NGI The Weekly Gas Market Report | Coronavirus | NGI All News Access

With Demand Smothered by Covid-19, Canadian E&Ps, OFS Operators Reduce Capex, Output

A cross-section of Canadian producer and contractor firms deepened 2020 capital spending cuts Monday in response to the worsening fossil fuel market outlook caused by the Covid-19 virus pandemic.

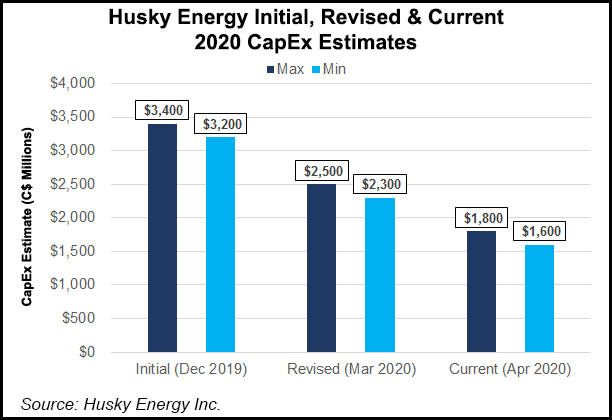

Husky Energy Inc., an integrated exploration and production (E&P) company with operations from oilsands extraction through refining to retailing, announced a C$700 million ($525 million) capital expenditure (capex) cut on top of a C$1 billion ($750 million) reduction in mid-March.

Husky also is cutting oil production by about 80,000 b/d, and it said further reductions could be made at sites where suspending activity would not damage reserves.

“As the market rebalances supply with demand over a very short period in North America, negative cash margins before operating costs are occurring,” said CEO Rob Peabody. “Reducing production minimizes our negative cash margin exposure.”

Canadian E&P Crescent Point Energy Corp. announced a C$75 million ($56 million) capex cut and a C$140 million ($105 million) operating expense reduction that would be partly achieved by shutting in wells.

Crescent Point also lowered its 2020 production forecast by 20,000 b/d, or 15%, to 110,000-114,000 b/d. The casualties are wells with operating costs above the company average.

Oilfield services (OFS) operator Cathedral Energy Services Ltd., a driller that is active in five U.S. states and two Canadian provinces, has announced staff cuts, pay, benefits, working hours, travel and equipment expense reductions ranging from 8% to 25%.

Canadian E&Ps and OFS firms said they are prepared to make further adaptations as the global health and economic emergencies evolve.

Canadian-based petroleum consulting firm Sproule Associates described global production cuts to date as insufficient to revive gutted prices, leaving an “imbalanced” oil market facing an “indeterminable” future for years to come.

“The greatest risk to the crude oil market in the medium to long term is the currently indeterminable impact on demand,” said a Sproule review of industry conditions. “Apart from changing trade patterns and social behavior, a recession coupled with [economic recovery] policy objectives and a green stimulus offer the potential for a new normal to emerge with lasting demand destruction.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |