Shale Daily | Coronavirus | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Montney NGL Pipe Delayed for One Year as Coronavirus Impacts Energy Markets

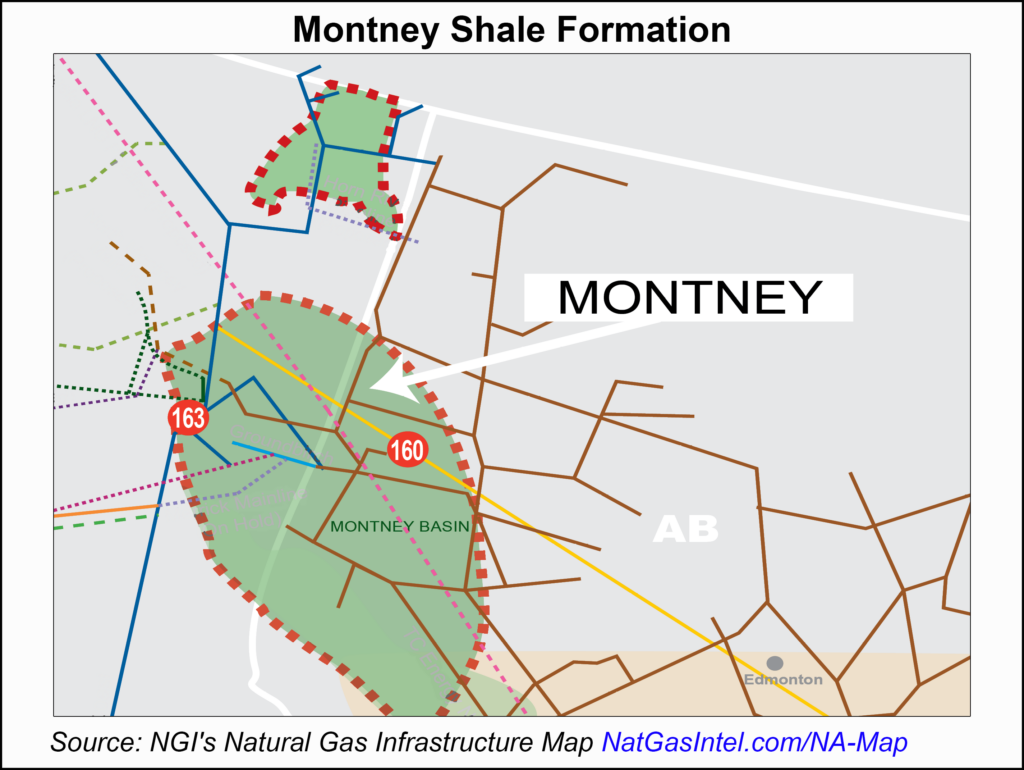

Canada’s Montney Shale natural gas producers have agreed to a one-year delay to construct a C$1.3 billion ($975 million) liquid byproducts pipeline because of the Covid-19 pandemic and energy market lull.

Partners Keyera Corp. and SemCAMS Midstream ULC said the unanimous decision postpones, until the second half of 2021, the start on two years of work to build the Key Access Pipeline System, or KAPS.

The system would transport gasoline-like condensate and lighter gas-liquids in two pipes for about 500 kilometers (300 miles) across Alberta from shale wells around Grande Prairie to Fort Saskatchewan storage and sales operations near the provincial capital, Edmonton.

KAPS secured transportation service contracts from producers of liquids-rich Montney gas as a route to markets for petrochemical plant raw materials and pipeline diluent for oilsands bitumen.

“The project remains highly desired by industry,” the sponsors said. “With the cooperation of the KAPS customers, all transportation agreements have been amended to support the one-year deferral. There have been no changes to the long-term volume commitments,” which average 14 years.

To pare down for lean times caused by the coronavirus, Keyera also reduced its 2020 budget by about one-third to C$475-525 million ($356-394 million) and reduced compensation.

The Calgary firm has also announced a plan to close four smaller processing plants and redirect their gas flows to newer, larger and lower-cost operations.

Tudor, Pickering, Holt & Co. analysts said they supported the delay “in light of macro uncertainty” as energy demand drops.

“We think this removes near-term funding uncertainty and helps long-term investors find an equity pricing floor against a more constructive natural gas backdrop,” analysts said, “as we expect full-year 2020 consensus numbers to move lower from increasing Canadian crude shut-in announcements, which should negatively impact Keyera’s wellhead, fracture and diluent transportation volumes.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |