Shale Daily | Coronavirus | E&P | NGI All News Access

Schlumberger, Halliburton Forecasting 2Q as Low Point for North American E&Ps, but Coronavirus Clouding Outlooks

Oilfield services giants Schlumberger Ltd. and Halliburton Co. may be competitors but they agree on one thing: the global oil and gas industry is facing a severe test from the Covid-19 pandemic, with impacts likely to increase through the second quarter.

Schlumberger CEO Olivier Le Peuch last Friday shared first quarter results and a partial outlook for the current quarter during a conference call with CFO Stephane Biguet in Houston. Even with the recent agreement by the Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, “the second quarter is likely to be the most uncertain and disruptive quarter that the industry has ever seen,” Le Peuch said.

The CEO deferred from offering guidance, “as we face a degree of uncertainty beyond the severe impact of oil demand contraction and delivery of commodity prices. First, it is very difficult to model or predict the frequency of magnitude of the Covid-19 on field operations.

“Second, it is too early to judge the impact of recent OPEC-plus decision on the level of international activity as well” because oil storage levels are nearing capacity.

For the largest operations, which are in North America, Schlumberger is anticipating onshore exploration and production (E&P) activity “to continue to decline sharply during the second quarter,” off by 40-60%, “which match the full-year budget adjustment guidance” shared by most customers. North American land operations during 2Q2020 are likely to see “the most severe decline in drilling and completion activity in a single quarter in several decades” based on capital expenditure (capex) cuts announced by E&Ps to date.

“At this time, customer feedback and our analysis indicate global capex spend is expected to decline by about 20% in 2020, with the largest share of the reduction affecting North America, which is estimated to drop by about 40%,” Le Peuch said. Final investment decisions “are expected to fall back to trough levels of 2015, which would indicate project delays to 2021 and beyond.”

Schlumberger had laid off 17% of the workforce through March, or by around 1,500 people. In addition, furloughs have been implemented “across many parts of organization in North America and internationally,” with compensation reduced for executives and the board.

Le Peuche, who made his comments before oil prices crashed on Monday, had said it would be “difficult to judge the magnitude” of how many wells could be shut-in across the Lower 48. “It would depend on how fast and how much there will be an excess of supply going into topping the storage tanks. I think it depends on the reservoir. It depends on the location.”

North American hydraulic fracturing (frack) fleets already are adjusting “to fit the market,” Le Peuch said. As “all prices began to collapse in March, customers rapidly dropped rigs and frack crews…Along with well construction and completion activity decreasing, the technology mix switched from the adding performance to saving costs…

“We have acted rapidly by stacking frack fleets leads to protect our margin and have reduced capacity by more than 27%.” By the end of March, North American capex had been reduced by 60% from original guidance. “The pace and scale of decline is still uncertain,” but it is likely to be “more abrupt than any recent downturn.”

“The enormity of the task ahead will require levels of response and depths of resilience that have yet to be fully realized,” Le Peuch said. “Our immediate actions have been focused on those things we can control in protecting our business in an uncertain industry and global environment…

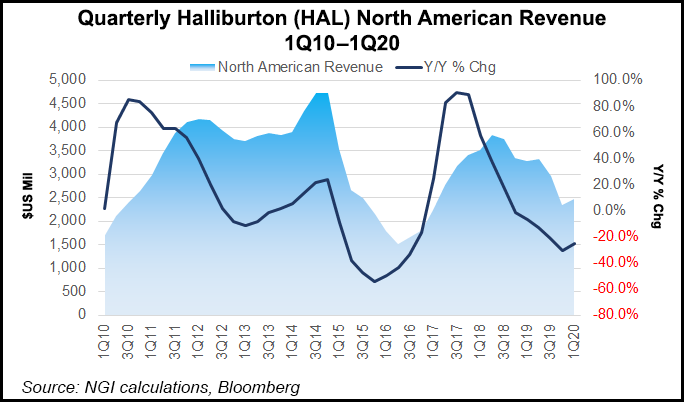

Houston-based Halliburton, the largest pressure pumper in the Lower 48, no longer is seeing a “flight to quality,” but a flight to anywhere, as customers deal with the pandemic and low commodity prices, CEO Jeff Miller said Monday. He helmed a conference call to discuss the first quarter results.

Exploration and production customers today are attempting to fly safely out of the morass as they are able, cutting as much from their capex budgets as they can. Fracking services, Halliburton’s forte in the Lower 48, are taking a big hit as E&Ps shut-in wells and lay off crews.

“I fully expect we will see a flight to quality, but at this very moment, there’s just not a lot of thought going into anything other than reducing capital spend,” Miller said. “In that kind of environment, there isn’t much flight because there’s not a lot of new things being added…We maintain that front and center and fully expect that after the industry’s able to take a collective breath…we will see the same flight to quality that we have always seen.”

Regarding its North American E&P customers, Miller said they are “an incredibly aggressive group of competitors…They’re going to each aggressively act independently. The dialogue with them at least with me has been disappointment over the near term, but all…looking ahead to what it looks like on the other side…

“The dialogue is always that, ”we’re going to need to be super competitive and work with Halliburton when we get to the other side.’ We’ve had many discussions about what does the recovery look like? How do we implement the things we’re talking about on the other side? So, that’s generally been a consistent conversation with all customers.”

Miller also expects the United States to see the biggest contraction during the second quarter, with Lower 48 “frack holidays” likely.

“It’s moving so quickly that our view on the U.S. is that we see dramatic reduction in the second quarter, though I’m not able to call the precise number or timing,” Miller said. In the North American onshore, “frack holidays” are a sure thing. For overseas operations, more weighted to the deepwater, it’s a different story.

“A frack holiday is a lot different than taking a deepwater rig holiday,” he said. “They just happen at different paces, and so we’ve got a view of slowing activity internationally. It doesn’t necessarily slow with the same pace,” as deepwater drillers cannot “pick a date…it’s at a point in time.”

Halliburton has reduced capex by roughly half from 2019 to $800 million. Around $1 billion is to be reduced from annualized overhead and other costs through the second half of the year.

“To accomplish this, we are streamlining our global and regional headcount, consolidating multiple facilities and removing another layer of operations management in North America,” Miller said. “We are cutting our technology budget by 25%. We have stopped discretionary spend across the business, and we have eliminated salary increases for all personnel this year, and I and other members of the executive committee have taken pay cuts.

“Additionally, we will make variable headcount adjustments and rationalize our assets to be in line with the activity reductions we anticipate. As we look to reduce our own input costs, we’re also renegotiating prices and terms with our suppliers…”

More actions could be taken, depending on how the market evolves.

“If I’ve learned something from all of the downturns I’ve been through in my career, it is that the industry always bounces back,” Miller said. “This downturn, although the most severe we’ve seen in a generation, will be no different.”

One area where Halliburton has seen improvement in the downturn is internal and customer acceleration toward adopting digital technologies.

“The current environment really accelerates, or allows us, to really test the art of the possible, with respect to how we work,” Miller said. “Digital is front and center. I can see when we embrace that wholeheartedly as opposed to incrementally, we’re able to do things quite differently in terms of less people, less footprint…

“This whole period is awful on a lot of different fronts, but I am an optimist. I think we take advantage of an opportunity; it’s an opportune time to say, ”okay, forget everything you thought you knew.’”

Over the last month or so Halliburton has seen a “meaningful uptake”in demand for cloud services and “things that would allow, not just working remotely, but…the same kind of cost removal” to help E&Ps reduce their overhead. With more E&P customers now working from home, the move to cloud technology has “accelerated the demand for that…Obviously, necessity is the mother of demand creation in that regard, but it’s quite encouraging to me…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |