NGI The Weekly Gas Market Report | E&P | LNG | LNG Insight | Markets | NGI All News Access

Global LNG Production Remains Resilient Despite Coronavirus, Falling Prices

Despite prices that have cratered since last year and a steep cut in demand caused by the Covid-19 pandemic, global liquefied natural gas (LNG) supplies remain resilient and cargoes are still being delivered.

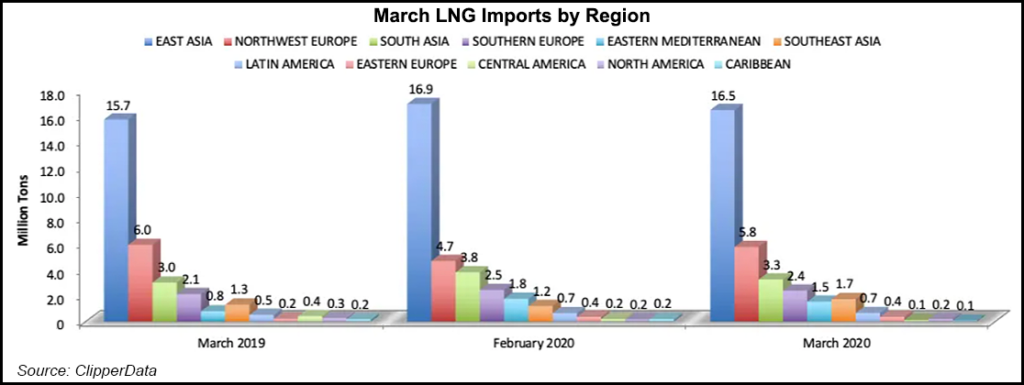

Global LNG exports remained steady in March, reaching 30.4 million tons (MT), or slightly under 30.8 MT exported at the same time last year, according to ClipperData. Imports were up during the month to 32.7 MT, compared with 30.5 MT in March 2019. Floating storage has remained elevated this year because the logistics of unloading have been complicated by the coronavirus, which has delayed some imports. The number of vessels floating with LNG aboard peaked at 19 last month, the firm said.

East Asia took in 16.5 MT of LNG during March, up from 15.7 MT a year ago, while South Asia imports increased by 7% to 3.3 MT. Asia began to take in more cargoes from Europe last month as the continent grappled with the pandemic.

ClipperData said U.S. exports increased 80% year/year in March to 4.6 MT as more facilities are online.

LNG arrivals into Europe have remained relentless as well. BTU Analytics LLC noted last week that imports averaged 13.3 Bcf/d in the first quarter, roughly in line with levels at the end of last year. The continent has also periodically absorbed deliveries from Asia during the pandemic.

The outlook for LNG producers has dimmed in recent weeks, however, as margins look increasingly squeezed with prices falling further and oil-linked gas taking a beating as crude has fallen too.

Tudor, Pickering, Holt & Co. said late last week it expects global demand to drop by 16% month/month in April. U.S. LNG producers have continued to churn out exports steadily despite falling prices as production is underpinned by long-term take or pay contracts. Still, TPH said last Friday Lower 48 terminals were running at a 97% utilization rate month-to-date.

“These utilization rates come despite the fact that we see uncommitted cargoes being out of the money presently and continuing” to show negative margins through September, TPH analysts said. “This suggests to us that LNG exports may be stickier than many expect, which, if true, would be a meaningful tailwind for Henry Hub pricing.”

The LNG market also moves at a glacial pace. Spot and long-term cargoes are generally scheduled to be lifted a few weeks or months in advance, meaning the prices that buyers and sellers have so far transacted are a thing of the past.

Looking ahead, cargo cancellations and shut-ins are likely as prices continue to fall. The Japan Korea Marker spot price hit a record low again on Tuesday of $2.04/MMBtu, shattering the previous lows set on Friday and Monday. Prompt prices at the National Balancing Point in the UK, meanwhile, dipped below Henry Hub on Monday. While prompt prices don’t matter as much in the LNG market given how cargoes are scheduled, the price swing is indicative of a bearish European market.

In northwestern Europe, the Dutch Title Transfer Facility also continues to trade at record lows, while the negative sentiment that walloped the U.S. crude benchmark on Monday continued on Tuesday and bled into Brent futures and other contracts. Brent dipped below $20/bbl. While some oil-linked contracts are insulated by formulas that guard against the impact of high crude prices on buyers and low crude prices on sellers, if oil stays lower for longer it still promises to dent the profits of LNG producers with supply contracts tied to crude.

While gas consumption has fallen in key markets from the virus, demand growth and a supply surplus is still forecast for this year, according to some analyst estimates. Storage is not yet full in places like Europe either.

Underground inventories in Europe stood at 55.8% on Tuesday, compared to the five-year average of 31.1%. European LNG inventories were 51.8% full, compared to historical averages of 48.7% for this time of year, according to NGI calculations.

“The gas coming in cannot be consumed at anywhere near the same rate. So instead of being burned in factories or consumed as electricity, that gas is being injected into underground sites,” said Poten & Partners’ Oleg Vukmanovic, European LNG and gas analyst. Storage was at record levels exiting the winter and refill rates have spiked in recents weeks. Vukmanovic said during a webinar last week if injection rates hold up, storage could fill in the next month or two.

Poten analysts estimated last week that more than 10 U.S. cargoes for June lifting would be canceled given the pandemic’s impact on demand and prices. Citing an anonymous source, Bloomberg reported Tuesday that Cheniere Energy Inc. may be facing up to 10 cargo cancellations in June in addition to others canceled earlier in the year.

Market participants have also continued to test different strategies to handle the market turmoil. For example, deliveries have been deferred at ports throughout the world and transactions are still being executed at extraordinarily low prices. Players like Cheniere, the largest U.S. LNG producer, have issued tenders to buy cargoes in the open market, which could give it optionality to meet the needs of its customers if prices fall further and make U.S. volumes uneconomic.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |