Shale Daily | E&P | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

U.S. Drops Another 73 Rigs, Down More Than 250 Since Mid-March

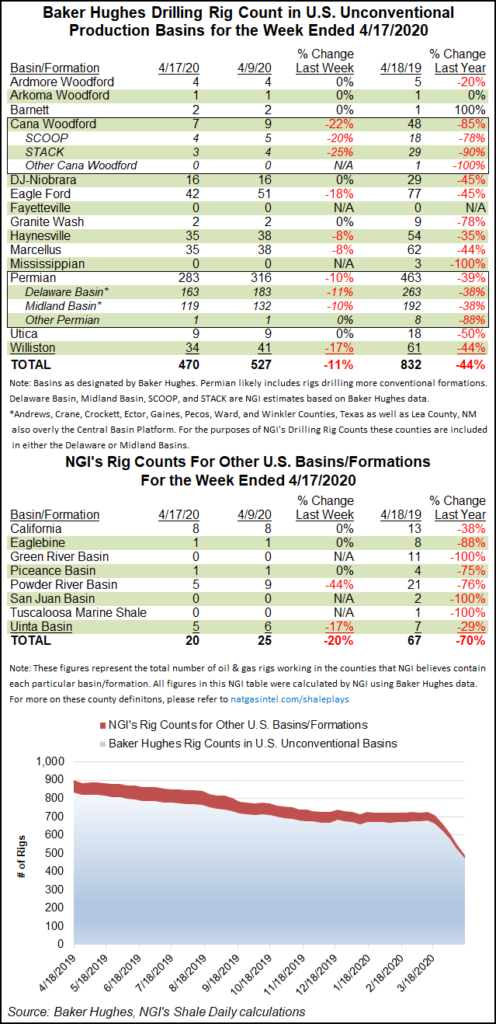

The dramatic decline in U.S. onshore activity showed no signs of letting up during the week ended Friday (April 17) as the domestic rig count plummeted another 73 rigs to fall to 529, according to the latest figures from Baker Hughes Co. (BKR).

The declines in the United States for the week included 66 oil-directed rigs and seven natural gas-directed. The U.S. rig count ended the week nearly 500 units behind its year-ago total of 1,012.

With the Covid-19 pandemic wiping out demand and collapsing crude prices, U.S. onshore operators have responded in kind to the unprecedented global economic crisis. The U.S. count has fallen more than 250 rigs since mid-March, according to BKR data.

The recent week’s changes included a loss of 72 land rigs and one Gulf of Mexico rig. Seven directional units and four vertical units joined 62 horizontal rigs in exiting the patch.

The Canadian rig count fell five units to end the week at 30, down from 66 in the year-ago period. Changes included a six-rig drop in gas-directed drilling, partially offset by the addition of one oil rig.

The combined North American count ended the week at 559, roughly half of the 1,078 rigs active at this time last year.

Among major plays, the Permian Basin dropped 33 rigs to fall to 283, down from 463 in the year-ago period. The Eagle Ford Shale dropped 9 rigs week/week, while the Williston Basin dropped seven. The Haynesville and Marcellus shales each saw three rigs depart during the week, while two rigs exited in the Cana Woodford, BKR data show.

Among states, Texas dropped 40 rigs on the week, while New Mexico dropped nine and North Dakota dropped seven. West Virginia and Wyoming each dropped four rigs from their respective totals, while Alaska dropped three.

Louisiana and Oklahoma each dropped two rigs on the week, while Utah dropped one. Pennsylvania added on rig overall week/week.

Citing global Covid-19 containment measures that have brought mobility “almost to a halt,” the International Energy Agency (IEA) said Wednesday it expects year/year global crude demand to fall by a record 9.3 million b/d in 2020 to 90.5 million b/d after nearly a decade of growth.

Following a historic pact reached earlier this month by the Organization of the Petroleum Exporting Countries (OPEC) and its allies to cut supply by 9.7 million b/d during May and June from an agreed baseline level, IEA expects global supply to fall by a record 12 million b/d in May versus April.

“Additional reductions are set to come from other countries with the U.S. and Canada seeing the largest declines,” researchers said, forecasting that full-year output for countries that are not part of OPEC, including the United States, could fall overall by 2.3 million b/d in comparison to 2019.

“That is not only a sharp reversal of the recent growth trend, but also of our earlier forecast that envisaged gains of more than 2 million b/d this year,” the report’s authors said. “Those taking part in the OPEC-plus deal account for 1.3 million b/d of the 2020 reduction, but declines from the U.S. and others accelerate through the year so that by 4Q20 total non-OPEC output could be 5.2 million b/d below the 4Q19 level.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |