Utica Shale | Coronavirus | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

EQT Given Breathing Room by Higher Natural Gas Prices, with Optimism for Even More Gains

Higher natural gas prices amid the Covid-19 pandemic may have given some unexpected breathing room to Pittsburgh-based EQT Corp., management said Thursday.

The twin shocks of the coronavirus and an oil price war that lasted more than a month came as the nation’s largest natural gas producer was in the midst of an overhaul to reduce debt, sell some assets and boost the stock price.

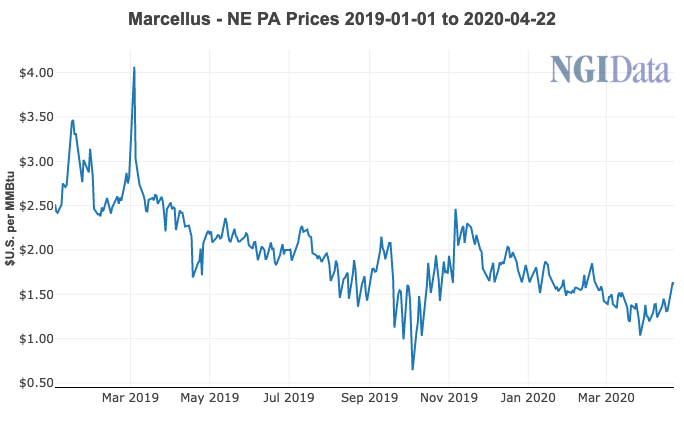

However, while prices for crude and natural gas liquids (NGL) have plunged, strip pricing for natural gas has strengthened in recent days, with markets betting that supply impacts from oil well shut-ins, which produce associated gas, will outweigh demand erosion by the virus, management said. Natural gas accounts for about 95% of the independent’s production.

CEO Toby Rice said EQT exceeded its production guidance in the first quarter “through continued operational efficiencies, made substantial progress toward our well cost targets and outperformed our operating cost projections, all while spending roughly 25% less capital than the prior quarter.”

EQT reduced capital expenditures in March and released 15% of firm transportation obligations to optimize the cost structure.

The company also is in “advanced stages” to sell some assets considered noncore that are primarily in central Pennsylvania for an anticipated price of about $125 million.

“Given current market conditions and our expectations and our expectation that natural gas prices may improve further starting in the latter half of 2020,” management said, “we intend to more selectively explore noncore asset sales and opportunistically assess monetizing our remaining equity interest in Equitrans Midstream Corp. in a strategic manner in lieu of attempting to fully achieve our deleveraging plan by mid-2020.”

Proceeds from the expected asset sales, with estimated $390 in income tax refunds and higher free cash flow from well cost reductions would be sufficient to repay or refinance debt maturing in 2021 by the end of this year.

The deleveraging plan announced in October sought to reduce EQT’s debt by about 30% or $1.5 billion by mid-2020 through asset divestments and increased free cash flow.

“Until our leverage target is achieved, we still expect to use all free cash flow and divestiture proceeds to reduce debt,” management said.

EQT, which operates in the Marcellus and Utica shales, recorded estimated sales volumes of 380-385 Bcfe in 1Q2020, exceeding the guidance of 360-370 Bcfe. The average gas differential was 20-15 cents/Mcf below the Henry Hub benchmark, in line with guidance 25-5 cents.

Capital expenditures fell by about 25% from 4Q2019 to an estimated $250-270 million, while Marcellus well costs averaged $740-750/lateral foot, “accelerating” the path toward reaching targeted well costs.

EQT’s 1Q2020 earnings call is scheduled for May 7.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |