NGI Data | Markets | NGI All News Access

Natural Gas Futures Trim Losses After EIA Reports 43 Bcf Storage Injection

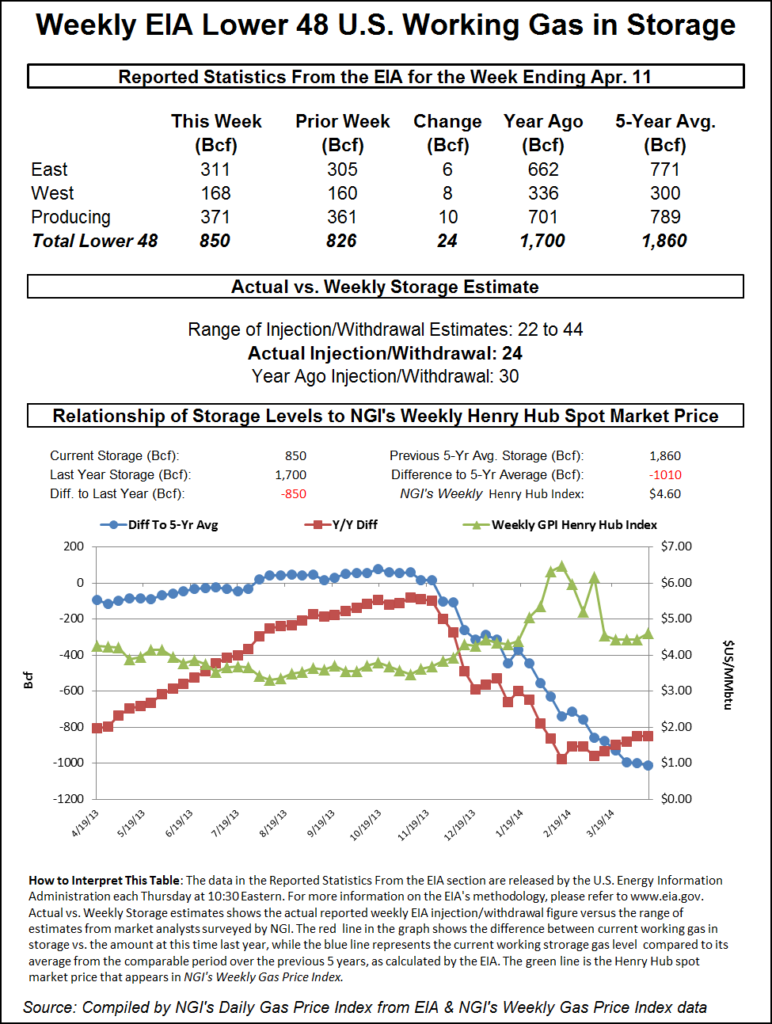

The Energy Information Administration (EIA) reported that natural gas storage inventories grew by 43 Bcf for the week ending April 17, well within the range of estimates but lower than both last year’s 92 Bcf injection and the five-year 49 Bcf build.

Natural gas futures, about a nickel lower at the front of the curve ahead of the EIA report, bounced as the print crossed trading desks. The May Nymex contract was trading near $1.890/MMBtu, then rose to $1.918 after the EIA data hit the screen. By 11 a.m., the prompt month was back down to $1.903, down 3.6 cents from Wednesday’s close.

Bespoke Weather Services, which had projected a 41 Bcf injection, said that after a string of huge misses, the latest data may mean the level of demand destruction is being captured more properly now, “although this does not change the theme that supply/demand balances are wicked loose.

“Yes, some market estimates were higher, which is why we rate the report as ”neutral,’ given that it was actually a slightly lower build versus the market consensus, but the balance of the past few weeks still points at an impossible end-of-season storage level of 5-plus Tcf. Until we see changes in the balance, we find it difficult to construct a bullish case at the front of the curve.”

Ahead of the report, a Bloomberg survey showed estimates ranging from 32 Bcf to 51 Bcf, with a median build of 44 Bcf. A Wall Street Journal poll of 12 analysts saw projections as low as 11 Bcf, though the survey produced an average build of 38 Bcf. A Reuters survey ranged from 11 Bcf to 55 Bcf, with a median injection of 39 Bcf. NGI pegged the build at 51 Bcf.

Broken down by region, the South Central led with a 29 Bcf build, including 15 Bcf into salt facilities and 14 Bcf into nonsalts, EIA said. The Pacific added 7 Bcf to inventories, while the Midwest added 6 Bcf. The East, meanwhile, reported that inventories were unchanged.

Total working gas in storage as of April 17 was 2,140 Bcf, 827 Bcf higher than last year and 364 Bcf above the five-year average, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |