Fifth Day of Losses for Natural Gas Futures Ahead of Hefty Storage Build; Cash Slides

With eyes on another plump storage injection, natural gas traders trimmed futures for a fifth consecutive session on Wednesday as weather forecasts continued to trend milder. The May Nymex contract settled at $1.598, down 5.2 cents day/day. June slipped a more substantial 7.8 cents to $1.748.

Spot gas prices also continued to retreat as some of the chilly air that descended into the United States earlier in the week started to move out of some regions as it headed eastward. NGI’s Spot Gas National Avg. fell 8.0 cents to $1.455.

The latest weather models maintained a mild pattern for the latter part of April, cutting into what little demand remained in the wake of a mild winter and, more recently, coronavirus-related shutdowns and stay-at-home measures. Although chilly weather was to continue for the next week, a “quite comfortable” pattern was expected to emerge thereafter, according to NatGasWeather.

Meanwhile, the impacts of the Covid-19 pandemic already have shown in government data. The U.S. Energy Information Administration (EIA) reported last week that natural gas storage inventories grew by 38 Bcf, boosting stocks above 2 Tcf, which is nearly 900 Bcf above year-ago levels.

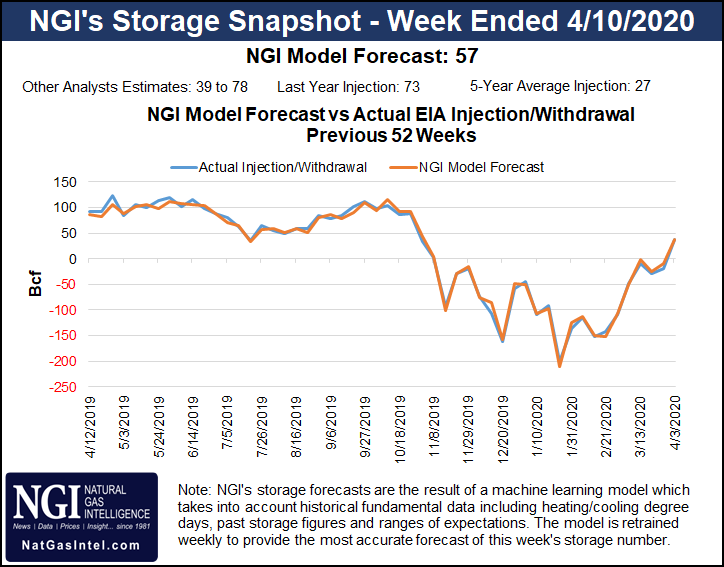

Perhaps because the EIA’s reported 38 Bcf build was well above consensus, estimates for Thursday’s storage report ranged widely. A Bloomberg survey showed projections ranging from 42 Bcf to 78 Bcf, with a median build of 67 Bcf. A Dow Jones poll showed estimates as low as 39 Bcf and produced an average 58 Bcf injection. NGI’s model pegged the build at 57 Bcf.

Last year, EIA recorded a 73 Bcf build for the similar week, and the five-year average is a build of 27 Bcf.

“There is simply too much gas right now, thanks to the very loose supply/demand balance caused by demand destruction with the economic shutdowns, with another loose number expected in tomorrow’s EIA report,” Bespoke Weather Services said.

The past two larger-than-expected injections reported by the EIA suggest that the market may be underestimating demand losses, and a third consecutive bearish stat could lead natural gas toward retesting lows in the $1.50s, according to EBW Analytics Group.

However, the current cold snap may boost spot demand enough to result in a small injection for the storage week ending April 17. EBW’s initial projection for a weekly injection of only 19 Bcf would slash the year/year storage surplus by 73 Bcf and the surplus versus the average by 30 Bcf.

“In the process, falling storage surpluses, driven by elevated late-season heating demand, may mistakenly give the market comfort that oversupply conditions may be averted,” EBW said. “Relative to year-ago storage levels, the decline is steep enough that the year/year surplus may not return to current levels until after Memorial Day.”

Mobius Risk Group analysts agreed, saying that while some indications point to potential triple-digit injections by the end of April, avoiding such hefty builds may result in an early summer rally.

“Conversely, if the century mark is breached before significant cooling degree days can amass in the South market, bears will look to squeeze more profit out of what has been a trifecta for them since late last year: an extremely warm winter; a pandemic and corresponding demand losses; and a multi-year period of underlying year/year looseness which was spurred by aggressive supply growth out of Appalachia, the Haynesville Shale and the Permian Basin.”

Looking ahead, the coronavirus pandemic likely will continue to drive natural gas prices, according to EBW. If it appears that the economy may reopen later than expected, demand implications “clearly would be bearish,” the firm said.

“It is also possible that analysts may simply follow recent downgrades to economic activity, with Goldman Sachs recently suggesting that the current economic downturn may be four times worse than the Great Recession, and similarly revise estimates lower.”

However, Goldman analysts also have offered an upside to natural gas, saying that more U.S. oil well shut-ins during 2Q2020 would lead to less associated gas. Goldman’s base case is for 1.5 million b/d of U.S. shut-ins during April and May, in addition to the 1 million b/d in domestic production declines between 1Q2020 and 4Q2020 reflected in the gas balances resulting from low oil prices.

“This results in an estimated 4.6 Bcf/d impact to U.S. natural gas production in that period, and a 2.1 Bcf impact to our previous 92.5 Bcf/d summer 2020 level expectations,” the Goldman analysts said.

With first quarter earnings kicking off this week, the market may get further clarification on how the supply side may respond to the downturn in the energy markets. NGI’s Patrick Rau, director of Strategy & Research, said firms likely will have plenty of bad news to share with investors over the coming weeks. While dozens of exploration and production companies already have made large cuts to spending and activity, it’s likely there will be more cuts ahead.

“More cuts to spending. More cuts to drilling. More cuts to employees,” Rau said. “This isn’t Trump talking. It’s not Capitol Hill. It’s the CEOs of energy companies telling us what they think. It’s going to be an awfully rough year. The market may go even lower, and possibly quite a bit.”

[For more on what NGI expects to hear during first quarter earnings, check out the third episode of our Hub & Flow podcast]

A sea of red characterized spot gas prices on Wednesday as chilly air started to move out of some regions as it headed toward the East Coast, with another front following closely behind.

Nevertheless, prices continued to fall throughout the region, though losses were fairly small at the majority of market hubs. Transco Zone 6 NY was down 3.0 cents to $1.550.

In Appalachia, Columbia Gas next-day deals averaged $1.485, down 6.5 cents day/day.

Losses throughout the Southeast, Louisiana and most of Texas were capped at less than a dime, while in the Midcontinent, OGT spot gas tumbled 13.0 cents to $1.190.

Texas Eastern Transmission (Tetco) is scheduled to conduct a tool run on its 30-inch diameter Line 16 in South Texas, from Angleton to Mont Belvieu, on Thursday. During the tool run, the Angleton station will be unavailable for flow.

Over the last 14 days, northbound flows through Angleton averaged 142 MMcf/d (lowered by one day of reverse flows) and maxed at 232 MMcf/d, according to Genscape Inc.

Additionally, deliveries will be unavailable to several locations in the area, namely Houston Pipeline, Enterprise Texas Pipeline and the NRG Cedar Bayou power plant, Genscape analyst Josh Garcia said.

“These locations have aggregated as much as 137 MMcf/d over the last 14 days, but have averaged 60 MMcf/d over the same time period. Tetco has the flexibility to manage imbalances in this area by reversing flows, and as such this event should not be more impactful than from what has been specified,” he said.

West Texas pricing broke away from the pack as repairs were completed along a section of the El Paso Natural Gas pipeline. Waha cash jumped 13.0 cents to average 29.0 cents.

On the West Coast, Ruby Pipeline is constraining 231 MMcf/d of Rockies supply headed toward Northern California for an indeterminate amount of time. Ruby declared a force majeure on Tuesday because of compressor issues at its Roberson station, which are constraining Westbound flow through Utah and Nevada.

Prior-month flows have been at 981 MMcf/d and are reduced to 756 MMcf/d, according to Genscape analyst Matthew McDowell.

Given the restrictions, Ruby Receipts plunged 13.5 cents day/day to $1.250, while prices farther downstream at Malin rose 4.5 cents to $1.505.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |