient remote troubleshooting and support of ongoing operating equipment.

Select businesses also out performed expectations as a result of the pandemic, the CEO noted.

“Orders for spare parts for rig equipment actually increased 4% sequentially, increasing in February and March as concerns began to grow around the supply chain disruptions from customers that did not want to be caught short of a critical spare part with no way to access it.” Demand for some industrial products for pharmaceuticals and consumer products also rose in response to the effort to defeat the virus.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

However, the pandemic has affected NOV and its customers, with the impacts presenting “longer term challenges,” Williams said.

“Well prices have been crushed, and prices in many regions are now below cash operating costs, meaning producers spend more to produce oil from existing wells than they make in revenue. This will lead to shut-ins by their owners to conserve cash. In other regions, pipelines and transportation companies have refused acceptance of crude regardless of its lifting costs because there is simply no place for it to go, which will lead to additional force shut-ins.

“In the aggregate, we are on the precipice of forced well shut-ins totaling 15-to-20 million b/d, a scale never before seen in this industry,” Williams said. “Rig and well servicing activity around the world, particularly in North America, is plummeting as it is difficult to make an economically rational argument that we should be drilling a new well against the current commodity backdrop.”

The international markets have reacted more slowly to the coronavirus but “they are not immune to the stark realities of this price collapse and will significantly curtail their spending later in the

Year,” he said. “This will likely be the worst downturn that any of us in the oil and gas industry will experience in our lifetimes.”

While many companies may not survive, “NOV will,” he said, as it has a strong balance sheet and $3.1 billion in liquidity. “Nevertheless, to ensure that we survive now and prosper later, we must continue to take measures and maximize cash flow, avoid consuming cash and protect, defend and strengthen our enterprise through this downturn.”

Net losses in 1Q2020 totaled $2.05 billion (minus $5.34/share), versus a year-ago net loss of $77 million (minus 20 cents). The first quarter of 2020 included one-time charges of $2.25 billion after it evaluated the carrying value of its long-lived assets, as well as for inventory, severance and facility closure charges.

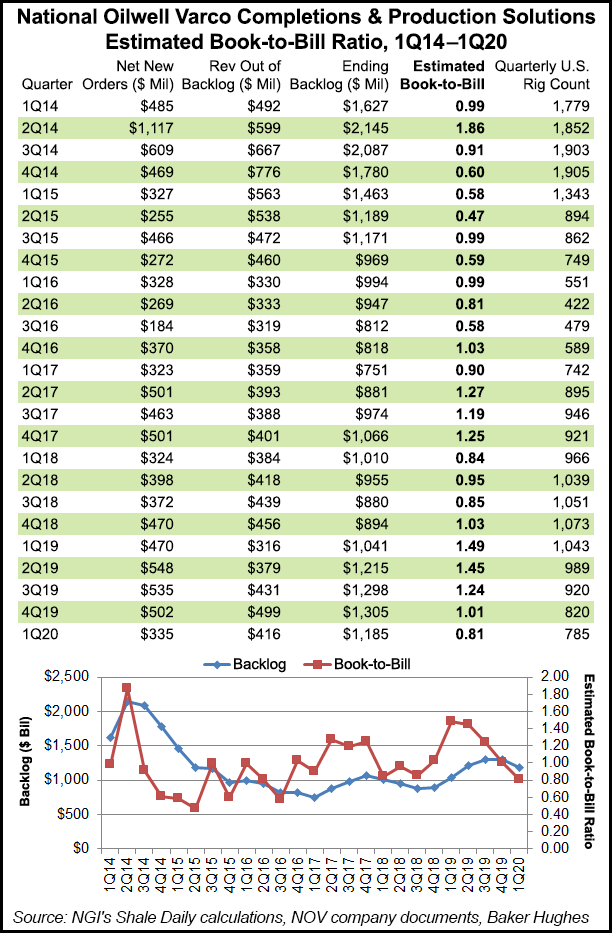

Orders booked during 1Q2019 totaled $335 million, representing a book-to-bill of 81% when compared to the $416 million of orders shipped from backlog. At the end of March, backlog for capital equipment orders for the Completion & Production Solutions (CPS) segment was $1.19 billion.

CPS generated revenues of $675 million in the first quarter, up 16% year/year but down 16% sequentially.

Wellbore Technologies generated revenues of $691 million in the quarter, off 14% from a year ago and down 10% from 4Q2019. In the Rig Technologies segment, revenue totaled $557 million, down 8% from a year ago and 27% sequentially.

Orders booked in the Rig Technology segment totaled $146 million, representing a book-to-bill of 70% when compared to the $208 million of orders shipped from backlog. Backlog for capital equipment orders at the end of March was $2.93 billion.

In the past several weeks, NOV has “sought to both protect the health of our employees and to

serve our customers who are facing daunting challenges and are relying on NOV to keep their operations running,” Williams said.

“This has been no easy task, as of today, 64 NOV facilities around the world remain shut down due to government mandates, which means approximately 3,300 of our valued employees globally or unable to come to work. This number varies daily, with evolving government restrictions, and it was as high as 4,000 employees a few weeks ago.”

Additionally, thousands of other NOV employees are working from home or are working reduced hours.

“The rest of our facilities remain operational although challenged. Many are short-handed and some working flex shifts. We are committed to operating in as safe a manner as possible and we’ve been able to do that, thanks in large part to the multitude of social distancing measures implemented by our management and the careful adherence to these measures by our employees.”

Social distancing at NOV includes modified scheduling, staggered lunch breaks, mandatory periodic hand-washing, incremental facility cleanings, as well as working from home when possible. Telephone and video conferences have taken the place of in-person meetings and there is increased spacing on shop floors.

Regarding Covid-19, employees are working to help “support our communities during this pandemic,” Williams said, by donating personal protective equipment and cleaning supplies to frontline emergency personnel and delivering portable generation systems from NOV’s WellSite Services business to provide critical power and air conditioning to quarantine testing and distribution centers.

“In fact, an NOV engineer helped design a low-cost mechanical ventilator and is now working with the Massachusetts Institute of Technology to validate the design and create a 3-D model that will be used to print the ventilator using additive manufacturing,” Williams noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |