NGI Mexico GPI | E&P | NGI All News Access

Mexico’s Pemex Hit With New Downgrade in Midst of Oil Price Collapse

Moody’s Investors Service downgraded Mexico’s state oil company Petróleos Mexicanos’ (Pemex) bonds to below investment grade, following on from a similar action by Fitch Ratings, a move sure to further strangle the company’s access to investment funds.

Analysts cited Pemex’s “high vulnerability to low commodities prices given its fragile liquidity position and excessive debt burden.”

Despite a historic agreement last week between the Organization of the Petroleum Exporting Countries (OPEC) and other producer states agreeing to slash global oil production by 9.7 million b/d, oil prices have continued to plunge.

Since closing February at $39.76/bbl, the Mexican basket price had fallen to $14.35/bbl as of Friday. But prices completely collapsed on Monday, with U.S. benchmark West Texas Intermediate (WTI) recording negative prices for the first time in history.

The managing director at consultancy IPD Latin America John Padilla said the significance of the ratings downgrade to junk is that it limits “the universe of investors that could hold and buy Pemex debt.” Pemex is the most indebted oil company in the world, with over $105 billion in outstanding debt.

The Pemex downgrade “took in consideration our expectations for an extended period of negative free cash flow and the need for external funding, despite the company’s efforts to adjust costs and investments to low oil prices,” said Moody’s Senior Vice President Nymia Almeida.

The downgrade comes after Mexico refused a 400,000 b/d production cut assigned to it by OPEC as part of a multilateral agreement to balance the market. Mexico instead committed to slash production by 100,000 b/d.

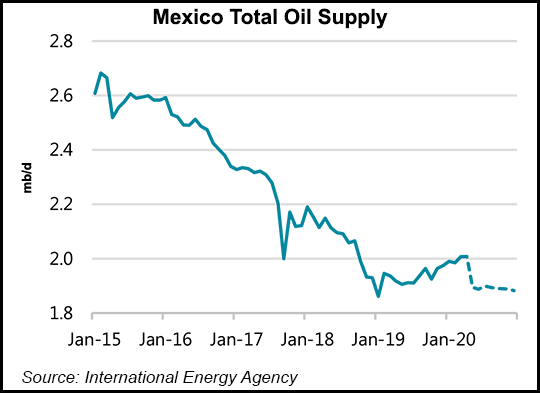

Mexico’s President Andrés Manuel López Obrador hailed the negotiation as a success and has said he will stick to his 2020 capital expenditure budget for Pemex of $10 billion in a bid to boost oil production to 2.7 million b/d by 2024, from around 1.72 million b/d today. He will also continue building the Dos Bocas refinery in his home state of Tabasco.

Padilla called the Dos Bocas project “economically nonviable.” Researchers at Welligence Energy Analytics meanwhile have argued that Pemex should slash its 2020 capital budget by 70% and focus only on the profitable fields in its portfolio, in line with other national oil companies in Latin America and oil companies elsewhere.

Moody’s warned that “Pemex’s need for external funding to cover negative free cash flow will increase as a consequence of the company’s limited ability to improve its business results due to the mature stage of oil fields; shortage of capital to sufficiently invest in exploration and production, with negative consequences in production and reserve replacement; and the mandate to expand the refining business, which Moody’s expects will continue to post operating losses and be vulnerable to the oil and gas industry medium-term demands trends.”

After downgrading Mexico’s sovereign rating last week, Fitch Ratings also downgraded the international foreign and local currency long-term ratings on Pemex, state utility Comision Federal de Electricidad (CFE), and energy companies Infraestructura Energetica Nova (IEnova) and Cometa Energia.

“Pemex and CFE’s rating downgrades reflect these companies’ direct linkage to Mexico’s sovereign ratings,” analysts said.

Mexico’s sovereign rating downgrade “reflects the economic shock represented by the coronavirus pandemic, which will lead to a severe recession in Mexico in 2020.”

Fitch expects the Mexican economy to contract by at least 4% in 2020, with a steep fall in the first half followed by the start of a recovery in the second. “But given the nature of the crisis, there is a higher than usual level of uncertainty around our forecasts, and the balance of risks is firmly to the downside.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |