NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Futures Plummet; More ‘Extreme Volatility” Seen Ahead

Major moves along the natural gas futures curve continued Thursday, with early selling intensifying once traders had time to digest the latest storage data. The May Nymex gas futures contract erased all of the previous day’s gains and then some, settling at $1.815, off 12.4 cents. June dropped 11.1 cents to $1.942, with the entire curve ending the day in the red.

Spot gas prices were range-bound with little change in weather patterns seen for the end of the week. NGI’s Spot Gas National Avg. fell a half-cent to $1.705.

With chilly weather continuing from the Midwest over to the East, the market has looked for signs as to when the cooler-than-normal pattern would come to an end. In fact, what potentially hurt prices early in the session was that the overnight data lost a little bit of demand through the first few days of May, according to NatGasWeather. Then, the midday Global Forecast System model lost a little more, giving back 4-5 degree days that the firm said was mostly because of less cool air arriving into the northern United States.

There were no “big changes” to the pattern as weak cool shots are still expected across the Great Lakes and East, while the Southwest into West Texas and the Southern Plains are forecast to become unseasonably hot, according to NatGasWeather. “Essentially, a better balance of heating degree days and cooling degree days, but just not quite hot or cold enough overall.”

Ever since U.S. crude’s unparalleled collapse into negative territory, Bespoke Weather Services has suspected that the front of the Nymex gas futures curve had gotten to a level that was “overvalued” based on fundamentals. “Nothing has really changed in the market dynamics as of this time. While we do expect cuts in production over the next several months, the balance is so loose that we can see some cuts and still run the risk of full storage this fall, especially with risk of liquefied natural gas (LNG) dropping off as well.”

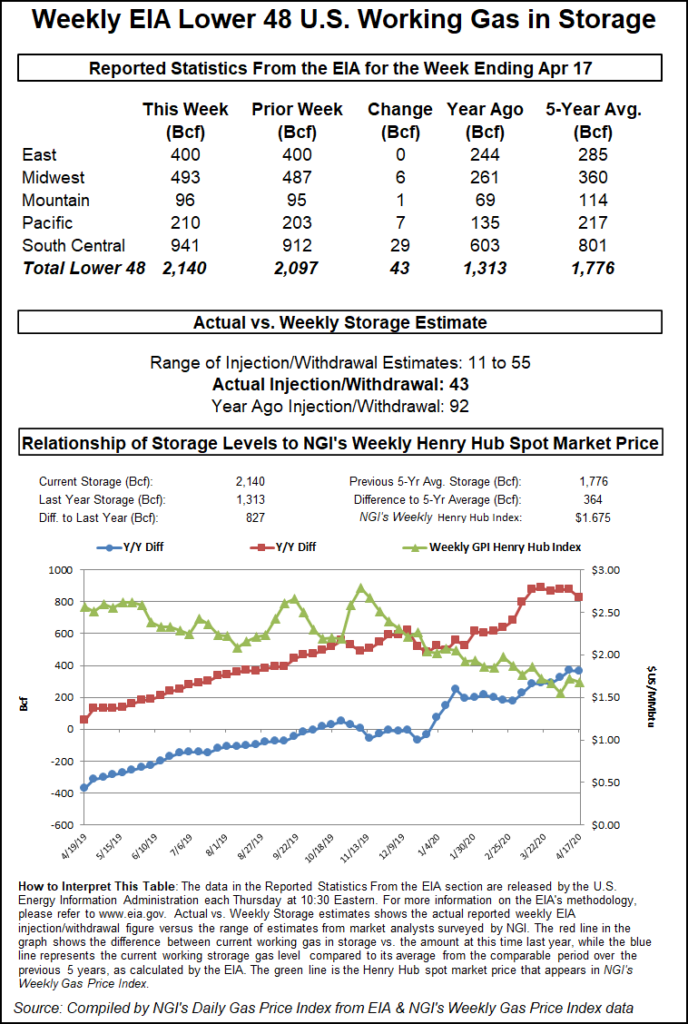

Indeed, the latest storage report reflected those “wicked loose” balances, with the Energy Information Administration (EIA) reporting a 43 Bcf injection for the week ending April 17, a figure that trailed some estimates but still puts the balance of the past few weeks at an “impossible” end-of-season storage level of 5-plus Tcf, according to Bespoke.

The EIA’s 43 Bcf injection compares with last year’s 92 Bcf injection and the five-year 49 Bcf build.

Broken down by region, the South Central led with a 29 Bcf build, including 15 Bcf into salt facilities and 14 Bcf into nonsalts, EIA said. The Pacific added 7 Bcf to inventories, while the Midwest added 6 Bcf. The East, meanwhile, reported that inventories were unchanged.

Total working gas in storage as of April 17 was 2,140 Bcf, 827 Bcf higher than last year and 364 Bcf above the five-year average, according to EIA.

Bespoke indicated that it would need to see at least some reopening of the economy in order to get rid of some of the demand destruction that’s taken place and allow the supply/demand balances to tighten. With so much uncertainty, though, the firm has to rely on the data it has “here and now,” which is not bullish at the front of the curve.

Furthermore, the United States’ emergence as a leading gas exporter means that domestic prices are not immune to weakness abroad. As the coronavirus pandemic has decimated demand in the Lower 48, so too has the outbreak clobbered demand in Europe, the so-called “market of last resort” when it comes to LNG exports.

Reports have circulated that north of 20 LNG cargoes have been canceled, with the latest cancellations reportedly from the Freeport terminal. Even before the Covid-19 outbreak, there were indications that U.S. cargoes could be shut in during the summer months following a mild winter and plentiful storage.

However, with Dutch Title Transfer Facility futures slipping below Nymex Henry Hub levels for July, August and September, “significant quantities” of LNG may be shut-in and therefore reduce the demand for Lower 48 gas, according to EBW Analytics Group LLC.

“Further cargoes marketed directly by LNG exporters may not be included in the total, suggesting LNG exports may fall even further,” EBW said.

Noting the “tremendous” uncertainty in both U.S. LNG demand and in associated gas supplies, the firm sees continued “extreme volatility” ahead for natural gas futures.

After several days of meaningful swings, spot gas prices took a breather on Thursday as the Midwest to East was expected to remain cool, while temperatures were on the rise in the South and West.

However, with the heat building and expected to intensify in the coming days, SoCal Citygate next-day gas shot up 16.0 cents to $1.845. Other prices within the region picked up less than a nickel day/day.

Most Rockies markets posted similarly small gains, although ongoing maintenance along El Paso Natural Gas boosted prices a bit more at El Paso San Juan, which jumped 8.5 cents to $1.285.

Spot gas prices across Texas were mostly lower on the day, but Waha only slipped 4.0 cents day/day to $1.170.

The rest of the Lower 48 was a mix of gains and losses, though few that were larger than a nickel or so.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |